Cheetos and kurkure will fall in catagory of “Namkeen” (Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

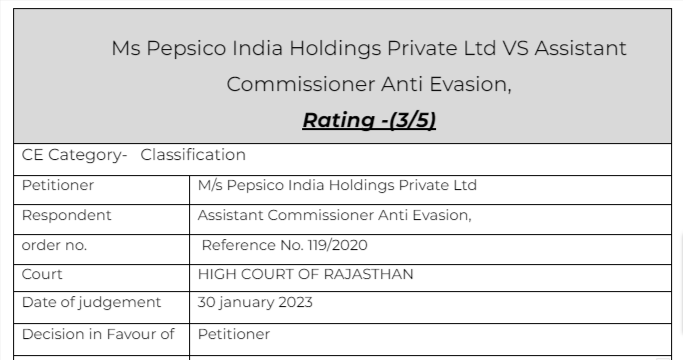

Ms Pepsico India Holdings Private Ltd VS Assistant Commissioner Anti Evasion,

Citations:

1. Parle Agro (P) Ltd. and Ors. vs. Commissioner of Commercial Taxes,

2. Commissioner of Central Excise vs. Hindustan Lever Ltd.

3. Muller and Phipps (India) Ltd. vs. The Collector of Central Excise,

4. Commissioner of Central Excise, Pune-II vs. Frito Lays India

5. Bharat Forge and Press Industries (P) Ltd. vs. Collector of Central Excise,

6. Dunlop India Ltd. vs. Union of India

7. Mauri Yeast India Pvt. Ltd. vs. State of Uttar Pradesh

8. Commissioner of Commercial Tax, U.P. vs. A.R. Thermosets (Pvt.) Ltd.

9. State of Maharashtra vs. Bradma of India Ltd

10. Hindustan Poles Corporation vs. Commissioner of Central Excise

11. Krishi Utpadan Mandi Samiti and Ors. vs. Ved Ram

12. L.R. Brothers Indo Flora Ltd. vs. Commissioner of Central Excise

13. Commissioner of Income Tax vs. Vatika Township Private Limited

14. Kanpur vs. Krishna Carbon Paper Co.

15. Ramavatar Budhaiprasad and Ors. vs. Assistant Sales Tax Officer

16. Purnia vs. State of Orissa

17. Calcutta vs. Collector of Central Excise

18. Collector of Central Excise vs. Fusebase Eltoto Ltd.

19. Hyderabad vs. Ashwani Homeo Pharmacy

20. Bhopal vs. Minwool Rock Fibers Ltd

21. M/s Compuage Infocom vs. The Assistant Commissioner,

22. HPL Chemicals vs. Commissioner of Central Excise

23. Suchitra Components Ltd. vs. Commissioner of Central Excise

Facts of the cases:

The lis in question pertains to classification of proprietary food items ‘Kurkure’ and ‘Cheetos’, manufactured by the petitioner-assessee. As per the petitioner-assessee, the goods in question, for the relevant period, would fall under the category of namkeen and would thus fall under Entry 131 of Schedule IV to the RVAT Act, which reads as “Sweetmeat Deshi (including Gajak & Revri), bhujiya, branded and unbranded namkeens.” On the contrary, the respondent-revenue contends that the good in questions are snacks and because snacks are not covered under any specific entry, the same would necessarily fall under the residual/orphan entry in Schedule V to the RVAT Act. As per settled position of law, a specific entry would always trump a general entry and the burden would always be on the Revenue to prove that the goods in question would have to fall in general entry as opposed to the specific entry.

The company is engaged in manufacture of potato chips, kurkure and cheetos. The classification of ‘Kurkure’ and ‘Cheetos’ under the residual entry of Schedule V to the RVAT Act was maintained. The Rajasthan Tax Board also dismissed the appeal filed by the petitioner-assessee vide order dated 03.01.2020 and maintained the levy of additional tax and interest by classifying ‘Kurkure’ and ‘Cheetos’ under the residual Entry No. 78 of Schedule V to the RVAT Act. Being aggrieved, the present STRs were filed.

Learned counsel for the petitioner-assessee has challenged the classification adopted by the Revenue, of the goods in question under residual entry.

Observation & Judgement of the Court:

Specific over the general entry

The submission of appellant was that the Cheetos and kurkure should fall in specific entry and not in general. They quoted many judgments for the supremacy of specific entry over a general entry.

In the case in hand, the Schedule V to the RVAT Act was substituted vide Notification dated 14.07.2014 and only thereafter the goods in question were incorporated under Schedule V and therefore there is no question of the notification having retrospective application.

Common parlance test-

As per common parlance test, the goods in question are considered to be ‘namkeens’. Reliance is placed on affidavits from traders and consumers of the goods in question to buttress the submission that the goods in question are perceived to be ‘namkeen’ in the common parlance.

Cheetos in US are not same as Cheetos in India-

The Tax Board has erroneously relied upon information available on the petitioner’s global website, which is headquartered in the United States of America. As per the impugned order, the petitioner is selling several variants of Cheetos, which is factually incorrect as the products manufactured by the petitioner’s global counterparts significantly vary in their manufacturing process and are specified to varied geographies

In case of two entries, more beneficial one should be considered-

In case there are two competing entries in which the product can be classified, the one that is more beneficial to the assessee should be given preference. Reliance in this regard is placed on Apex Court judgment of Commnr. of Central Excise, Bhopal vs. Minwool Rock Fibers Ltd. reported in 2012 (3) SCALE 37.

Judgment

It is noted that the Revenue neither sought any technical / expert opinion, nor brought any evidence on record to prove their point. It appears that the Tax Board merely relied on a basic Google search result wherein the goods in question were described as namkeen snacks.

The order impugned of the Tax Board and the authorities below are quashed and set aside.

Read & Download the Full Ms Pepsico India Holdings Private Ltd VS Assistant Commissioner Anti Evasion,

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.