Customer Relationship Value- Compendium

“Every business has Customers, But Not every business has Customer Relationships”

Table of Contents

- Customer Relationship

- Value Drivers

- Why should Company maintain Customer Information?

- How can Company motivate customers to continue to purchase Goods or Services?

- Benefits of Customer Information?

- Factors That May Influence The Value Of Customer Intangible Asset

- Valuation Methods

- Application of Multi-Period Excess Earnings Method for valuing Customer Relationship

- Attrition

- Contributory Assets

- Type Of Contributory Assets

- Contributory Assets Charge

Customer Relationship

Customer relationship plays a significant role in a Company and a form of key Intangible Asset (IA). Companies are paying much attention to developing, maintaining, and upgrading customer relationships. Customer-related IA consist of the information collected from repeated transactions, with or without underlying contracts. A company can lease, sell, buy or otherwise trade such information, which are generally organized as customer lists or customer databases.

Value Drivers

Two aspects of a business’s relationship with its customers are primary value drivers. One is the ‘amount of inertia’ in the relationship and the other is the ‘amount of information’ available about the customer.

The inertia element includes factual information about the customer. That information may include name, address, contact number, e-mail address, customer account number, and so forth.

The informational element may also include such as when the customer first purchased, the date of the last purchase, a current accounts receivable balance, the amount purchased last year, the greatest amount purchased in any year, the greatest amount purchased at any one time, the customer’s payment record, purchase seasonality, etc.

Both the above element is important and useful to the owner and of course, there is time and expense cost associated with assembling, maintaining, and using this customer account information.

Why should Company maintain Customer Information?

To manage customer relationships, customer information is typically used by the Company to motivate customers to continue to purchase goods or services.

How can Company motivate customers to continue to purchase Goods or Services?

Keep in touch with customers through calls/ messages or through any other communication mode and offer discount coupons/sales/ new products etc.

Benefits of Customer Information?

Based on the Customer’s historical purchase data, the Company expects that customers will continue to do business and that continued business expectation translates into the company’s expectation of future revenue and future cash flow.

With regards to Financial Reporting, Taxation, and Litigation matter customer intangible assets are being valued for the following purpose:

– Fair value of customer intangible assets as part of the Purchase Price Allocation of the business acquisition;

– Impairment Testing, including the fair value of recorded IA as part of periodic impairment test of recorded asset values;

– Valuation of intangible assets as part of a solvency or insolvency analysis of the taxpayer entity;

– Intercompany transfer price analysis of customer Intangible assets transferred between controlled entities within a consolidated multinational taxpayer entity;

– Breach of a customer purchase contract or supplier contract;

– Family law disputes involving a family-owned business or professional practice.

Factors That May Influence The Value Of Customer Intangible Asset

- Ease or difficulty in the ability to transfer the Customer IA between owners

- The price elasticity of demand of the goods or services

- The frequency at which the goods or services are purchased (e.g. monthly, annually, or sporadically)

- The growth rate in the number of customers and Customer Revenue

- Profit margin earned from the customer revenue

- Customer historical churn (or turnover) rate

- Average customer total life (of expected tenure of relationship)

- Average customer relationship age and expected remaining life

Valuation Methods

All three valuation approaches may be applicable to the customer intangible asset valuation. Both, the Customer Asset Type and the Purpose of Valuation influence which approach (or approaches) are more suitable for customer relationship analysis. However in most of cases analyst used the income approach and, specifically, the Multi-Period Excess Earnings Method (MEEM). It is best used when Customers are the primary assets of the business.

Application of Multi-Period Excess Earnings Method for valuing Customer Relationship

– First step is to understand the entity’s business operations and determine the subject intangible asset contribution to Company’s total revenue;

– Estimate attrition rates for the subject intangible asset;

– Calculate the forecast revenue of subject intangible asset after adjustment of attrition rate;

– Estimate expenses and cash flow associated with the subject intangible asset;

– Calculate Debt-Free Net Income before Contributory Charge;

– Estimate the rate of return (discount rate) for each contributory asset;

– Calculate Contributory Asset Charge;

– Calculate the excess earnings associated with the primary intangible asset;

– Estimate the rate of return (discount rate) for the subject intangible asset;

– Calculate the present value of the remaining cash flow (calculated at step no. 8);

– Calculate and add the tax amortization benefit (TAB) for the subject intangible asset.

Attrition

While valuing customer-related assets using MPEEM, the valuer should determine the portion of revenue expected to be generated through repeat customers existing as of the valuation date. Attrition is the measurement of the rate of decay or loss of existing customers. The valuer may have to conduct a statistical analysis of historical customer turnover and revenue growth rates to estimate the expected attrition.

Contributory Assets

Assets that are used in conjunction with the subject intangible asset in the realization of prospective cash flows associated with the subject intangible asset. For example, a certain amount of real assets property may be necessary to support the cash flow attributable to a subject intangible asset. Alternatively, land held by an entity for investment purposes would not be appropriate to include as a contributory asset.

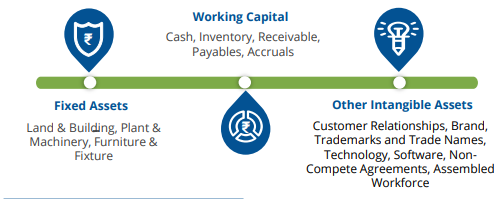

Type Of Contributory Assets

Contributory Assets Charge

Contributory asset charge represents the economic “rent,” or a charge equivalent to the return on and the return of, an asset necessary to produce the goods or services of the company. The Valuer should, therefore, reduce the cash flow attributable to the customer relationship intangible asset by the required return on the contributory assets.

In order to estimate the contributory asset charges, the Valuer should:

– Identify and value all contributory asset;

– Estimate a value for all of the contributory assets to which a fair rate of return charge will be applied;

– Estimated a fair rate of return for each contributory asset, this fair rate of return should reflect the risk associated with an investment in the contributory asset categories; and

– Multiply the contributory asset values by the fair rate of return in order to calculate the contributory asset charge

Disclaimer: This publication contains general information only, and none of Fintellectual Corporate Advisors Private Limited, its director, employees or their related entities (collectively, the ‘Fintellectual Corporate Advisors’) is, by means of this publication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

Contact Person: Mr. Amit Puri (Founder & Partner)

Contact No.: +91- 9990244588

Fintellectual Corporate Advisors

Fintellectual Corporate Advisors

Fintellectual Corporate Advisors is a transaction advisory firm, founded by experienced and professional entrepreneurial management, having rich and vast experience in the fields of Investment Banking, Valuations, Transaction Advisory, Corporate Finance and Corporate Law Advisory. We help the businesses in designing their growth stories by sailing through in the right direction, providing the best guidance through application of experience and intellect gained by the team in the past years. Our team with finance and legal professional is experienced in their respective field of expertise, helping us in delivering the services and customized business suited solutions to the clients in an effective and efficient manner further supporting them in achieving their objectives. High integrity and confidentiality are deeply inculcated in our team when dealing with clients and the assignments undertaken for them.