TDS u/s 192 is not conclusive proof of incentives given to WTD is salary

Incentives paid to WTD in form of salary-

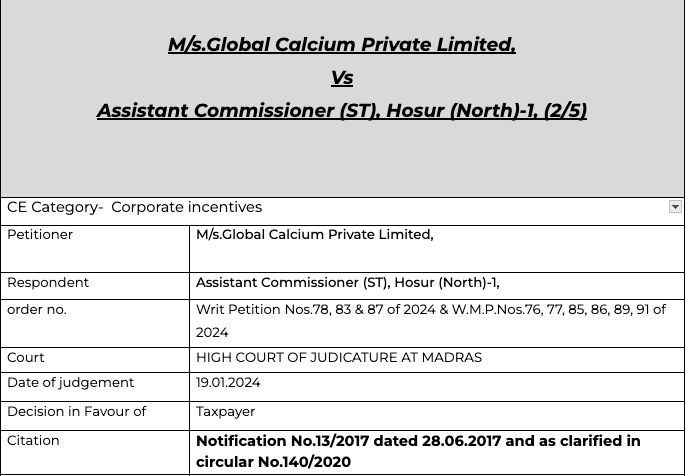

Even after clarification by the CBIC via Notification No.13/2017 dated 28.06.2017 and as clarified in circular No.140/2020 the deptt passed the order against the company. The incentives given to the WTD were claimed to be chargeable to tax under reverse charge.

Although the relevant provisions were put to place and TDS certificate u/s 192 was placed and was matched with CA certificate and 26AS.

This is an interesting case of Madras high court where the court asked the taxpayer to put documents to prove that the amount paid was in form of salary and not other incentives.

Details of the case of Madras high court –

Global calcium Private limited Vs Assistant commissioner , Madras high court.

Pleading

To drop the orders passed by the Assistant commissioner without considering their reply.

Facts

In the orders impugned in these writ petitions, other than W.P.No.78 of 2024, three defects were dealt with. The first of those relates to suppression of purchases by not availing of available Input Tax Credit (ITC). The second issue, which is the principal issue, pertains to the payment of performance linked incentives to two persons who held office as whole time directors of the company. By the impugned orders, such performance linked incentive was held to be liable to GST. The third issue relates to discrepancies relating to E-way bills.

Observations

The orders impugned herein were not issued after taking the above relevant aspects into consideration. It is also possible that the petitioner did not place on record all relevant documents. In these circumstances, the impugned orders are not sustainable and are hereby quashed.

As a consequence, these matters are remanded for reconsideration by the assessing officer. The petitioner is granted leave to place on record any additional documents with regard to all issues dealt with in the impugned orders. Such documents shall be submitted within ten days from the date of receipt of a copy of this order. Upon receipt thereof, the respondent is directed to consider all materials on record, provide areasonable opportunity to the petitioner and complete the reassessment within four weeks thereafter.

Read/download the copy-

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.