Rule 89(4C) is ultra vires and thus strike down (Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

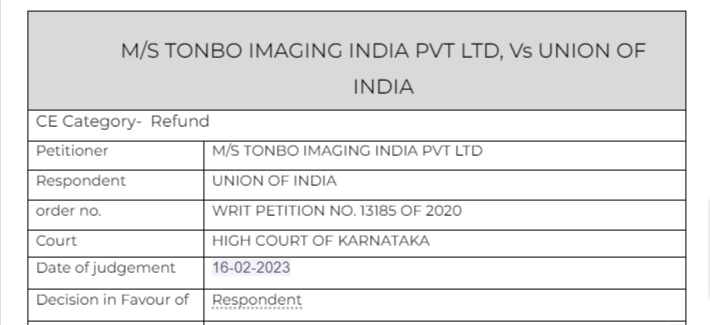

M/S TONBO IMAGING INDIA PVT LTD, Vs UNION OF INDIA

Citations:

(i) CIT vs. Taj Mahal Hotel – (1971) 3 SCC 550;

(ii) Bimal Chandra Banerjee vs. State of Madhya Pradesh – 1970) 2 SCC 467;

(iii) Sangram Singh vs. Election Tribunal – AIR 1955 SC 425; (iv) All India Federation of Tax Practioners vs. Union of India – 2007) 7 SCC 527;

(v) Shayarabano vs. Union of India – (2017) 9 SCC 1;

(vi) Pitambra Books Pvt. Ltd., vs. Union of India (34) – GSTL 196 (DEL);

(vii) Shreya Singal vs. Union of India – (2015) 5 SCC 1;

(viii) Universal Drinks Pvt. Ltd., vs. Union of India – 1984 (18) ELT 207(BOM);

(ix) Deepak Vegetable Oil Industries vs. Union of India – 1991(52) ELT 222 (GUJ);

(x) Hajee K Assiannar vs. CIT – (1971) 81 ITR 423 (KER);

(xi) CIT vs. Vatika Township Pvt. Ltd., – (2014) 367 ITR 466 (SC);

(xii) Verghese vs. DCIT – (1994) 210 ITR 511 (KAR);

(xiii) ACCT vs. Shukla & Brothers – 2010 (254) ELT 6 (SC); (xiv) Moopil Nair vs. State of Kerala – AIR 1961 SC 552;

(xv) Deputy Commissioner of Income Tax vs. Pepsi Foods Ltd., – (2021) 7 SCC 413;

(xvi) Reckitt Benckiser vs. Union of India – 2011 (269) ELT 194 (J & K)

Facts of the cases:

Apart from other issues, the validity of Rule 89(4C) of the Central Goods and Services Tax Rules, 2017 (for short ‘the CGST Rules’) as amended vide Para 8 of the Notification No.16/2020-CT dated 23.03.2020 is the subject matter of the present petition. It was submitted that Rule 89(4)(C) of the CGST Rules, as amended on 23.03.2020 is ultra vires and invalid and deserves to be declared unconstitutional and struck down. It was further submitted that the impugned order is illegal, arbitrary and without jurisdiction or authority of law and deserves to be quashed and the respondents be directed to accept/allow the subject refund claims of the petitioner and grant refund of taxes along with interest in favour of the petitioner

Observation & Judgement of the Court:

The impugned offending words, “or the value which is 1.5 times the value of like goods domestically supplied by the same or, similarly placed supplier” appearing in Rule 89(4C) of the Central Goods and Services Tax Rules, 2017 as amended vide Para 8 of the Notification No.16/2020-Central Tax(F.No.CBEC20/06/04/2020-GST) dated 23.03.2020 is declared ultra vires the provisions of the Central Goods and Services Tax Act, 2017 and the Integrated Goods and Services Tax Act, 2017 as also violative of Articles 14 and 19 of the Constitution of India and resultantly, the same are hereby quashed; (iii) The impugned order at Annexure-C dated 30.6.2020 passed by the 3rd respondent is hereby quashed; (iv) The respondents-revenue are directed to accept the refund claims/applications of the petitioner at Annexures D-1 to D-6 and grant refund together with applicable interest in favour of the petitioner within a period of three (3) months from the date of receipt of a copy of this order.

Read & Download the Full M/S TONBO IMAGING INDIA PVT LTD, Vs UNION OF INDIA

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.