Route disclosure is not required under GST provisions, Penalty order quashed by court

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

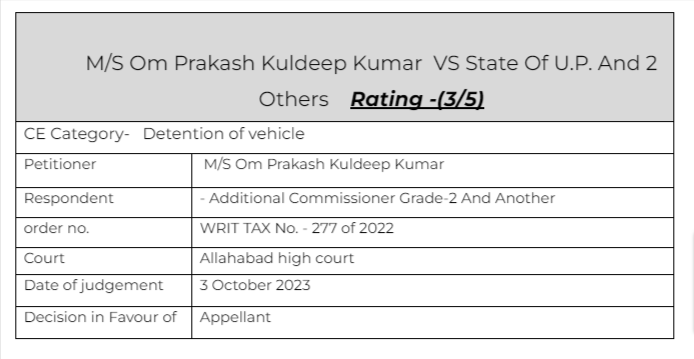

M/S Om Prakash Kuldeep Kumar VS State Of U.P. And 2 Others

Citations:

M/s Karnataka Traders Vs. State of Gujrat

Vijay Metal Vs. Deputy Commercial Tax Officer

Facts of the cases:

The petitioner is a registered dealer engaged in trading of Bidi, Matchbox, Tobacco, etc. In the normal course of business, the petitioner received an order for a supply of bidi and match box from M/s Satish Chand Shelendra Kumar, Karahal Road, Mainpuri, and from M/s Pawani Provisions Store, G.T. Road Chhibramau, Kannauj.

Thereafter the petitioner prepared the Tax invoice no. 723 and 724 both dated 16.1.2020 as well as E-way bill no. 481104756271 and 461104755579 respectively. The said goods were loaded on Truck no. UP 76 K 5205 for transportation from Bewar Mainpuri to Karahal Mainpuri and Chhibramau, Kannauj. During the onward journey, when the goods were in transit, the same was intercepted and on the production of documents i.e. tax invoice and e-way bills, form GST MOV-1 was prepared on 17.1.2020, thereafter on the statement of the driver of the vehicle, the seizure/ detention order in form GST MOV-06 was passed on 17.1.2020

Observation & Judgement of the Court:

The court accepted that the route disclosure is not required in GST provisions. If the documents are complete.

The court said-

“The writ petition is allowed with the cost of Rs. 5000/- (five thousand) which shall be paid to the petitioner by the State within 15 days from today.

The State exchequer will be at liberty to recover the said cost from the erring officer. The amount already deposited by the petitioner shall be refunded to him in accordance with law within a period of one month from the date of production of a certified copy of this order.

comment:

The route is not required to be disclosed in GST. Even if the truck is on a different route, it can’t be detained merely for this reason if the other documents are available

Read & Download the Full M/S Om Prakash Kuldeep Kumar VS State Of U.P. And 2 Others

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.