Law Amendments during 31st Meeting of the GST Council

Law Amendments during 31st Meeting of the GST Council

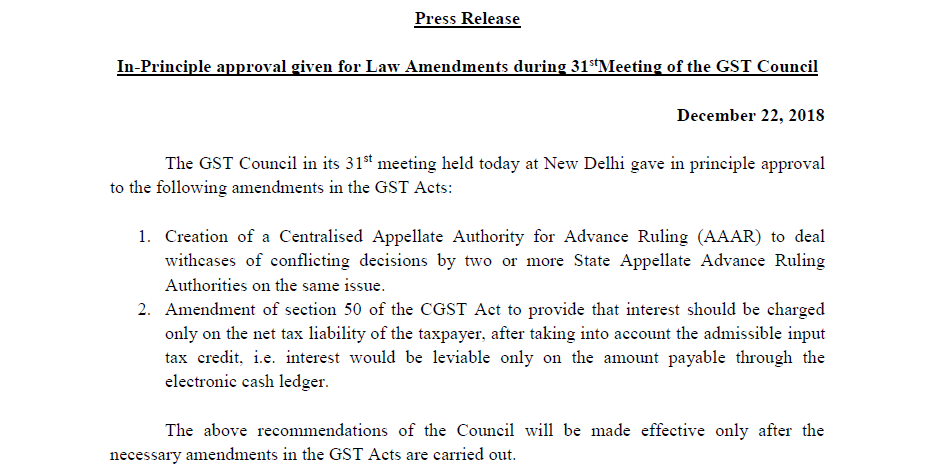

The press release has been issued on the Law Amendments during 31st Meeting of the GST Council. The formation of AAAR and interest applicable on the tax. Following is the press release on Law Amendments during 31st Meeting of the GST Council:

In-Principle approval given for Law Amendments during 31stMeeting of the GST Council:

The GST Council in its 31st meeting held today at New Delhi gave in principle approval to the following amendments in the GST Acts:

1. Creation of a Centralised Appellate Authority for Advance Ruling (AAAR) to deal withcases of conflicting decisions by two or more State Appellate Advance Ruling Authorities on the same issue.

2. Amendment of section 50 of the CGST Act to provide that interest should be charged only on the net tax liability of the taxpayer, after taking into account the admissible input tax credit, i.e. interest would be leviable only on the amount payable through the electronic cash ledger.

The above recommendations of the Council will be made effective only after the necessary amendments in the GST Acts are carried out.

Download the press release on Law Amendments during 31st Meeting of the GST Council by clicking the below image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.