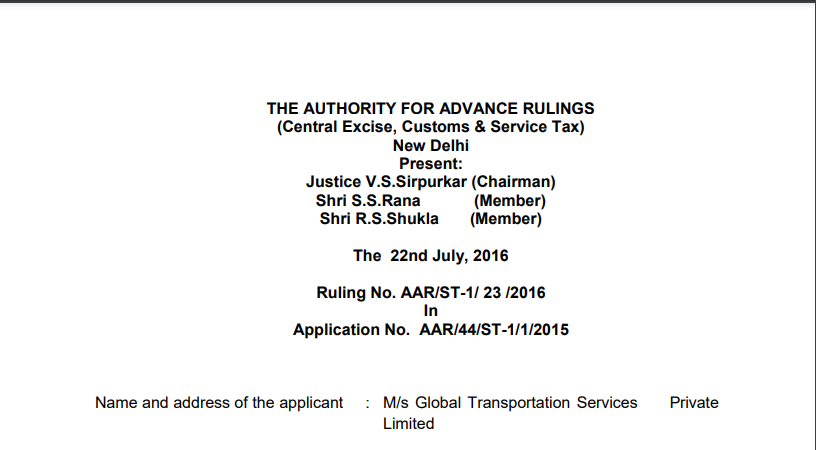

AAR in the case of M/s Global Transportation Services Private Limited

Case Covered:

M/s Global Transportation Services Private Limited

Facts of the Case:

M/S Global Transportation Services Private Limited (hereinafter also referred to as applicant seeks to provide logistics solutions to its customers, comprising of a number of services, which are mutually exclusive and can be provided on a standalone basis. The applicant will sell and bill the customer separately for each of the services availed. For a rendition of such services, the applicant seeks to enter into service agreements with various service providers on a principal to principal basis and not as an agent of its customer. Applicant submits that in his proposed business model, the various stages of consignment shall be distributed inter-se services providers in the following manner.

The applicant shall contract with an IATA member airline for transportation of consignment; the airline shall issue an Airway Bill (Awb) to the applicant. Awb shall govern the terms of the contract for transportation of cargo between the airline and the applicant on a principal to principal basis. Further, the applicant shall not contract with the airline as an agent of its customer. Instead, the Awb shall lay down the terms and conditions assumed by the airline and the applicant on their own account. Therefore, in case the cargo consignment is damaged during the transportation, the applicant shall

have an independent right against the carrier to recover damages in accordance with the Carriage Act and the Montreal Convention. In the majority of the cases, the applicant as the carrier shall further issue a House Airways Bill („House Awb‟) upon its customer, i.e. the original consignor, as the shipper. The applicant‟s customer shall have independent access to contractual remedies and rights available under the Carriage Act and the Montreal Convention against the applicant.

Related Topic:

Place of Provision of Service Rules, 2012 (POPS)

Observations:

It is reiterated that the place of provision of service of transportation of goods shall be the place of destination of the goods, as per Rule 10 of POP Rules. In the case of outbound shipment –both by aircraft and vessel, the destination of goods shall be outside India. Therefore, the place of provision of service of outbound shipment shall be outside India, hence there will be no Service Tax on freight margin recovered by the applicant from the customer.

Ruling:

In view of the above, we rule as under;

A. The freight margin recovered by the applicant from its customer in an outbound shipment is not taxable under the Finance Act, 1994 in light of Rule 10 of Place of Provision Rules, 2012 on account of the fact that place of provision of service would be outside India.

B. The freight margin recovered by the applicant from its customer or a Freight Partner in an inbound shipment is exempt from levy of service tax under the Finance Act, 1994 in light of the exemption provided to transportation of goods by aircraft and vessel under Section 66 D of the Act as same is service by way of transportation of goods by air or sea from a place outside India into Indian Customs area up-to 31.05.2016. However, the exemption provided to transportation of goods by aircraft has been extended vide Notification No. 9/2016-ST (S. No. 53) w. e. f. 01.06.2016.

C & D. In view of A and B above, questions C and D have become infructuous.

Read & Download the full Ruling in Pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.