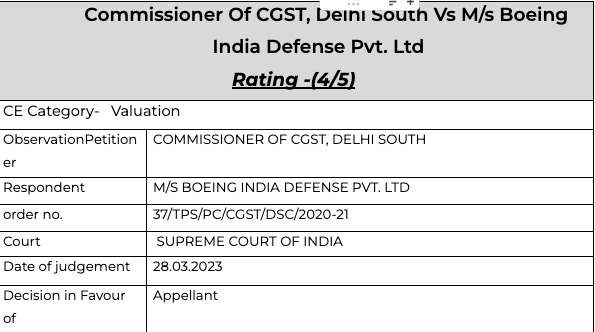

Value of services not to include the reimbursed amount

Case Covered-

Citation

Commissioner of Service Tax Vs Bhayana Builders (P) Ltd2

M/s Target Corporation India Pvt Ltd vs C.C.E. – Bangalore-II5 M/s Yutaka Auto Parts India Private Limited vs The Commissioner, Central Excise & Service Tax Commissionerate, Alwar6 . M/s Volkswagen India Pvt Ltd vs Commissioner of Central Excise

Nissin Brake India Pvt. Ltd. vs Commissioner of C. Ex.,

The Commissioner of Central Excise vs M/s. Computer Sciences Corporation India Put. Ltd10 .jaipur-I

Intercontinental Consultants & Technocrats Pvt Ltd Vs. Union

Union of India and Anr. v. M/s. Intercontinental Consultants and Technocrats Pvt. Ltd

Facts of the case

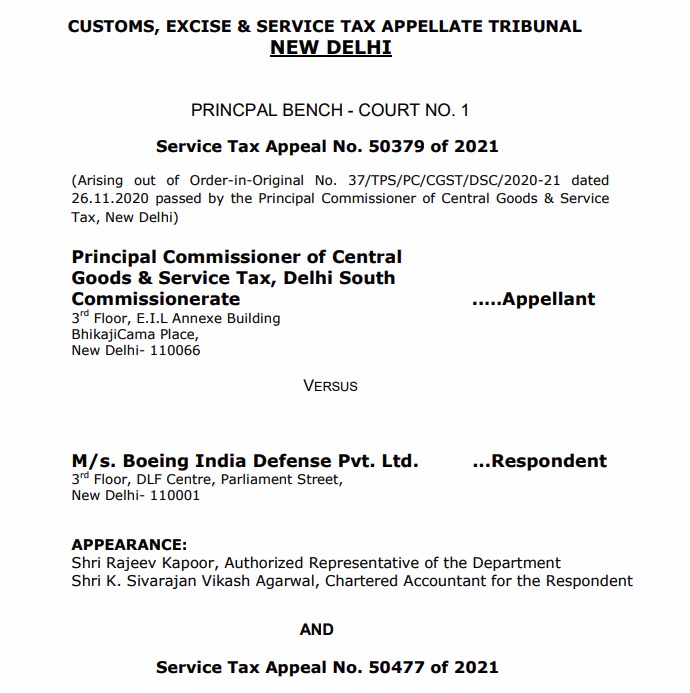

The Appellant, having its registered office at 3rd Floor, DLF Centre, Sansad Marg, Delhi, had entered into an agreement with its holding company, namely The Boeing Company1 for providing services on a cost plus mark-up basis. In order to provide service effectively and efficiently, the Appellant employed employees of TBC on secondment basis. The Appellant entered into a salary reimbursement agreement with TBC to facilitate secondment of employees from TBC to it and payment of remuneration to the seconded employee in their home country. Pursuant to service tax audit by the department, the impugned show cause notice was issued demanding service tax on the expenditure incurred towards hotel stay, school tuition fees for the disputed period considering the same as part of the consideration paid for import of manpower services from April 2015 to June 2017.

- The Appellant has filed the instant appeal Service Tax appeal No. 50477 of 2021 challenging the impugned order against the confirmation of the demand of service tax of Rs.46,67,212/- along with interest and penalty of Rs. 46,67,212/- and Rs.10,000/- under section 78 and 77 of the Finance Act respectively. The department filed the Appeal no. ST/50379/2021 challenging the dropping of the demand of Rs. 1,68,14,783/- by the adjudicating authority.

Observation

We note that this issue with regard to non-payment of service tax on the reimbursable expenses travelled upto Hon’ble Apex Court wherein it got settled by the decision in the case of Union of India and Anr. v. M/s. Intercontinental Consultants and Technocrats Pvt. Ltd.13 The Apex Court has held as per Section 67 (un-amended prior to 1st May, 2006) or after its amendment with effect from 1st May, 2006, the only possible interpretation of the said Section 67 is that for the valuation of taxable services for charging service tax, the gross amount charged for providing such taxable services only has to be taken into consideration. Any other amount which is not for providing such taxable service cannot be the part of the said value. It was clarified that the value of service tax cannot be anything more or less than consideration paid as quid pro quo for rendering such services. Accordingly, it was held that Section 67 of Finance Act, 1994 do not allow inclusion of reimbursable expenses in valuation of service rules.

comment

It was clarified that the value of service tax cannot be anything more or less than consideration paid as quid pro quo for rendering such services. Very important judgment in relation to the valuation of services.

Download/Read Pdf

boeing india-SC

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.