Section 50 of CGST Act: Interest (updated Till on October 2023)

Section 50 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 50 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color

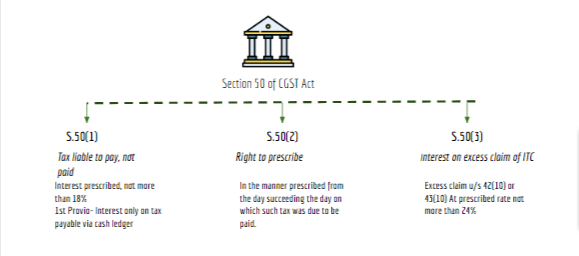

Section 50 of CGST Act provide for the interest on the delayed payments.

“(1) Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent., as may be notified by the Government on the recommendations of the Council.

Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger.

(2) The interest under sub-section (1) shall be calculated, in such manner as may be prescribed, from the day succeeding the day on which such tax was due to be paid.

(3) A taxable person who makes an undue or excess claim of input tax credit under subsection (10) of section 42 or undue or excess reduction in output tax liability under subsection(10) of section 43, shall pay interest on such undue or excess claim or on such undue or excess reduction, as the case may be, at such rate not exceeding twenty-four per cent., as may be notified by the Government on the recommendations of the Council.”

(3) Where the input tax credit has been wrongly availed and utilised, the registered person shall pay interest on such input tax credit wrongly availed and utilised, at such rate not exceeding twenty-four percent as may be notified by the Government, on the recommendations of the Council, and the interest shall be calculated, in such manner as may be prescribed

Chart of the Section:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.