How your GSTIN dashboard will look like

First look of GSTIN Dashboard:

GSTIN has released the first outlook of dashboard of GSTIN for suggestions. Here we will share that outlook with you. Although GSTIN has release a 115 slides pdf for GSTIN dashboard. Here we will discuss its components. In this particular article we will cover the basic features of GSTIN Dashboard.

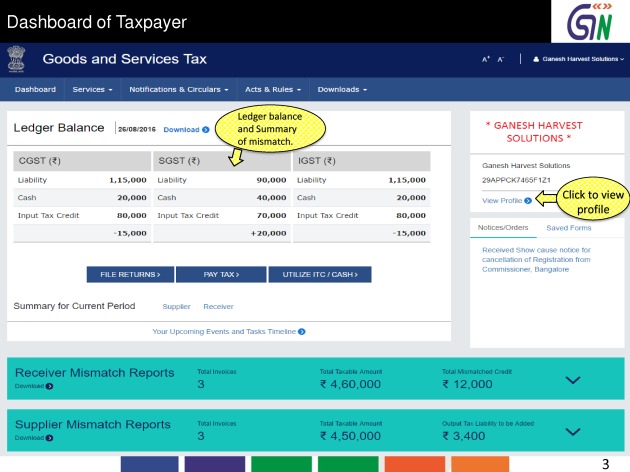

GSTIN Dashboard of Taxpayer:

This page will be the homepage of dashboard. It will look like this.

As you can see this portion will have liability, cash balance and credit balance for CGST,SGST and IGST. It will also have the mismatch report for the supplies and receipts.

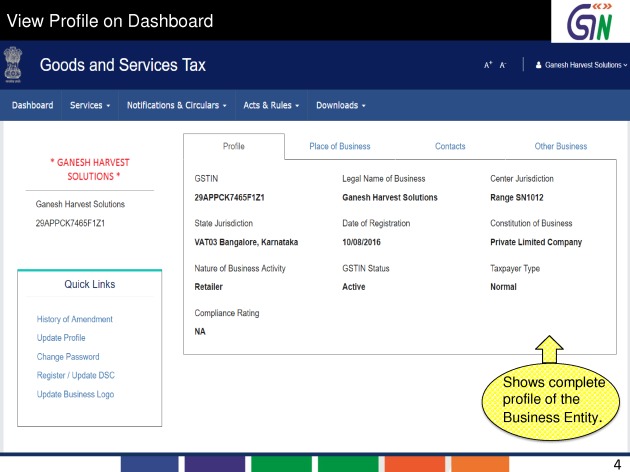

Profile of business entity:

This portion will have the profile of the business entity.

you can see in above image that you can change some of your basic details here. It contains the links to change password and upload dsc here.

GSTIN Dashboard: Receiver and supplier mismatch reports:

This part of the dashboard have the details of mismatch report. This report will have all the necessary fields like supplier and receiver GSTIN, name, invoice date, invoice number, ITC available and taken and mismatch amount.

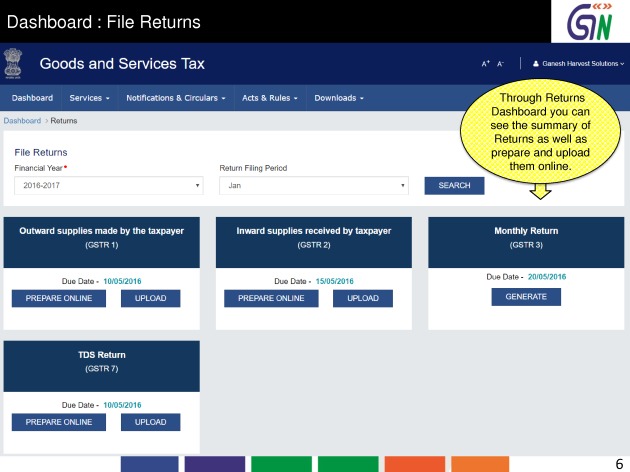

Filing of returns via GSTIN:

Here you can see the returns dashboard. At this dashboard you will be able to see all returns you need to file and links to upload their respective details.

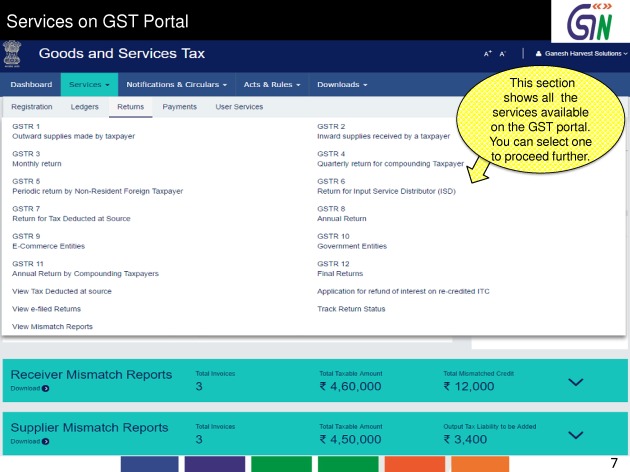

In the following image you will see all the returns required to be filed under GST. From this page you can select any of them to proceed further. We will discuss the filing of returns on GST portal in detail in our next article.

This is how your GSTIN dashboard will be going to work. GST will be a reality soon. It is important to have a look and understand it. You can also give your suggestions at prototype-feedback@gst.gov.in.

It is open for suggestions for 15 days.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.