E-way bill lapsed but necessary documents were available (Pdf Attach)

Cases Covered:

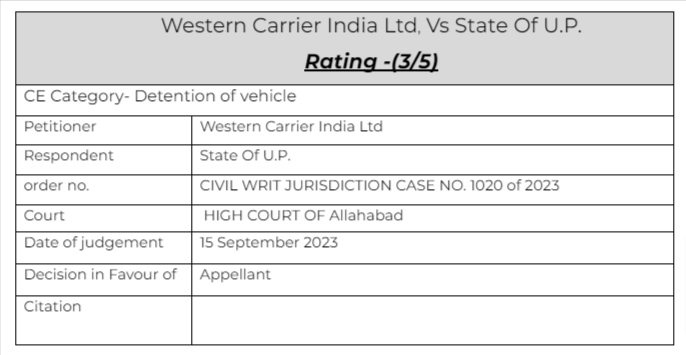

Western Carrier India Ltd, Vs State Of U.P.

Facts of the cases:

In a recent judgment the Allahabad high court has waived off the penalty levied u/s 129 of CGST Act. The vehicle was transporting the goods for Tata Steel. In the way the vehicle break down.

Observation & Judgement of the court:

They were not able to amend the E-way bill and extend the time limit. But all the documents were available. The court observed that their is no mala fide intention to evade tax thus the petitioner is not liable for penalty.

The court said that the vehicle should have been released by the department. The court also observed that in Circular 76/50/2018 the procedure is mentioned. In case the invoice is there the consignee can be assumed as the owner. The penalty proceedings were dropped by the department.

Read & Download the Full Western Carrier India Ltd, Vs State Of U.P.

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.