GST on services of RWA, Madras high court ends the confusion

Introduction

Housing societies are bodies to maintain the societies. They are formed to provide common services. They collect an amount for these services. Generally called RWA or housing societies. There is controversy related to the mutuality and that their services are not supplied. But if we leave that apart, they are exempted by 12/2017 up to an amount. Then the circular from cbic sparked controversy as they said that the entire amount above the limit will become taxable once it crosses the threshold.GST on services of RWA started to create confusion amongst the taxpayers.

The exemption provided by CBIC

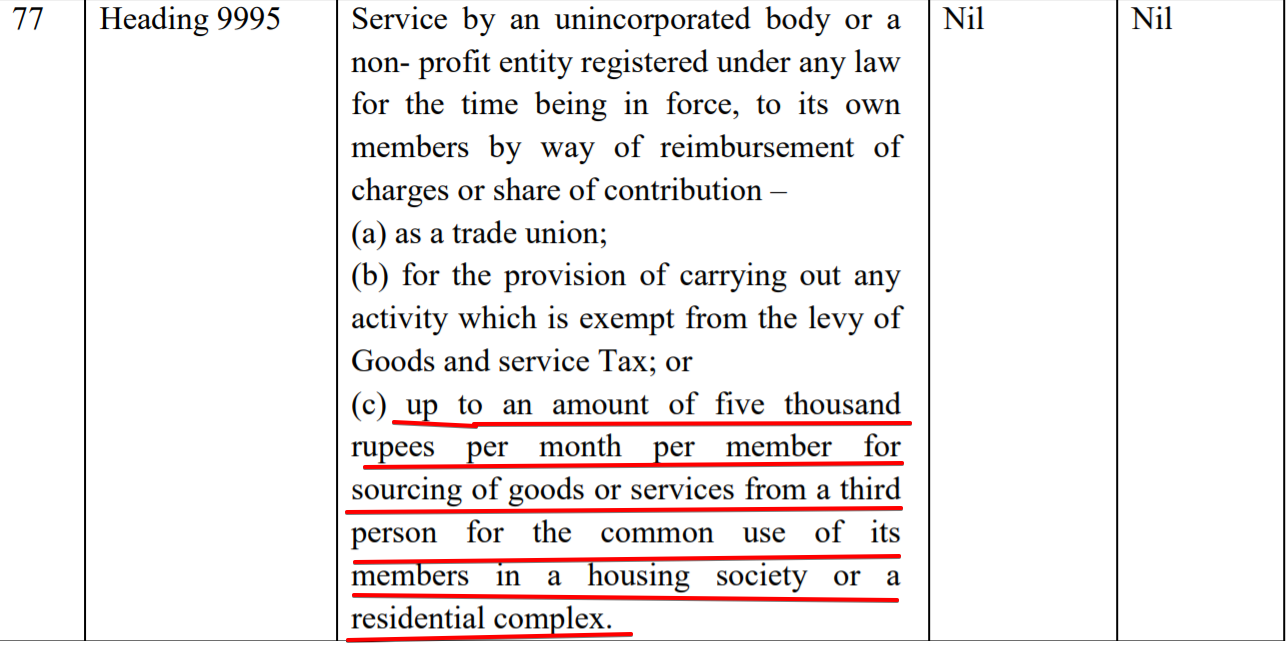

The exemption provided by CBIC was Rs. 5000 which was increased to Rs. 7500 lateron. Let us have a look on the language used by CBIC. It was covered by entry no. 77 of 12/2017.

GST on services of RWA

As you can notice the word used is upto an amount of Rs. 5000. The taxpayers interpreted it to mean that any amount above Rs. 5000 or Rs. 7500 is taxable under GST.

Related Topic:

Whether Online Coaching Outside India is Liable for GST?

CBIC clarification and AAR

CBIC later clarified that the amount taxable is the full amount once the amount crosses Rs.7500. Let us try to understand it with an example.

E.g 1 Star society RWA charges Rs. 6500 for monthly maintenance. What is tax liability in this case? This is completely exempted as it is below the exemption limit.

E.g 2 Now if they start charging Rs. 8000 per month. The GST is chargeable on Rs. 8000 as per CBIC clarification. Whereas the taxpayer thinks that they should pay tax on Rs. 500 only. (Rs. 8000 – Rs. 7500).

Clarification by madras high court in case of M/s.TVH Lumbini Square Owners Association

The issue was creating a lot of confusion. The taxpayer was suffering as the clarification by CBIC was against their stand. Then the issue is discussed in the case of M/s.TVH Lumbini Square Owners Association. The court held that the plea of taxpayers is correct. The court observed that

“The term ‘upto’ hardly needs to be defined and connotes an upper limit. It is interchangeable with the term ‘till’ and means that any amount till the ceiling of Rs.7,500/- would exempt for the purposes of GST.”

Conclusion

The issue was long-lasting. But now it is clarified. We hope that the notification will not get changed retrospectively to settle the point.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.