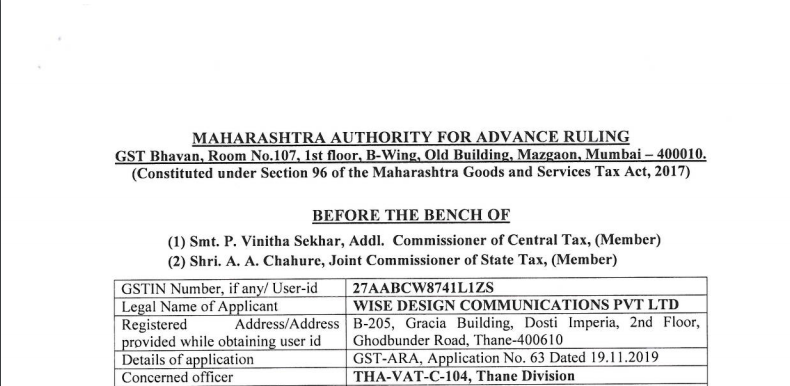

GST ARA order in case M/s. Wise Design Communications Pvt. Ltd

Case Covered:

Wise Design Communications Pvt. Ltd

Facts of the case:

The applicant is engaged in the supply of goods/products for export under the Letter of Undertaking(LUT). These products are advertised on platforms like Google and Facebook apart from other social media platforms of digital marketing. For placing an order, their customers make payment in US dollars with the use of PayPal money transfer and once the payment is received, the order goes into processing and the products are packed and then shipped via air courier(DHL) to the said customers. For every export sales invoice generated by the applicant on the DHL portal of e-commerce, manual shipping bills are issued by the customs officer in New Delhi, duly stamped and signed with various details. Hardcopies of these shipping bills are available with applicants and details such as shipping bill number, shipping bill date, port code, amount, etc. for each invoice are mentioned in the GSTR-1 filed by them. These shipping bills cannot be tracked on the ICEGATE website as this facility is not available with DHL Logistics Pvt. Ltd.

Observations:

We have gone through the facts of the case and the oral submissions made by both, the applicant and the departmental authority.

The applicant is engaged in the supply of e-commerce products which are exported out of India. The sale amount is realized in foreign exchange. For these export transactions, the applicant has all the required documents as export proof, but for filing claim for refund of ITC, they require a shipping bill which is not traceable on the ICEGATE website. Their question is whether hard copies of shipping bills(which are duly stamped & signed by the LET Export Officer of Customs) are enough for filing of the claim for refund of ITC even though shipping bills are not traceable on ICEGATE website.

As per Section 95 of the CGST Act, 2017, this authority can only pass a ruling on matters or questions specified in subsection 2 of Section 97 of the CGST Act,2017, in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.