Section 37 of CGST Act: outward supply details (updated till July 2024)

Section 37 of the CGST Act as amended by the Finance Act 2023

Note: Section 37 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Section 37 of CGST Act provide for the details of outward supply in GSTR-1

(1) Every registered person, other than an Input Service Distributor, a non-resident taxable person and a person paying tax under the provisions of section 10 or section 51 or section 52, shall furnish, electronically, [subject to such conditions and restrictions and] in such form and manner as may be prescribed, the details of outward supplies of goods or services or both effected during a tax period on or before the tenth day of the month succeeding the said tax period and such details shall be communicated to the recipient of the said supplies within such time and in such manner as may be prescribed: [shall, subject to such conditions and restrictions, within such time and in such manner as may be prescribed, be communicated to the recipient of the said supplies]

Provided that the registered person shall not be allowed to furnish the details of outward supplies during the period from the eleventh day to the fifteenth day of the month succeeding the tax period:

Provided further that [Provided that] the Commissioner may, for reasons to be recorded in writing, by notification, extend the time limit for furnishing such details for such class of taxable persons as may be specified therein:

Provided also that [Provided further that] any extension of time limit notified by the Commissioner of State tax or Commissioner of Union territory tax shall be deemed to be notified by the Commissioner.

(2) Every registered person who has been communicated the details under sub-section (3) of section 38 or the details pertaining to inward supplies of Input Service Distributor under sub-section (4) of section 38, shall either accept or reject the details so communicated, on or before the seventeenth day, but not before the fifteenth day, of the month succeeding the tax period and the details furnished by him under sub-section (1) shall stand amended accordingly.

(3) Any registered person, who has furnished the details under sub-section (1) for any tax period and which have remained unmatched under section 42 or section 43, shall, upon discovery of any error or omission therein, rectify such error or omission in such manner as may be prescribed, and shall pay the tax and interest, if any, in case there is a short payment of tax on account of such error or omission, in the return to be furnished for such tax period:

Provided that no rectification of error or omission in respect of the details furnished under sub-section (1) shall be allowed after furnishing of the return under section 39 for the month of September following the end of the financial year to which such details pertain, or furnishing of the relevant annual return, whichever is earlier.

[Provided further that the rectification of error or omission in respect of the details furnished

under sub-section (1) shall be allowed after furnishing of the return under section 39 for the month

of September, 2018 till the due date for furnishing the details under subsection (1) for the month of

March, 2019 or for the quarter January, 2019 to March, 2019]

[(4) A registered person shall not be allowed to furnish the details of outward supplies under sub- section (1) for a tax period, if the details of outward supplies for any of the previous tax periods has not been furnished by him:

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish the details of outward supplies under sub- section (1), even if he has not furnished the details of outward supplies for one or more previous tax periods]

[(5) A registered person shall not be allowed to furnish the details of outward supplies under sub –

section (1) for a tax period after the expiry of a period of three years from the due date of

furnishing the said details:

Provided that the Government may, on the recommendations of the Council, by notification,

subject to such conditions and restrictions as may be specified therein, allow a registered person

or a class of registered persons to furnish the details of outward supplies for a tax period under

sub-section (1), even after the expiry of the said period of three years from the due date of

furnishing the said details.]

Explanation.––For the purposes of this Chapter, the expression “details of outward supplies” shall include details of invoices, debit notes, credit notes and revised invoices issued in relation to outward supplies made during any tax period.

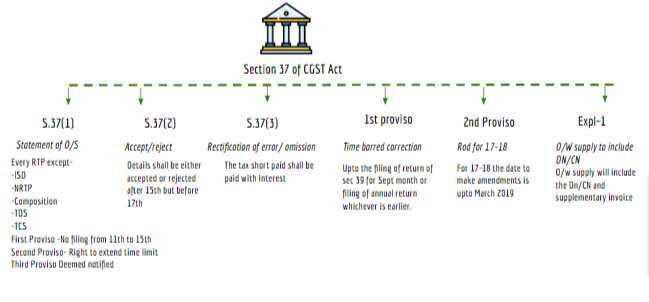

Chart of the Section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.