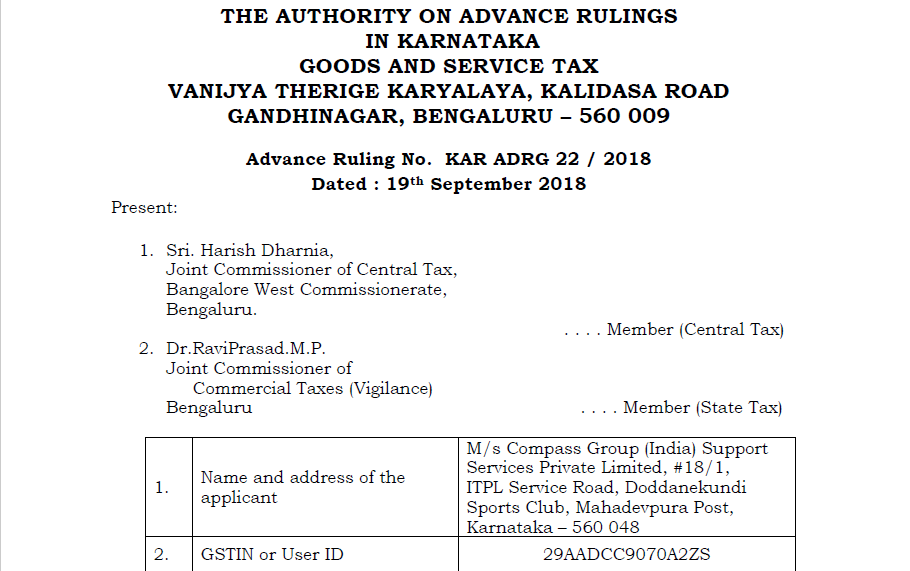

Original order of GST AAR of M/s Compass Group (India) Support Services Private Limited

Original order of GST AAR of M/s Compass Group (India) Support Services Private Limited

In the GST AAR of M/s Compass Group (India) Support Services Private Limited. The applicant has raised the query regarding the tax liability of the services provided to educational services.

ORDER UNDER SUB-SECTION (4) OF SECTION 98 OF CENTRAL GOODS AND SERVICE TAX ACT, 2017 AND UNDER SUB-SECTION (4) OF SECTION 98 OF KARNATAKA GOODS AND SERVICES TAX ACT, 2017

M/s Compass Group (India) Support Services Private Limited, (“Compass India”) is a private limited company having its registered office at #426, 4th Floor, Tower-A, Spaze 1-Tech Park, Sohna Road, Sector 49, Gurugram-122 018 and also having local office at #18/1, ITPL Service Road, Doddanekundi Sports Club, Mahadevpura Post, Karnataka – 560 048 (herein after referred to as Applicant) having GSTIN number 29AADCC9070A2ZS, have filed an application, on 20.04.2018, for advance ruling under Section 97 of CGST Act,2017, KGST Act, 2017 & IGST Act, 2017 read with rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01. They also enclosed copy of challan for Rs.10,000/- (CGST – Rs.5,000/-&SGST–Rs.5,000/-) bearing CIN number SBIN18042900080695 dated 12.04.2018.

2. The Applicant is engaged in supply of cooked food & beverages and undertakes the following two, separate nature of transactions for its customers.

a) Transaction 1 :Supply of cooked food and beverages to the employees of the customers within designated area (generally the cafeteria / canteen) of the client’s premises.

b) Transaction 2 : Over the counter supply of food and beverages to the employees of clients / customers, which include products which are required to have Maximum Retail Price (MRP) mentioned on the packages under the Legal Metrology Act, 2009.

Download the copy of the Original order of GST AAR of M/s Compass Group (India) Support Services Private Limited. By clicking the below image:

3. In view of the above, the Applicant has sought for Advance Ruling on the following four questions :

i. Whether cooking and subsequent supply of food by the Applicant to educational institutions under Transaction 1 is classifiable as “mess/canteen services” and exigible to GST @ 5% in the light of the Circular No.28/02/2018-GST dated 08.11.2018 and Corrigendum dated 18.01.2018.

ii. Whether cooking and subsequent supply of food by the Applicant in designated premises of its customers other than educational institutions under Transaction 1 is classifiable as “mess/canteen services” and exigible to GST @ 5% in the light of the Circular No.28/02/2018-GST dated 08.11.2018 and Corrigendum dated 18.01.2018.

iii. Whether, over the counter supply of food & beverages (including MRP Products) by the Applicant on a stand-alone basis in educational institutions under Transaction 2 is classifiable as supply provided by eating joint / mess / canteen etc., and be exigible to GST @ 5% in the light of the Circular No.28/02/2018-GST dated 08.11.2018 and Corrigendum dated 18.01.2018.

iv. Whether, over the counter supply of food & beverages (including MRP Products) by the Applicant on a stand-alone basis in establishments other than educational institutions under Transaction 2 is classifiable as supply provided by eating joint /mess / canteen etc., and be exigible to GST @ 5% in the light of the Circular No.28/02/2018-GST dated 08.11.2018 and Corrigendum dated 18.01.2018.

4. The Applicant vide their letter dated 10.08.2018 requested to permit them to withdraw the advance ruling application, filed by them on 20.04.2018, stating the reason that all the transactions of the applicant, that were subject matter of the questions raised in the advance ruling application, have been covered, under Notification No.13/2018- Central Tax (Rate) dated 26.07.2018, & are liable to GST @ 5% & accordingly the advance ruling application has become infructuous.

RULING

The application filed by the Applicant for the advance ruling is dismissed as withdrawn.

Source: GST Karnataka

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.