AMENDMENTS PROPOSED IN 39TH GST COUNCIL MEETING AS PER PRESS RELEASE

- AMENDMENTS PROPOSED IN 39TH GST COUNCIL MEETING AS PER PRESS RELEASE

- GST MONTHLY RETURNS, ANNUAL RETURNS, RECONCILIATION STATEMENT, INFORMATION RETURN

- E-INVOICING

- INTEREST

- KNOW YOUR SUPPLIER

- INPUT TAX CREDIT FOR NEW TAXPAYERS AND REVERSAL OF CREDIT OF CAPITAL GOODS AND OTHERS

- REFUNDS FOR EXCESS TAX PAID AND OTHERS

- REVOCATION OF CANCELLATION OF REGISTRATION AND NEW REGISTRATIONS

- EXPORTERS

- MISCELLANEOUS

- Download the copy:

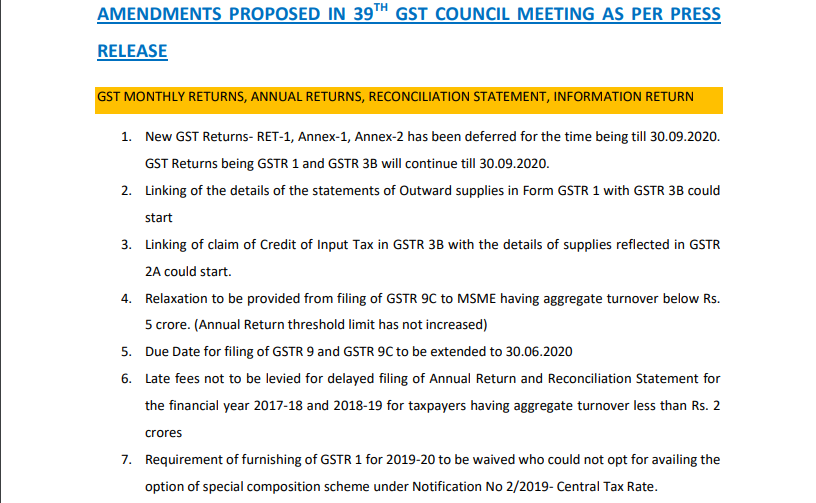

AMENDMENTS PROPOSED IN 39TH GST COUNCIL MEETING AS PER PRESS RELEASE

GST MONTHLY RETURNS, ANNUAL RETURNS, RECONCILIATION STATEMENT, INFORMATION RETURN

1. New GST Returns- RET-1, Annex-1, Annex-2 has been deferred for the time being till 30.09.2020. GST Returns being GSTR 1 and GSTR 3B will continue till 30.09.2020.

2. Linking of the details of the statements of Outward supplies in Form GSTR 1 with GSTR 3B could start

3. Linking of the claim of Credit of Input Tax in GSTR 3B with the details of supplies reflected in GSTR 2A could start.

4. Relaxation to be provided from the filing of GSTR 9C to MSME having aggregate turnover below Rs. 5 crore. (Annual Return threshold limit has not increased)

5. Due Date for filing of GSTR 9 and GSTR 9C to be extended to 30.06.2020

6. Late fees not to be levied for delayed filing of Annual Return and Reconciliation Statement for the financial year 2017-18 and 2018-19 for taxpayers having aggregate turnover less than Rs. 2 crores

7. The requirement of furnishing of GSTR 1 for 2019-20 to be waived who could not opt for availing the option of special composition scheme under Notification No 2/2019- Central Tax Rate.

8. Extension of due dates for form GSTR 3B, GSTR 1, GSTR 7 for the month of July 2019 to January 2020 till 24.03.2020 for the registered persons having principal place of business in Union territory of Ladakh

9. Special procedure for registered persons in Dadra and Nagar Haveli & Daman and Diu during transition period consequent to a merger of UTs w.e.f 26.01.2020 to be completed by 31.05.2020

10. GST Authority would be seeking information return from Banks

11. Shri Nandan Nilekani said hardware procurement process has been initiated to concurrently handle 3 lakh taxpayers from the present level of 1.50 lakh taxpayers

E-INVOICING

1. The dates for implementation of e-invoicing and QR code to be extended till 01.10.2020

2. A certain class of registered persons to be exempted from issuing e-invoices for capturing dynamic QR code

INTEREST

Interest for delay in payment of GST to be charged on the net cash tax liability w.e.f 01.07.2017. (Law to be amended retrospectively)

KNOW YOUR SUPPLIER

A new facility called Know Your Suppliers to be introduced so as to enable every registered person to have some basic information about the suppliers.

INPUT TAX CREDIT FOR NEW TAXPAYERS AND REVERSAL OF CREDIT OF CAPITAL GOODS AND OTHERS

1. Restrictions to be imposed on the passing of the ITC in case of new GST registrations before physical verification of premises and Financial KYC of the registered persons

2. Procedure for reversal of input tax credit in respect of capital goods partly used for effecting taxable supplies and partly for exempt supplies under Rule 43(1)(c ).

3. Clarification in the apportionment of ITC in case of business reorganization u/s 18(3) [sale, merger, demerger, amalgamation, lease or transfer of the business with the specific provisions for transfer of liabilities]

REFUNDS FOR EXCESS TAX PAID AND OTHERS

1. The proper procedure to be notified for the refund to be sanctioned in both cash and credit in case of excess payment of tax

2. Further clarification on the refund related issues

REVOCATION OF CANCELLATION OF REGISTRATION AND NEW REGISTRATIONS

1. Where registrations have been cancelled till 14.03.2020 application for revocation of cancellation of registration can be filed up to 30.06.2020 for the facilitation of taxpayers who want to conduct business

2. To operationalize Aadhar authentication for new taxpayers

EXPORTERS

1. Extension of present exemptions from IGST and Cess on imports under AA/EPCG/EOU schemes up to 31.03.2021

2. Ceiling to be fixed for the value of the export supply for the calculation of refund on zero-rated supplies

3. Recovery of refund on the export of goods where export proceeds are not realized within the time prescribed under FEMA

4. Extension of e-wallet scheme to be extended till 31.03.2021

MISCELLANEOUS

1. Appeals during non-constitution of the Appellate Tribunal

2. Clarification issued on a special procedure for the registered persons who the corporate debtors under provisions of the Insolvency and Bankruptcy Code 2016.

The above amendments will come into effect only after the issue of Notifications and Circulars

Download the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal