Membership fee can be consideration in GST

Membership fee can be consideration in GST

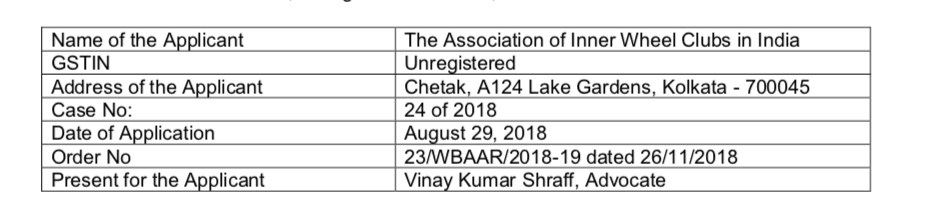

In the recent advance ruling by AAR of west Bengal clarified this issue. In the respected case the question raised before the authority was about activities done by it for its members. The Applicant was affiliated to inner wheel circle. It is an international body for women. The authority observed that Membership fee can be the consideration in GST. Let us have a look on details of advance ruling of

Membership fee can be consideration in GST

Members of the Clubs which fall under the Applicant organize events which combine personal service, fundraising, fellowship and fun, united by friendship and to serve the local community. They provide financial and other practical support to the financially disadvantaged classes, including people suffering from natural disaster or in war-torn regions. The club accumulates funds through subscriptions, sponsorship fees, the sale of souvenirs etc.

The Application, as well as the literature subsequently submitted by the Applicant regarding the Constitution, workings and objectives of the International Inner Wheel and the Bye-Laws of the Association of Inner Wheel Clubs in India, the Applicant, does not provide for any “import of services”, nor for any of the supplies of goods or services, with or without consideration, as enumerated in Schedules I and II.

The activity of the Applicant, therefore, is to be considered in the light of Section 7(1)(a) of the GST Act.

On details perusal of applicants activities it was observed that they have pre defined objectives. Their activities dont even fall in charitable activities in GST. Definition of business is wide enough to cover the activities done by the applicant.

Observation:

The Applicant’s activities involve supply of services classifiable under SAC Heading 99959 against consideration received in the form of subscription and membership fees. Services classifiable under SAC Heading 99836 are also supplied.

Sale of souvenirs is to be considered as a supply of goods.

The nature of supply for miscellaneous income as recorded in the Financial Accounts is to be determined by the nature of the supply.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.