PLACE OF SUPPLY OF GOODS AND SERVICES

- PLACE OF SUPPLY OF GOODS AND SERVICES

- Part 1 – Place of Supply of Goods

- a. Section 10(1)(a): Supply involves the movement of goods.

- b. Section 10(1)(b): Where goods are delivered by the supplier to the recipient but at the instruction of a third person.

- c. Section 10(1)(c): Where the supply does not involve the movement of goods

- d. Section 10(1)(d): Where the goods are assembled or installed at the site

- Download the copy:

- e. Section 10(1)(e): Where the goods are supplied on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle

PLACE OF SUPPLY OF GOODS AND SERVICES

GST is a destination-based tax and hence, the taxes go to the state where the goods and services are consumed not where they are originated. For the correct levy of CGST, SGST or IGST, it becomes all the more important to have an understanding of the place of supply of goods and services. Place of Supply defines if the supply would be considered as interstate or intrastate. When the location of the supplier and the place of supply are in two different States, then it will be inter-State supply and IGST would be chargeable and when they are in the same state, it will be intraState and CGST/SGST would be chargeable.

Part 1 – Place of Supply of Goods

Part 1 of this article will discuss the provisions pertaining to ‘Place of Supply of Goods’. Section 10 and 11 of the IGST Act, 2017 covers provisions pertaining to ‘Place of Supply of Goods’.

Section 10 deals with the place of supply of goods, other than the supply of goods imported into, or exported from India. Hence, the place of supply of goods, where the supplier and the recipient are located within India, will be determined in accordance with Section 10 of the IGST Act.

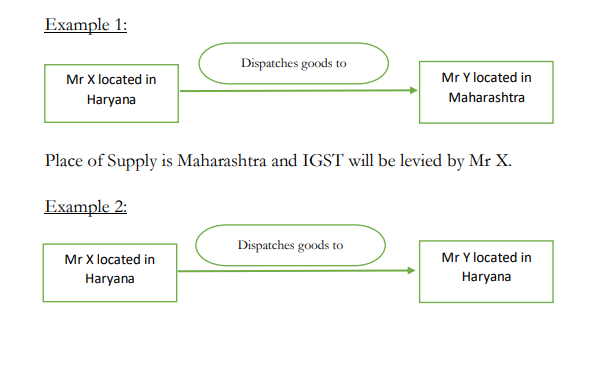

a. Section 10(1)(a): Supply involves the movement of goods.

Place of supply will be the place where the goods are located at the time at which the movement terminates for delivery to the recipient.

The place of supply is Haryana and CGST/SGST will be levied by Mr. X.

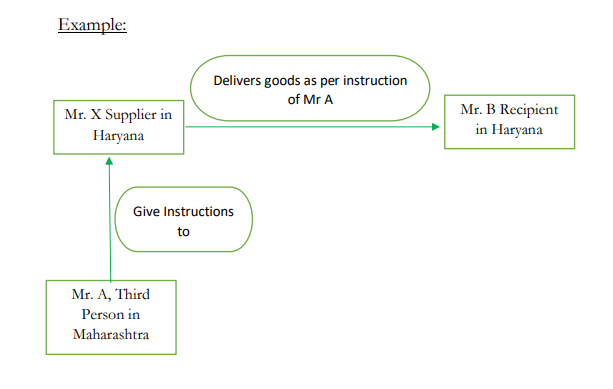

b. Section 10(1)(b): Where goods are delivered by the supplier to the recipient but at the instruction of a third person.

Place of supply will be the principal place of business of such third person and not of the actual recipient.

Place of Supply is Maharashtra i.e. location of the principal place of business of Mr. A (third-person) – Supply shall be chargeable to IGST.

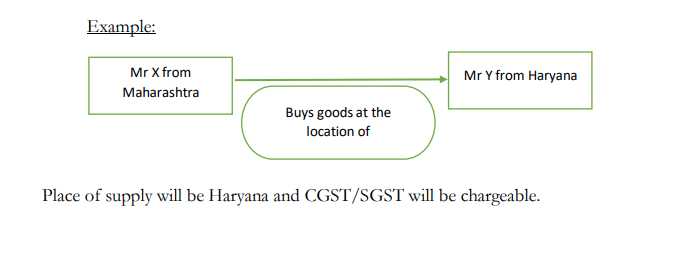

c. Section 10(1)(c): Where the supply does not involve the movement of goods

The place of supply will be the location of the goods at the time of its delivery to the recipient.

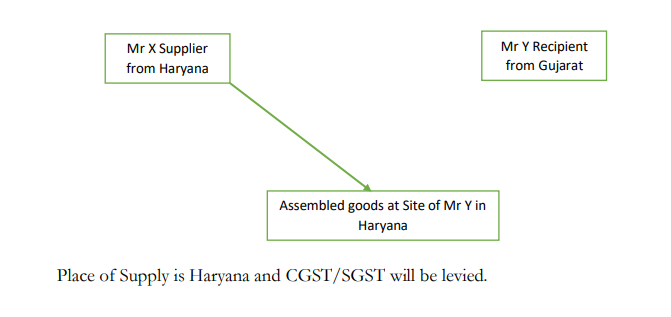

d. Section 10(1)(d): Where the goods are assembled or installed at the site

The place of supply will be the location of such installation or assembly.

Download the copy:

e. Section 10(1)(e): Where the goods are supplied on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle

Place of supply shall be the location at which such goods are taken on board

This provision includes those purchases which are done while traveling on a conveyance.

Example:

Mr. A traveling in a cruise from Mumbai to Goa, purchased a book from the in-house store in a cruise liner. These books were on-boarded from Mumbai, the registered place of business of the book shop is in Delhi. Place of Supply will be Maharashtra and IGST will be charged.

Section 11 deals with the place of supply for supplies outside India. Place of supply of goods that are imported into or exported from India will be determined in accordance with Section 11 of the IGST Act, 2017.

a. In case of import of goods, the location of the importer and

b. In the case of export of goods, the location outside India where the goods are exported.

If you already have a premium membership, Sign In.