Rectification of GSTR 1 allowed by the court after time barred

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

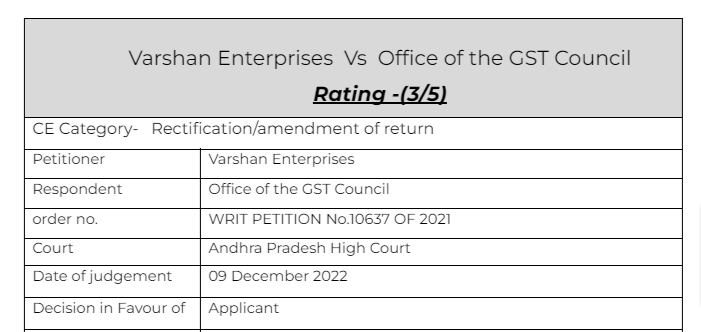

Varshan Enterprises Vs Office of the GST Council

Citation

Mafatlal Industries Limited v. Union of India

Pentacle Plant Machineries Private Limited v. Office of the GST Council, New Delhi and others

Commissioner of CGST & Central Excise v. Shriram Transport Finance Company Limited

Laxmi Organic Industries Limited v. Union of India and others

Hyderabad and another v. Assistant Commissioner of Service Tax, Hyderabad

M/s. Cosmol Energy Private Limited v. State of Gujarat

Union of India and others v. VKC Footsteps India Private Limited

Natraj and Venkat Associates v. Assistant Commissioner,

Laxmi Organic Industries Limited v. Union of India and others

Facts of the cases:

Request to issue an appropriate writ, order or direction, more in the nature of Writ of Mandamus, setting aside the communication of the Superintendent of Central GST, Bheemavaram Range vide his Reference No: OC No:-151/2021 dated 26-2-2021 and directing the Respondent No:- 1 & the Respondent No:- 2 to permit the Petitioner to rectify the details of the recipient of the services in the form GSTR – 1 for the quarter ending on 30-6-2018 to enable M/s. Vodafone Mobile Services Ltd., Kondla Koya, Telangana State, to claim the credit of IGST of Rs. 7,87,328=78 or to refund the sum of Rs. 7,87,328=78 to the petitioner which is paid on the transactions which are not actually conducted, and pass such other order or orders.

Observation & Judgement of the Court:

Viewing from any angle, the respondents cannot retain the disputed amount, that is paid to them, due to an inadvertent error while keying the name of M/s.Vodafone Mobile Services Limited, Kandlakoya village, Medchal Mandal, Telangana State. 26. As the Circular of the year 2019 restricts only electronic filing and as the contention of the respondents that the claim of the petitioner is barred by limitation is not acceptable, the respondents cannot retain the amount, that was paid by the petitioner. Under the circumstances, we are of the considered view that the petitioner is entitled to the relief. 27. In the result, the Writ Petition is allowed to set aside the communication of the Superintendent of Central GST, Bhimavaram Range vide his Reference in OC No.151/2021, dated 26.02.2021, and directing the petitioner to make an application in manual form for refund of the amount to which he is entitled to and the respondents are directed to pass orders in accordance with law, within a period of four (4) weeks thereafter. No order as to costs.

Read & Download the Full Varshan Enterprises Vs Office of the GST Council

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.