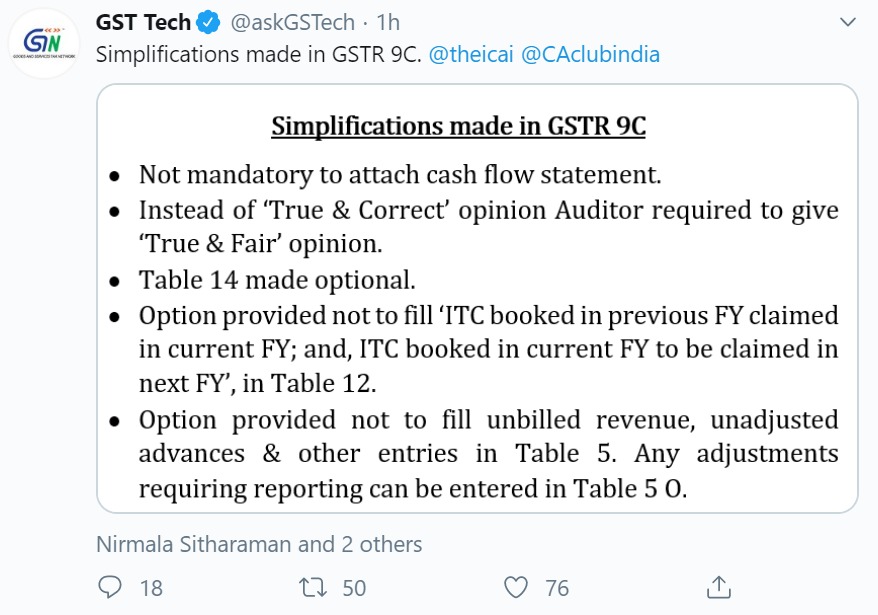

GSTR 9C Part B Certification of Cash Flow Statement

In case of individuals, cash flow statement is not required & not mandatory as per the notification but still, Part B of GSTR 9C offline utility as well as draft from that JSON is using ” we certify Balance Sheet, Profit & Loss & Cash flow are in the agreement in books of accounts” even if Cash flow is not applicable on assesse. How we can proceed in such cases where we haven’t certified the cash Flow and is not possible to do the same.