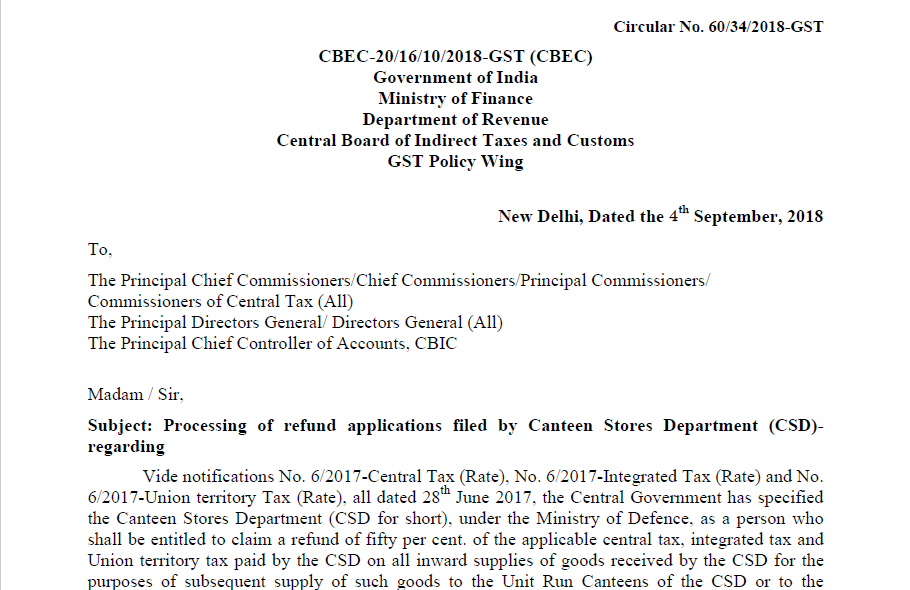

Circular No. 60/34/2018-GST

Circular No. 60/34/2018-GST

Circular No. 60/34/2018-GST

CBEC-20/16/10/2018-GST (CBEC)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

New Delhi, Dated the 4th September 2018

To,

The Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/

Commissioners of Central Tax (All)

The Principal Directors General/ Directors General (All)

The Principal Chief Controller of Accounts, CBIC

Madam / Sir,

Subject: Processing of refund applications filed by Canteen Stores Department (CSD)- regarding

Vide notifications No. 6/2017-Central Tax (Rate), No. 6/2017-Integrated Tax (Rate) and No. 6/2017-Union territory Tax (Rate), all dated 28th June 2017, the Central Government has specified the Canteen Stores Department (CSD for short), under the Ministry of Defence, as a person who shall be entitled to claim a refund of fifty per cent. of the applicable central tax, integrated tax and Union territory tax paid by the CSD on all inward supplies of goods received by the CSD for the purposes of subsequent supply of such goods to the Unit Run Canteens of the CSD or to the authorized customers of the CSD. Identical notifications have been issued by the State Governments allowing refund of fifty per cent of the State tax paid by the CSD on the inward supply of goods received by it and supplied subsequently as stated above.

2. With a view to ensuring expeditious processing of refund claims, the Board, in exercise of its powers conferred under section 168(1) of the Central Goods and Services Tax Act, 2017 (hereafter referred to as the ‘CGST Act’), hereby specifies the manner and procedure for filing and processing of such refund claims as below:-

Download the Circular No. 60/34/2018-GST by clicking the image:

3. Filing Application for Refund:

3.1 Invoice-based refund: It is clarified that the instant refund to be granted to the CSD is not for the accumulated input tax credit but refund based on the invoices of the inward supplies of goods received by them.

3.2 Manual filing of claims on a quarterly basis: In terms of rule 95 of the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the ‘CGST Rules’), the CSD are required to apply for the Circular No. 60/34/2018-GSTrefund on a quarterly basis. Till the time the online utility for filing the refund claim is made available on the common portal, the CSD shall apply for the refund by filing an application in FORM GST RFD-10A (Annexure-A to this Circular) manually to the jurisdictional tax office. The said form shall be accompanied with the following documents:

(i) An undertaking stating that the goods on which refund is being claimed have been received by the CSD;

(ii) A declaration stating that no refund has been claimed earlier against the invoices on which the refund is being claimed;

(iii) Copies of the valid return filed in FORM GSTR-3B by the CSD for the period covered in the refund claim;

(iv) Copies of FORM GSTR-2A of the CSD for the period covered in the refund claim along with the attested hard copies of the invoices on which refund is claimed but which are not reflected in FORM GSTR-2A;

(v) Details of the bank account in which the refund amount is to be credited.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.