Bunching of notices not allowed by the court- Read judgment

Bunching if notices cant extend the time limit us 73-

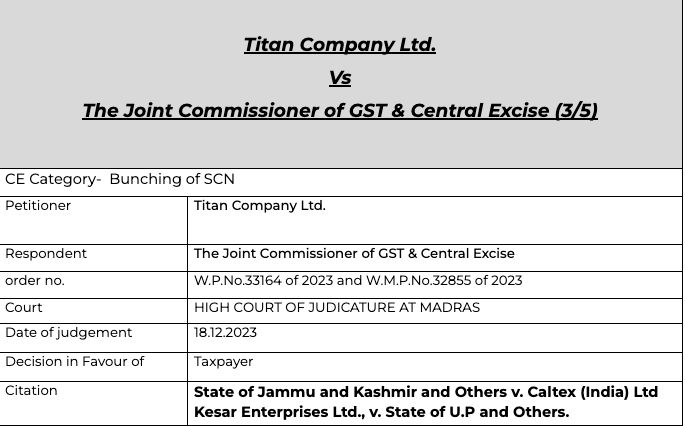

In a recent judgment the honourable Madras high court had rejected the notice, where the notices were bunched. There is a time limit for issuance of notices in section 73. It provide for a time limit of 3 years.

In this case the court said that the bunching of notices cant be done to extend the time limit provided under section 73.(The author can be reached at shaifaly.ca@gmail.com)

Pleading

The petitioner has come up with the present Writ Petition seeking for issuance of a Writ of Mandamus directing the first respondent to consider and pass orders on the representation dated 25.10.2023 submitted by the petitioner before proceeding with the adjudication of show cause notice dated 28.09.2023.

Facts-

Mr.N.L.Rajah, learned Senior Counsel appearing on behalf of the petitioner would submit that the first and foremost grievance of the petitioner is that the respondent had issued bunching of show cause notices dated 28.09.2023 for five Assessment Years starting from 2017-18 to 2021-22. According to the learned Senior Counsel, in terms of Section 73 of CGST Act, 2017 [hereinafter referred to as the ‘Act’], bunching of show cause notices is not permissible and it only provides for determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for any reason other than fraud or willful misstatement or suppression of facts.

Section 73(10) of the Act has categorically fixed the limitation for the purpose of making assessment under Section 73. What the respondents cannot do directly, they cannot do the same indirectly by issuing bunching of show cause notices to extend the period of limitation, is the further submission of the learned Senior Counsel appearing on behalf of the petitioner

Observation

For all these reasons, I do not find force in the submission made by the learned Senior Standing Counsel appearing on behalf of the respondents. Therefore, I find fault in the process of issuing of bunching of show cause notices and the same is liable to be quashed. However, since the petitioner has made an representation before the authorities concerned for splitting up of the show cause notices and pass separate adjudication order, this Court is inclined to pass the following order: (i) The first respondent is directed to dispose of the representation dated 25.10.2023 made by the petitioner, keeping in mind the above order passed by this Court. (ii) As far as splitting up of the show cause notice pertaining to the Assessment Year 2017-18 is concerned, the period of stay granted by this Court viz., 26 days will be excluded and accordingly, the time period of passing the adjudication order pertaining to the Assessment Year 2017-18 is extended upto 26.01.2024, subject to the orders to be passed in the W.P.Nos.34065, 34073 and 34074 of 2023. (iii) In view of the aforesaid direction, the respondent is directed to defer all the proceedings, until the date of disposal of the representation of the petitioner to split up the show cause notices for each year separately.

Read/Download the judgement-

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.