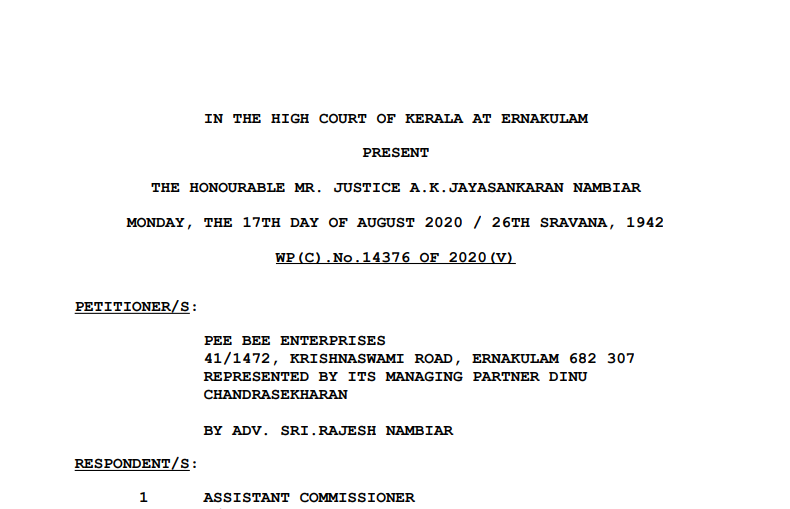

Kerala HC in the Case of Pee Bee Enterprises Versus Assistant Commissioner

Case Covered:

Pee Bee Enterprises

Versus

Assistant Commissioner

Facts of the Case:

The petitioner has approached this Court aggrieved by Exts.P1 and P2 assessment orders and Exts.P8 and P9 consequential demand notices issued him under the GST Act. In the writ petition, it is the case of the petitioner that the assessments pertaining to the months April and May 2019 was completed under Section 62 of the SGST Act on best judgment basis, taking note of the non-filing of returns by the petitioner assessee for the said month. While the assessment orders are dated 20.8.2019, it is the case of the petitioner that these orders were not served on him till much later and within 30 days after the date of receipt of the orders, he filed the returns as permitted under Section 62 of the SGST Act. He contends, therefore, that the assessment orders have to be treated as withdrawn by virtue of the provisions of Section 62 of the Act.

Observations of the Court:

On a consideration of the facts and circumstances of the case as also the submissions made across the Bar, I find from a reading of the statement of the respondent that the assessment orders dated 20.8.2019 were served on the petitioner through publication on the web portal on 20.8.2019 itself. Over and above that, an email was also sent to the petitioner at his registered email id, although the petitioner says that he did not receive the email but received only a copy of the or through registered post much later. I find, however, that the service of an order through the web portal is one of the methods of service statutorily prescribed under Section 161(1)(c) and (d) of the SGST Act. If that be so, then the petitioner cannot deny the fact of receipt of the order on 28.9.2019 for the purposes of filing the returns as contemplated under Section 62 of the SGST Act with a view to getting the assessment order withdrawn. In as much as the return filed by the petitioner for the period, April and May 2019 was only on 30.10.2019, i.e., 71 days after the date of service of the assessment order through the web portal (20.8.2019), the petitioner cannot aspire to get the benefit of withdrawal of the assessment orders contemplated under Section 62 of the SGST Act. The assessment orders would, therefore, have to be held valid and the remedy of the petitioner against the said assessment order can only be through an appeal before the appellate authority under the Act.

The decision of the Court:

Taking note of the submission of the learned counsel for the petitioner that he would require some time to move the appellate authority, I direct that the recovery steps for recovery of amounts confirmed against the petitioner by Exts.P1 and P2 assessment orders and Exts. P8 and P9 demand notices shall be kept in abeyance for a period of one month so as to enable the petitioner to move the appellate authority in the meanwhile and obtain orders of stay in the stay application filed along with the appeal. If the petitioner files the appeal within a period of two weeks from the date of receipt of a copy of this judgment, then the appellate authority shall treat the appeals as filed within time, and proceed to consider the stay applications preferred by the petitioner on merits after hearing the petitioner. The petitioner shall produce a copy of the writ petition together with a copy of this judgment, before the respondents, for further action.

Read & Download the Full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.