Goa AAR in the case of Springfields (India) Distilleries

Case Covered:

Springfields (India) Distilleries

facts of the case:

Springfields (India) Distilleries, have their registered office at H. No. 2, Raicho Ambo, Raia Salcete, and hold GSTIN 30AAOFS2556B1ZI.

The applicant is a registered partnership firm manufacturing Hand Sanitizers vide License No. 999, issued by Directorate of Food and Drugs Administration dated 01.04.2020.

Comments from concerned officers were called.

Concerned Officer has offered his comments and is briefed as below:

Hand Sanitizers are primarily used for disinfecting/Sanitizing hands, Following entries are found in Notification No. 1/2017- Central Tax (Rate) related to hand sanitizers based on the end-use of the product.

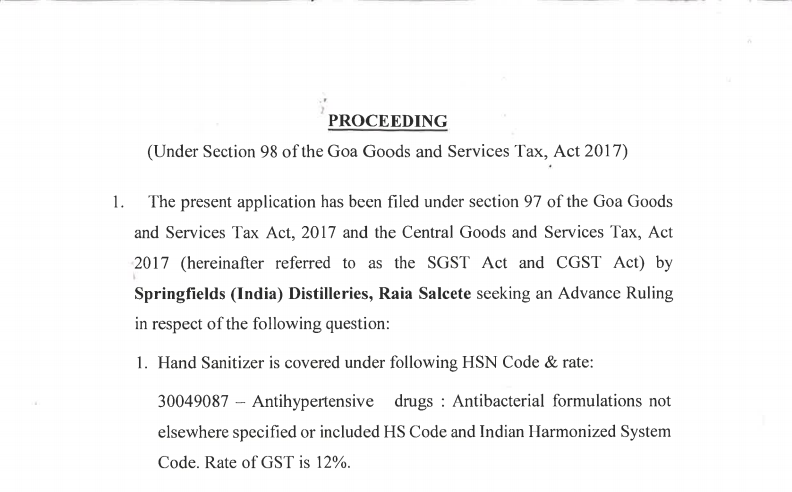

Question(s) on which Advance Ruling Sought:

- Hand Sanitizer is covered under following HSN Code & rate 30049087 – Antihypertensive drugs: Antibacterial formulations not elsewhere specified or included HS Code and Indian Harmonized System Code. The rate of GST is 12%.

- The Ministry of Consumer Affairs, Food, and Public Distribution, in a notification CG-DL-E13032020-218645, has classified Hand Sanitizers under the Essential Commodities Act, 1955 as an essential commodity and thus exempt from GST.

Observations:

Ongoing through the submissions made by the applicant and through the provisions of the GST Act, this authority is of the opinion that Hand Sanitizers manufactured by the applicant are of the category of Alcobased hand sanitizers and are classifiable under heading 3808 of HSN to which rate of GST applicable is 18%. As far as exempting hand sanitizers as an essential commodity since it is classified as such by the Ministry of Consumer Affairs, Food, and Public Distribution, this Authority is of that exempted goods are covered by Notification No. 2/2017/- Central Tax (Rate) dated 28/06/2017. Merely classifying any goods as an essential commodity will not be the criteria for exempting such Goods from GST.

Order:

The ruling so sought by the Applicant is accordingly answered as under:-

Alcohol-Based Hand Sanitizers manufactured by the applicant are covered by HSN 3808 and are accordingly taxable at an appropriate rate as per schedule entry notified vide Notification No. 1 Central Tax (Rate) dated 28/06/2017.

Read & Download the full decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.