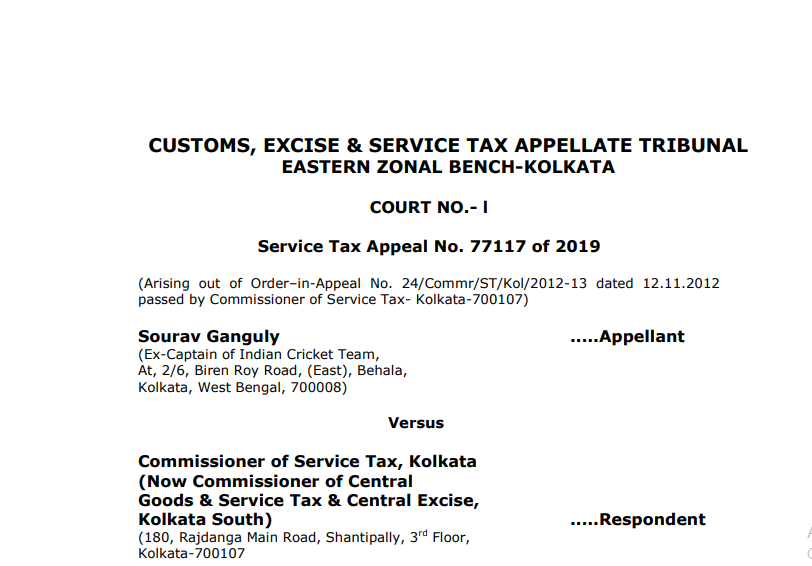

CESTAT in the case of Sourav Ganguly Versus Commissioner of Service Tax

Case Covered:

Sourav Ganguly

Versus

Commissioner of Service Tax

Facts of the Case:

The reliefs claimed in this appeal, which is directed against the order dated November 12, 2012, passed by the Commissioner of Service Tax, Kolkata confirming the demand of service tax under “business auxiliary service” and “support services of business or commerce” with interest and penalty, are for setting aside the aforesaid order passed by the Commissioner and for granting interest to the appellant on the amount of Rs. 1,51,66,500/- deposited with the Department on February 26, 2014, towards the demand of service tax as also Rs. 50 lacs deposited on March 26, 2014, towards penalty, from the date of deposit till the date the amount was transferred to the account of the Registrar General of the Calcutta High Court.

Observations:

The contention of the appellant is that no interest has been paid to the appellant from the date of deposit of the amount of Rs. 1,51,66,500/- on February 26, 2014, with the Government till the date the said amount was deposited by the Government with the Registrar General of the High Court. Likewise, the appellant has not been paid interest on Rs. 50 lacs from the date it was deposited with the Government on March 21/26, 2014 till the said amount was deposited by the Government with the Registrar General of the High Court. It has, therefore, been urged by the learned counsel of the appellant that the appellant should get interest on the amount of Rs. 2,01,66,500/- from the date of deposit with the Government till the said amount was transferred to the Registrar General of the High Court if it is ultimately held that the appellant is not entitled to pay service tax.

Decision:

Thus, for all the reasons above, the impugned order dated November 12, 2012, passed by the Commissioner is set aside and the appeal is allowed. The appellant shall also be entitled to interest on the amount of Rs. 1,51,66,500/- and Rs. 50,00,000/- from the date of deposit of the amount with the Government up to the date the amount was transferred to the Registrar General of the Calcutta High Court at the rate of ten percent per annum. This amount shall be paid to the appellant within a period of one month from the date of this order, failing which the appellant would be entitled to get interested at the same rate from the date of this order up to the date of payment of the amount.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.