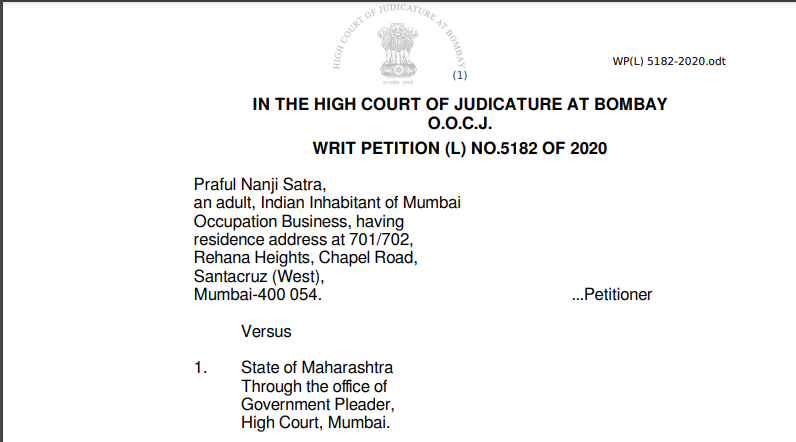

Bombay HC in the case of Praful Nanji Satra Versus State of Maharashtra

Case Covered:

Praful Nanji Satra

Versus

State of Maharashtra

Facts of the Case:

By fling, this petition under Article 226 of the Constitution of India, petitioner seeks to quash of provisional attachment order dated 19.06.2020 issued by respondent no.3 attaching the bank account of the petitioner maintained with the ICICI Bank, Andheri West Branch, Mumbai.

The case of the petitioner is that he is a businessman having his office at Dev Plaza, 2nd floor, S.V. Road, Opp. Fire Brigade, Andheri (West), Mumbai- 400 058. There are various other offices carrying on their business from the said address.

Petitioner has rented out commercial premises on leave and license basis receiving license fees from the licensees. Since the petitioner is required to pay goods and services taxes (GST) on such license fees, he is duly registered with the GST department and submitting GST returns regularly.

On 17.01.2020, the office of respondent no.2 carried out a search operation in the office address of the petitioner in respect of other companies having their offices there, namely, Satra Retail Private Limited, Bleu Noir Infrastructures Private Limited, Prarush Impex, and Minaxi Satra Ventures whereafter, summons under section 70 of the Maharashtra Goods and Services Tax Act, 2017 (briefly ‘the MGST Act’ hereinafter) were issued. However, no such search was undertaken against the petitioner and the petitioner has not received any summons from the office of respondent no.2.

Related Topic:

Bombay HC in the case of Dharmendra M. Jani Versus Union of India

Observations:

As per the note sheet, we find that premises of M/s. Prarush Impex was visited by the investigation team from 17.01.2020 to 21.01.2020. During the course of investigation and search, 5 other firms were found in the same premises including that of the petitioner i.e. M/s. Praful Nanji Satra. The record contains Form GST INS-1 which is an authorization for inspection or search. The authorization was given by the Deputy Commissioner of State Tax (GST INV-E-02), INV-A, Mumbai to Smt. Poonam Ombase, Assistant Commissioner of State Tax, and Shri Uttam K. Bodhgire, Assistant Commissioner of State Tax to visit the premises of M/s. Prarush Impex on 17.01.2020. This authorization is dated 16.01.2020. There is one summons to witness issued by Smt. Poonam Ombase, Assistant Commissioner of State Tax on 21.01.2020 summoning the petitioner Shri Praful Nanji Satra (Director), M/s. Satra Retail Private Limited to give evidence and to produce documents before the Assistant Commissioner of State Tax (Investigation)-08, Mumbai immediately in proceedings of investigation under section 67 of the MGST Act and section 64 of Maharashtra Value Added Tax Act, 2002 in the case of M/s. Satra Retail Private Limited for the period from 01.07.2017 to date. This summons to witness was issued under section 70 of the MGST Act read with section 14 of the Maharashtra Value Added Tax Act, 2002 and section 30 of the Civil Procedure Code, 1908.

Related Topic:

Bombay HC in the case of GGS Infrastructure Private Limited

The Decision of the Court:

Since the impugned attachment of bank account has been found to be without jurisdiction, availability of alternative remedy in the form of fling objection under rule 159(5) of the MGST Rules would be no bar to the petitioner from seeking relief under writ jurisdiction. Even here also it is doubtful whether the Joint Commissioner to whom the representation dated 01.07.2020 was addressed could have at all exercised power under rule 159(5) of the MGST Rules when the authority to do so is the Commissioner.

Consequently and in the light of the above, we are of the opinion that the impugned provisional attachment order dated 19.06.2020 cannot be sustained. The same is hereby set aside and quashed. Consequently, respondents are directed to forthwith withdraw the provisional attachment of the bank account of the petitioner bearing account No.001101218141 maintained with ICICI Bank Limited, Andheri West Branch, Mumbai.

The writ petition is accordingly allowed. However, there shall be no order as to costs.

Record produced be returned back.

Related Topic:

Bombay HC in the case of Daulat Samirmal Mehta Versus Union of India

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.