Detail analysis of provisions of refund in GST

Coverage of refund in GST (PDF of this article is also attached in the end)

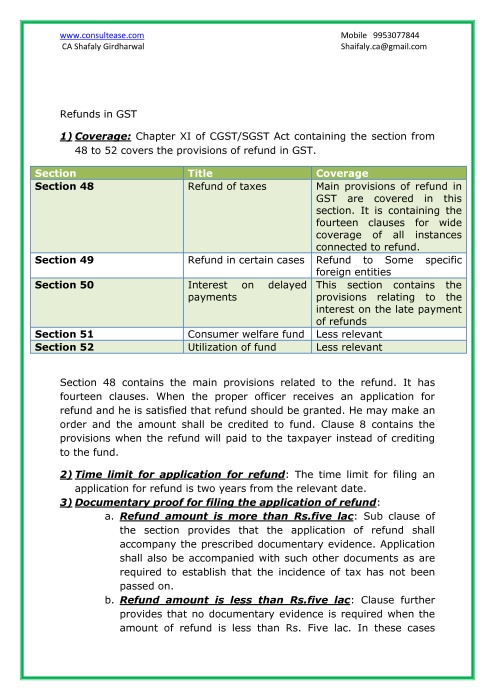

We can broadly segregate the refunds in two parts. Refund for the exports and refund for domestic sales. Chapter XI of CGST/SGST Act containing the section from 48 to 52 covers the provisions of refund in GST. First of all let us start with the sections covering the provisions of refund.

|

Section |

Title |

Coverage |

|

Section 48 |

Refund of taxes |

Main provisions of refund in GST are covered in this section. It is containing the fourteen clauses for wide coverage of all instances connected to refund. |

|

Section 49 |

Refund in certain cases |

Refund to Some specific foreign entities |

|

Section 50 |

Interest on delayed payments |

This section contains the provisions relating to the interest on the late payment of refunds |

|

Section 51 |

Consumer welfare fund |

Less relevant |

|

Section 52 |

Utilization of fund |

Less relevant |

Section 48 contains the main provisions related to the refund. It has fourteen clauses. When the proper officer receives an application for refund and he is satisfied that refund should be granted. He may make an order and the amount shall be credited to fund. Clause 8 contains the instances when the refund will paid to the taxpayer instead of crediting to the fund.

Time limit for application for refund:

The time limit for filing an application for refund is two years from the relevant date. Relevant date will be different for various cases. Later in this article we will also discuss the relevant date for various instances of refund.

Documentary proof for filing the application of refund:

- Refund amount is more than Rs.five lac: Sub clause of the section provides that the application of refund shall accompany the prescribed documentary evidence.In addition of it application shall also be accompanied with such other documents as are required.These documents should be enough to establish that the incidence of tax has not been passed on.Hence in case the refund amount is more than Rs. five lac documentary evidence will be required.

- Refund amount is less than Rs.five lac: The Clause further provides that no documentary evidence is required when the amount of refund is less than Rs. Five lac. In these cases taxpayer can file a declaration that the incidence of tax is not passed on by him. This declaration shall be based on the documentary evidence.Therefore when the refund amount is less than Rs. 5 lac only this declaration thing will work.

Availability of refund in various cases

Clause 8 of section 48 contains the provisions when the refund will be paid to the taxpayer. We have summarised the provisions of sub clause 8 for better understanding.

|

Sub clause |

Coverage |

Analysis |

A |

Refund of tax on goods and/or services exported out of India or on inputs or input services used in the goods and/or services which are exported out of India. |

Section 16 of IGST covers the zero rate supplies. Taxpayer is allowed to take benefit via any of two options. Options for refund: 1) Export the goods or services without payment of IGST and claim refund of unutilized input tax credit in accordance of provisions of section 48. 2) Export the goods or services on payment of IGST utilizing the input tax credit. Then claim the refund of IGST paid on goods and services exported. Restrictions on refund of input tax credit on exports: Clause 3 of section 48 covers the cases where the credit of input tax credit is available. This clause has put two restrictions on refund of input tax credit for goods/services exported. Proviso 2 to clause 3 provide that no refund of unutilized input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty Proviso 3 to sub clause 3 provide that no refund of input tax credit shall be allowed if the supplier of Goods or services claims refund of output tax paid under the IGST Act, 2016. |

b |

Refund of unutilized input tax credit under sub-section (3) |

Clause 3 provides the instances where the refund of unutilized input tax credit will be available. This clause provides that refund of input tax credit will be available only in following cases. 1) exports including zero rated supplies 2) in cases where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies, other than nil rated or fully exempt supplies Refund for exports has been already discussed in earlier clause of this table. Refund of unutilised credit for the reason of higher tax rate on input will be available under this part of clause. |

C |

Refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued |

This case will need three conditions fulfilling simultaneously: a) The supply itself is not provided b) The invoice is not issued c) The tax has been paid. Here we will have to look into the provisions of time of supply. Payment of tax is made at the time of supply only. Section 12 and 13 covers the provisions for time of supply. In case of goods or services the tax without supply and invoice can be paid only in case of advance payment. This part of refund will cover the instances where the tax is paid on advance but supply was not made and the invoice is not issued. The taxpayer will be able to claim refund in this case. |

D |

Refund of tax in pursuance of section 70 |

Section 70 covers the refund of taxes wrongly paid. When CGST/SGST is paid in place of IGST or vice versa. The taxpayer will be able to claim the refund of taxes wrongly paid. Also they won’t need to pay interest on the correct tax. |

E |

The tax and interest, if any, or any other amount paid by the applicant, if he had not passed on the incidence of such tax and interest to any other person |

Here the other residuary cases where the incidence of tax has not been passed on by the supplier. The refund will be available to him. |

F |

The tax or interest borne by such other class of applicants as the Central or a State Government may, on the recommendation of the Council, by notification, specify |

Here the central or state government is given right to classify the class of applicants who will be able to claim the refund the taxes borne by them. |

Witholding the refund

- Clause 10 provide that where any refund is due to a registered taxable person who:

- Has defaulted in furnishing any return

- Is required to pay any tax, interest or penalty, which has not been stayed by any court or tribunal or appellate authority

The proper officer may withhold the refund due until the said person has furnished the return or paid the tax, interest or penalty or may deduct from the refund due, any tax, interest, penalty, fee or any other amount which the taxable person is liable to pay but which remains unpaid under the Act or under any earlier law

PO is required to make order within 60 days of receipt of application

Clause 7 provides that the proper officer shall issue the order under sub-section (5) within sixty days from the date of receipt of application. The “application” for the purpose of this sub-section shall mean complete application containing all information as may be prescribed

Meaning of relevant date:

- Clause 14b provide for the relevant date for determining the time limit to file refund application.

(a) in the case of goods exported out of India

In case of export two type of refund can be paid. It can be for the goods exported or the input or input services used in such goods.

(i) if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India, or

(ii) if the goods are exported by land, the date on which such goods pass the frontier, or

(iii) if the goods are exported by post, the date of despatch of goods by the Post Office concerned to a place outside India;

(b) in the case of supply of goods regarded as deemed exports

where a refund of tax paid is available in respect of the goods, the date on which the return relating to such deemed exports is filed;

(c) in the case of services exported out of India

where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of

(i) receipt of payment in convertible foreign exchange, where the supply of service had been completed prior to the receipt of such payment; or

(ii) issue of invoice, where payment for the service had been received in advance prior to the date of issue of the invoice;

(d) in case where the tax becomes refundable as a consequence of any judicial proceeding

This will cover the cases when refund arise because of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any Court, the date of communication of such judgment, decree, order or direction;

(e) in the case of refund of unutilized input tax credit under sub-section (3) , the end of the financial year in which such claim for refund arises;

(f) in the case where tax is paid provisionally under this Act or the rules made thereunder, the date of adjustment of tax after the final assessment thereof;

(g) in the case of a person, other than the supplier, the date of receipt of goods or services by such person; and

(h) in any other case, the date of payment of tax.

- Meaning of refund :Clause 14 also covers the definition of refund.

“refund” includes refund of tax on goods and/or services exported out of India or on inputs or input services used in the goods and/or services which are exported out of India, or refund of tax on the supply of goods regarded as deemed exports, or refund of unutilized input tax credit as provided under sub-section (3)

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.