Amendment in 89(4) (c) is not retrospective ( Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

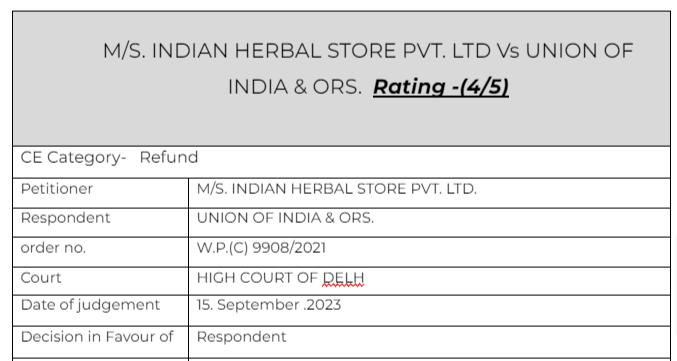

M/S. INDIAN HERBAL STORE PVT. LTD Vs UNION OF INDIA & ORS.

Citations:

1. Ministry of Chemicals & Fertilizers, Govt. of India v. Cipla Ltd.,

2. M/s Tonbo Imaging India Pvt. Ltd. v. Union of India and Ors

3. Central Bureau of Investigation v. R.R Kishore

Facts of the cases:

The petitioner impugns the provisions of Rule 89(4)(C) of the Central Goods and Services Tax Rules, 2017 (hereafter ‘the Rules’) as ultra vires the provisions of Section 54 of the Central Goods and Services Tax Act, 2017 (hereafter ‘the CGST Act’) as well as Section 2(5) and Section 16 of the Integrated Goods and Services Tax Act, 2017 (hereafter ‘the IGST Act’). The petitioner also claims that Rule 89(4)(C) of the Rules falls foul of Article 14 of the Constitution of India and therefore, is liable to be struck down.

Observation & Judgement of the Court:

It is pertinent to note that when we heard the matter on 19th September 2018, our attention was invited to the guidelines issued by the In this view, we find that the appellate authority erred in applying Rule 89(4)(C) of Rules as amended with effect from 23.03.2020 for computing the export turnover for the purposes of determining the refund as claimed by the petitioner 22. In view of the above, the petitioner’s claim for a refund of the accumulated ITC in respect of its exports for the period of 01.10.2018 to 30.09.2019 is liable to succeed. Having observed the above, it is also necessary to note that the amendment of Rule 89(4)(C) of the Rules has been struck down by the Karnataka High Court in W.P.(C) No.13185/2020 captioned M/s Tonbo Imaging India Pvt. Ltd. v. Union of India and Ors., decided on 16.02.2023. Thus, as on this date, the amended provisions are nonexistent. It is well settled that if a statute or a statutory position is struck down as ultra vires the Constitution of India, it relates back to the date on which it was promulgated as is reiterated by the Supreme Court in the recent decision in Central Bureau of Investigation v. R.R Kishore : (2016) 13 SCC 240

Comment:

Thus the rejection of refund orders was set aside by the honorable High Court.

Read & Download the Full M/S. INDIAN HERBAL STORE PVT. LTD Vs UNION OF INDIA & ORS.

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.