How to operate Business in UAE

How to operate Business in UAE

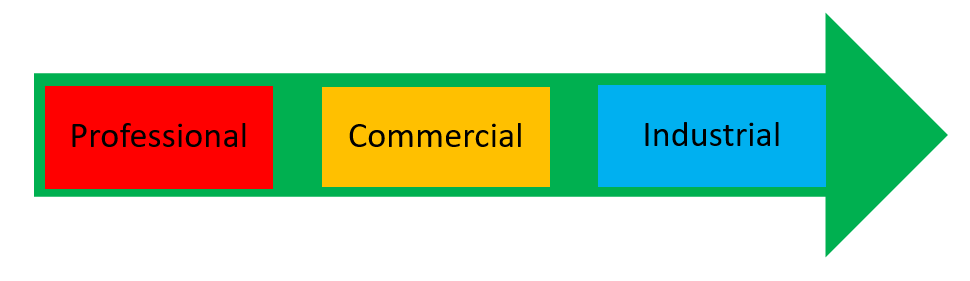

Your type of business in will determine the kind of license you require to operate Business in UAE. Whether it’s commercial, professional or industrial licenses, these will define the basis of your operations. However, while selecting, remember that certain activities such as food trading, jewelry trade, veterinary activities and legal consultancy require further approvals from other governmental departments. So, let us discuss “How to Operate Business in UAE”.

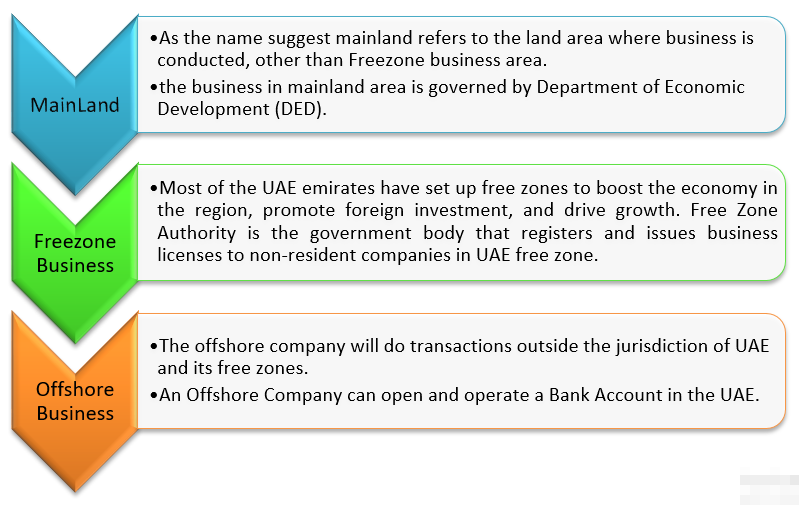

Business Jurisdictions in UAE

From the business point of view, the jurisdictions within which an entity can operate its business is classified broadly into three categories:

Forms of Business Enterprise Permitted in UAE

There are mainly three types of business entities permitted by law in the UAE and they are:

A brief overview of types of business entities permitted in UAE:

UAE government states that there are three types of business which are given below:

Professional:

- Professional License is issued to professionals, artisans, and craftsmen.

- The professional license is for professional services which depend on the skills, knowledge, and experience of the professional.

- The holder of the professional license is not permitted to import or export any goods and thus is not permitted to engage in any trading or manufacturing activity.

Commercial:

- This license is issued to the business entities which are involved in commercial activities of buying and selling of goods, imports and exports, transportation and all other commercial activities which are performed with the intention of making the profit.

- In the trading business, the government can permit general or specifies the business license. The General trading License allows dealing on the entire range of products whereas Specific Trading License allows only on specific products. For example, a Business Entity which has a specific food items trading license can deal only in food items and not in building materials. On the other hand, a General Trading License permits the business entity to deal in both food items as well as building materials.

Industrial:

- Industrial License is issued to those business entities which are involved in the manufacturing or industrial activity which involves value addition or conversion of the input into a different output.

Process for Operating Business in UAE

Starting a business in the UAE should not take you more than a week once you’ve sorted all your legal procedures, but before you start your legal formalities, you need to consider some elements required in the process:

Step-1 Identify Type of Business

Type of business will determine the kind of license you require. Whether it’s commercial, professional or industrial licenses, these will define the basis of your operations. However, while selecting, remember that certain activities such as food trading, jewelry trade, veterinary activities and legal consultancy require further approvals from other governmental departments.

The Department of Economic Development (DED) in UAE has a list of over 2100 activities you can choose from. If you’re unable to find your specific one in there, you can contact the DED. Each free zone has its own regulations and approval formalities.

Link: http://www.dubai.ae/en/Lists/GovernmentDepartments/DispForm.aspx?ID=3&category=Government

Step-2 Select Form of Ownership/Business

- Partnership – A Partnership Company is a form of organization where there are two or more partners who are contributing to the business. The name of the company shall have the name of one of the partners in addition to a word that signifies the nature of the business.

- Company – A company incorporated under the Commercial Company Law (CCL). Article (9) of the CCL has prescribed five different forms of companies, viz., (i) Joint Liability Company- 2 or more UAE nationals, jointly and severally liable; (ii) Simple Commandite Company- 2 or more UAE nationals, general partners whose liability is unlimited should be UAE Nationals and the Limited Partners can be nationals of other countries; (iii) Limited Liability Company- 2 or more members, maximum up to 50, UAE national to hold minimum 51% of Share capital; (iv) Public Joint Stock Company- Shares listed on stock exchange, Minimum 5 members (v) Private Joint Stock Company- minimum 2 members, maximum 200 members, Minimum capital AED 5 Million.

- Civil Company – A civil company is formed for professionals like Doctors, Lawyers, Accountants, and Engineers. A Civil Company can be owned by a person of any nationality but if the owners of the Civil Company are other than UAE National or Citizen of GCC then the Civil Company should have a UAE National as its “Service Agent”. In the case of Civil Company in Engineering business, UAE National should be a Partner owning minimum 51% of the Share Capital.

- One Person Company – A One Person Company is also like a Sole Establishment as it is owned by one individual. One Person Company can be formed by a UAE National or GCC Citizen. It is a Limited Liability Company formed with only one person and hence the owner’s liability is limited to the extent of the share capital of the company.

- Sole Establishment – Sole proprietary Organisation which can be formed only by UAE Nationals or GCC Citizens. Sole Proprietary Establishment is generally formed in the name of the individual owner. The liability of the Sole Owner is unlimited and hence the owner needs to meet all the obligations of the business.

- Branches –

(i) Branches can be established for Foreign Companies. The branch office shall carry on the activities of the Parent Entity. The Branch Office should have a local agent who shall be a UAE National.

(ii) Branch also includes the branch of a UAE based company where the branch is 100% Owned by the parent company.

(iii) Branches can also be the branch of GCC based company where the branch is 100% Owned by the parent company which is headquartered and based in one of the GCC countries.

- Representative Office – office set up in the UAE to represent a Foreign Company which can only perform the liaison function and is not permitted to import or export goods. The Representative Office can solicit business and do business promotion but cannot directly engage in any trading activity. A UAE National should be appointed as “Service Agent” for the Representative Office.

- Intelaq – Home Office owned by a UAE National for conducting any type of professional, trade or artisan business. The business must be such that can be operated from a residential unit without causing any harm to the environment. The legal form of the business can be Sole Establishment or LLC or Civil Company or Partnership.

- SME License – UAE National can also obtain SME License which is valid for 3 years for any activity.

Step-3 Name approval of Business

After deciding the type of business next step is entity should seek name approval for the name of the business and generally the name should reflect the activity. For instance, if the business entity is offering Accounting Services then the name should include the phrase “Accounting Services” and the activities to be performed by such entity will be limited to Accounting Services and related activities only.

Step-4 Establishment or Leasing of Office

Once you have your legal procedures and forms ready to go, it would be best to shortlist some offices with costs and other details. This would mean a clear path forward once you get your legal formalities out of the way. In free zones, you will get assistance to find premises suitable to your requirement along with help to set up electricity, internet, water and other amenities.

Step-5 Obtaining Trade License

Once the Leasing of premises is finalized then the Business Entity needs to be registered and a Trade License has to be obtained. If the business entity is owned by more than one person then the Shareholders Agreement, Memorandum of Association and Articles of Association have to be executed as the case may be. These contracts can be executed only in the presence of the Notary Public. The Contract between the Shareholders/Partners is required for getting the Trade License and also for registering the entity with the Chamber o Commerce.

Step-6 Investor Visa/Employment Visa/Residence Permit

In most legal forms of the DED, you need to hire a manager to oversee operations and have him ready to be on board before your registration is approved. But in other cases, you may not be allowed to hire at all. For example, Intelaq license holders (license for home-based Emirati business owners) are not allowed to hire staff but can engage contractors. Details can be seen here. For free zones, each zone has its own specific regulations regarding the structure of the business.

Step-7 Commencement of Business

Upon incorporation of the business by obtaining the Trade License the business entity can start its activities. In order to commence the business, the first step would be the opening of a Bank Account in the name of the business entity.

Step-8 Maintenance of Business Licenses

Maintenance of the Business Entity would entail:

- renewal of the Trade License every year (if required);

- Audited Accounts to be submitted each year for renewal of the Trade License, in some free trade zones;

Step-9 Liquidation of Business

While starting a business is fairly simple and easy the closure of business is quite complex. To start a business it may take a few days in most of the jurisdictions. However, liquidation of business would mean first settling all liabilities of the business, whether it amounts due to Government Departments or Banks or Financial Institutions or Suppliers or Vendors or Employees. All dues of the business have to be fully settled and all registrations have to be properly closed. Finally, the business will get liquidated if all the formalities are fully complied with as per the requirements of the Government or Free Zone Authority. The normal time span for the liquidation of a business in the UAE can be anywhere between 12 to 18 months as the process is quite complex and tedious.

Disclaimer

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system,

Or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording,

Or otherwise without prior permission, in writing, from the publisher.

About Author

Author of this article is CA Deepak Bharti who is the member of ICAI since 2013. Currently, he is working as the partner in M/s NAV & Co. Chartered Accountants, handling the Corporate Compliance and Legal Department. He can be reached at cadeepakbharti@yahoo.com. Suggestions/comments are most welcome.

If you already have a premium membership, Sign In.

CA Deepak Bharti

CA Deepak Bharti

Delhi, India