Refund rejected without proper reasons was set aside (Pdf Attach)

Cases Covered:

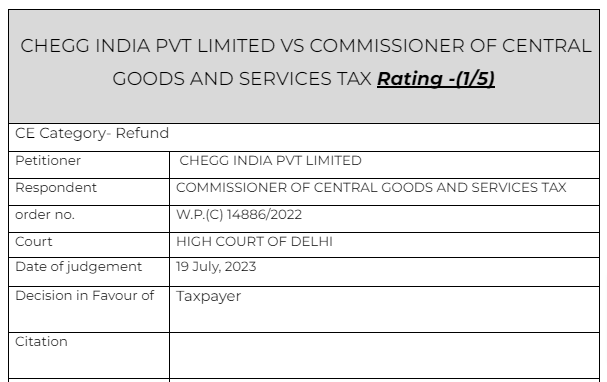

CHEGG INDIA PVT LIMITED VS COMMISSIONER OF CENTRAL GOODS AND SERVICES TAX

Facts of the case

The petitioner is, inter alia, engaged in the business of software development, content development, marketing and other IT and IT enabled services in the field of education technology. The petitioner W.P.(C) 14886/2022 Page 2 of 4 claims that it exports education services to recipients in seventy countries without payment of GST. The said services are Zero Rated Supplies in terms of Section 16 of the Integrated Goods & Services Tax Act, 2017 (hereafter ‘IGST Act’). The petitioner is thus entitled to refund of Input Tax Credit (hereafter ‘ITC’) relating to input services

Observations & Judgement of the court

The authorities rejected the refund on the wrong grounds. They did not specify the details for rejections and just mentioned the sections. Even the proper hearing was not done by the authorities.

Thus the order was set aside and case was remanded back to the authorities.

Read & Download the Full M/s Aastha Enterprises VS State of Bihar through the Commissioner of Commercial State Taxes

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.