Amendment of Registration of NRTP, OIDAR, TDS, and TCS

Amendment of Registration of NRTP, OIDAR, TDS, and TCS taxpayers are now Available on GST portal

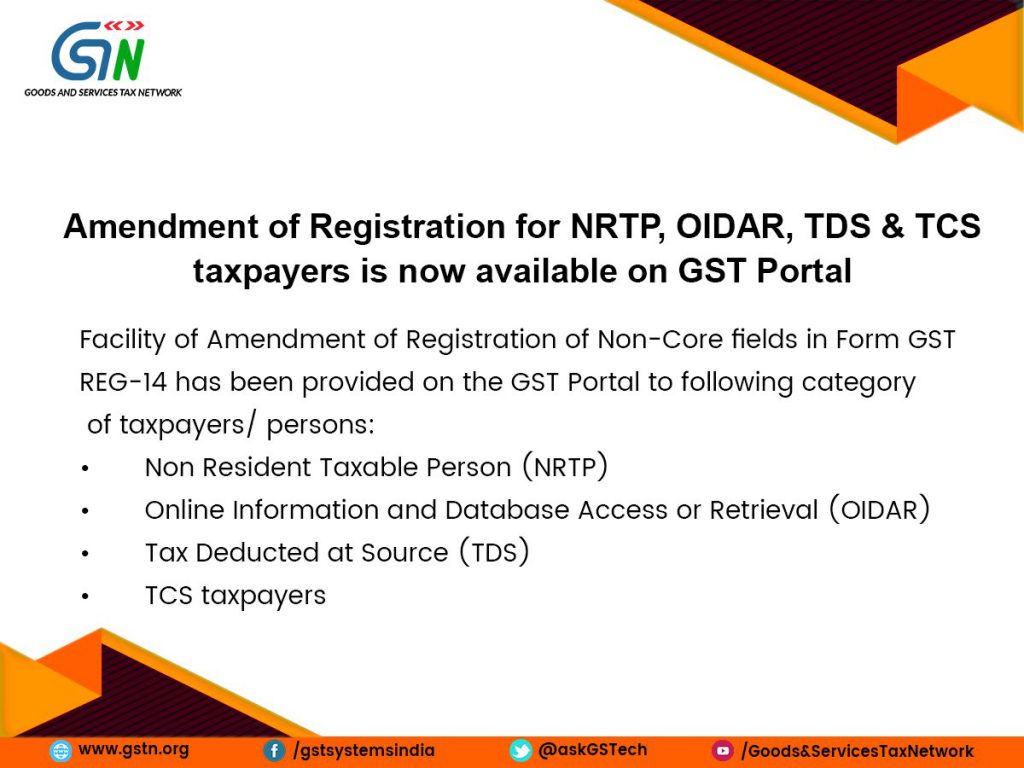

Amendment of Registration of NRTP, OIDAR, TDS, and TCS taxpayers are now Available on GST portal is now available to submit. The facility of Amendment of Registration of Non-core fields in Form GST REG-14 has been provided on the GST portal to the following category of Taxpayers/persons :

- Non-Resident Taxable person

- Online Information and database access or retrieval (OIDAR)

- Tax Deducted at source

- TCS Taxpayers

After the applicability of the TDS and TCS from the 1st of October 2018. The Government has provided the Amendment option for the NRTP, OIDAR, TDS, and TCS taxpayers. The TDS and TCS were applicable by the Notification No. 50/2018 and Notification No. 51/2018.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.