Format and salient features of GSTR Sahaj

Format and salient features of GSTR Sahaj:

- Who can file the GSTR Sahaj?

Ans: A taxpayer having B2C only supplies can file GSTR Sahaj. A taxpayer can choose the option to file it monthly or quarterly. So a small taxpayer can choose a quarterly option.

2. When can Sahaj be filed monthly and quarterly respectively?

Ans: Sahaj can be filed quarterly by the taxpayers having a turnover of up to Rs. 5 Crores. A taxpayer having a turnover of more than Rs. 5 Crore can file it monthly.

3. What is the main information a taxpayer is required to provide in GSTR return Sahaj?

Details of B2B supplies, input tax credit, and inward supplies covered in RCM are required in GST return Sahaj. So it is suitable for small and medium level taxpayers.

4. Who are not eligible to file Sahaj?

Following taxpayers are not eligible for GST Sahaj:

a) Composition dealer

b) Non-resident taxable person

c) TDS deductor u/s 51.

d) TCS eductor u/s 52.

e) Input service distributor.

5. When a taxpayer opts for the filing of monthly/quarterly GSTR Sahaj?

A taxpayer can opt for quarterly filing at the beginning of a year. If nothing opts than by default the filing will be monthly.

Thus we can say that a taxpayer having B2C supplies will be liable to file GST return Sahaj. But to see his eligibility to file the return quarterly we will have to check his turnover. Let us try to understand through an example.

e.g.1:

Mr. X had a turnover of Rs. 55 Crores in the preceding year. All his supplies are b2b. Which GST return he needs to file and what will be the frequency of filing of GST return? What will be the frequency of filing of return if the turnover is less than Rs. 5 Crore?

Mr. X will file GST return Sahaj. He will file GST return monthly.His turnover is more than threshold of Rs. 5 Cr. option to file a quarterly return can be taken. Thus In case, the turnover of Mr. X is up to Rs. 5 Crore, he can file GST return Sahaj quarterly.

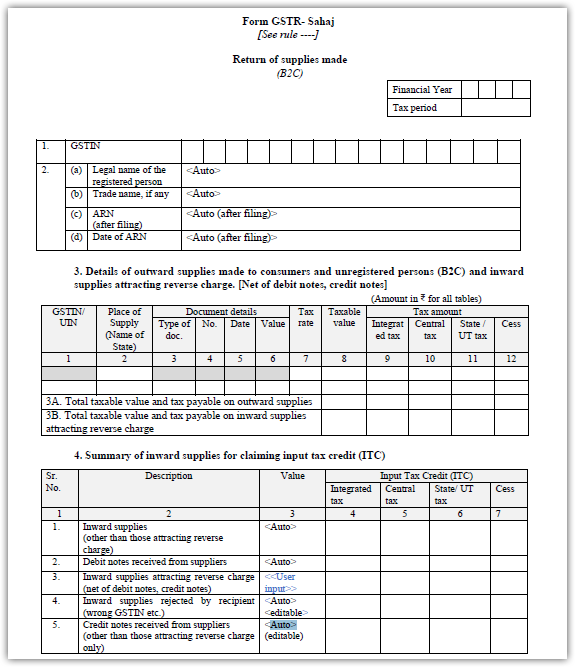

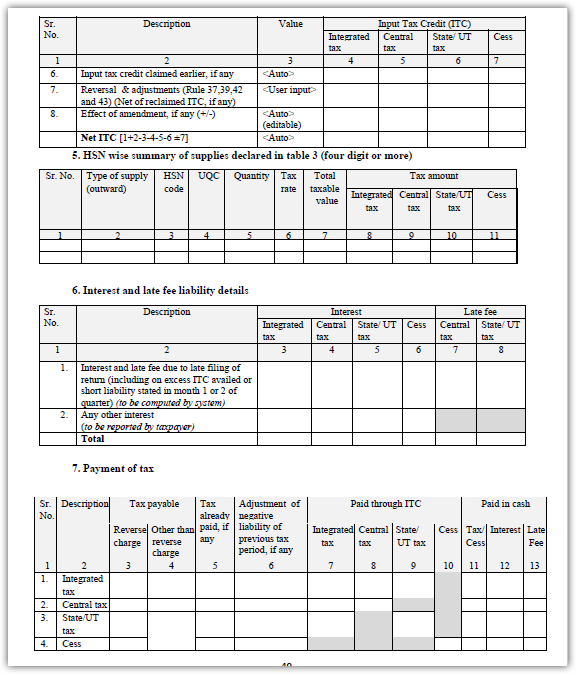

The format of GSTR Sahaj:

GSTR Sahaj first page

GSTR sahaj page 2

Thus you can see these formats to have a detailed view.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.