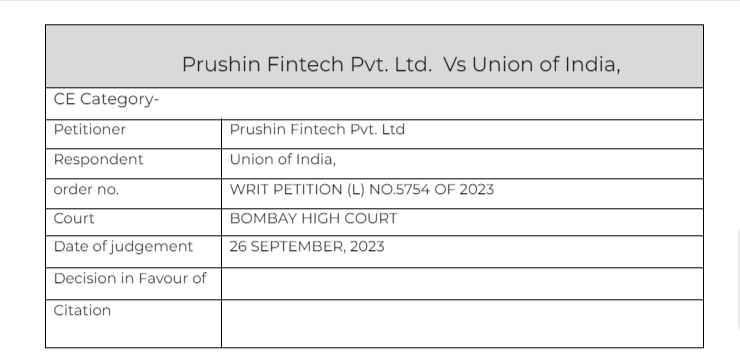

Bombay HC in the case of Prushin Fintech Pvt. Ltd. Vs Union of India,

Post credit to Advocate Bharat Raichandani

Cases Covered:

Prushin Fintech Pvt. Ltd. Vs Union of India

Facts of the cases:

The petitioner is a service provider. It filed returns for the period 2017-2018. There was some technical issue with the online portal. It could not file its return for January, 2019 as the portal suggested that earlier returns were not filed. It sought redressal of its grievance by writing letters to the State GST department, the grievance portal, and the Finance and MSME Ministry to no reply. Grievance was also raised on the portal. About 23 representations were made, to no reply. However, a show cause notice came to be issued alleging that there is a delay in filing returns, and hence, the petitioner is not entitled to input tax credit under section 16(4) of the CGST Act. Such notice was challenged.

Observation & Judgement of the Court:

The Hon’ble Bombay High Court lambasts and notes that it is disturbing to see gross inaction on the part of the State in not responding to over 20 representations made by the petitioner, which is against the Government’s policy of ease of doing business. There cannot be the approach of reticence on the part of the officers leading to disharmony in working the statutory machinery leading to unwarranted litigation.

The court cannot overlook the accountability of the officers to the assessee, more so to the court, and hence, calls upon the Commissioner of State Tax to file an affidavit explaining reasons for no communication. Stays the adjudication of the show cause notice.

Read & Download the Full Prushin Fintech Pvt. Ltd. Vs Union of India

optional file name

optional file name

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.