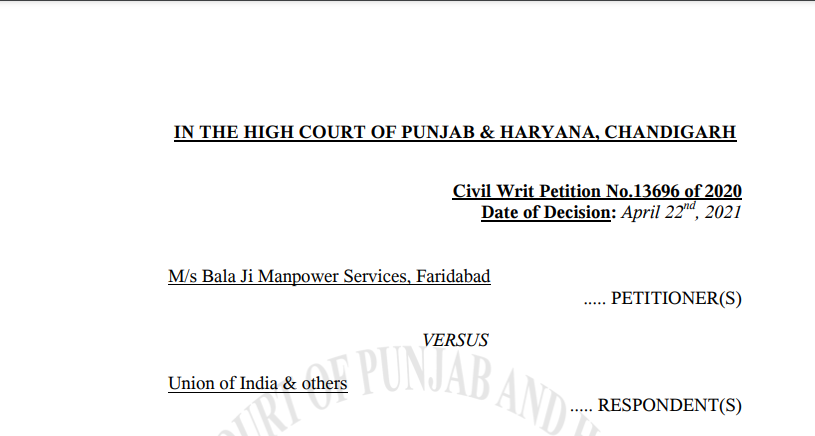

Punjab & Haryana HC in the case of M/s Bala Ji Manpower Services Versus Union of India

Case Covered:

M/s Bala Ji Manpower Services

Versus

Union of India

Facts of the Case:

This writ petition has been preferred under Article 226/227 of the Constitution of India for issuance of a writ in the nature of certiorari for quashing/modification of order dated 06.08.2020 (Annexure P-7) passed by Settlement Commission, to the extent of demand of interest in accordance with Notification No.13/2016-ST dated 01.03.2016.

The petitioner-Firm is engaged in rendering services of ‘supply of manpower. The respondents initiated an investigation against the petitioner alleging for not disclosing the correct value of services rendered by it and collected various documents including balance sheet, Form – 26AS, and recorded different statements of the proprietor of the petitioner firm. On the basis of comparison of balance sheets for the years 2011-12 to 2014-15, Form – 26AS with periodical ST-3 returns, respondents found a shortfall in value declared in ST-3 returns which resulted in short payment of service tax to the tune of ` 72,65,808. Accordingly, respondents served upon the petitioner a show-cause notice dated 24.10.2016 raising demand of ` 72,65,808/- along with interest and penalty for the period 2010-11 to 2014-15. On 21.03.2017, the petitioner filed an application before Customs & Central Excise Settlement Commission, New Delhi to settle its duty liability, which was disposed of vide order dated 28.12.2017 (Annexure P-1) by the Settlement Commission holding that benefit of cum-tax benefit on the basis of sample invoices could not be allowed.

Observations:

The only question that requires adjudication is at what rate the petitioner is liable to pay interest i.e. 15% or 24%.

Admittedly, the petitioner firm started its service after completing registration formalities in July 2011 and the respondents have calculated the interest liability from the first quarter of Financial Year 2011-12. If the petitioner firm has started its services in July 2011, there cannot be any demand for the first quarter of 2011-12. As per the contention of respondents, the petitioner made delayed payment of service tax between August 2016 and February 2017, i.e. the time when the aforesaid notification was in force i.e. 14.05.2016.

Related Topic:

No Benefit No Arrest: Punjab & Haryana HC

The Decision of the Court:

It is clear from the above reproduction that the notification fixed the rate of simple interest @ 24% in the case where any amount is specifically collected as service tax and still not deposited with the Central Government on or before the date on which such payment became due whereas the rate of 15% is fixed for any other situation. In the case in hand, it is the specific stand of the petitioner that it did not specifically collect the tax from the service recipients. The respondents have quantified interest 24% per annum on the basis of Notification dated 01.03.2016 presuming that the petitioner has specifically collected some amount as service tax and still not deposited with Central Government, whereas the petitioner, in the invoices issued during the period in question, did not collect any amount specifically mentioning it as service tax. The grant of benefit of cum-tax value vide order dated 03.10.2019 passed by this Court in CWP No.1502 of 2018, further supports the case of the petitioner. In this view of the matter, we are of the considered view that action of the respondents to charge interest @ 24% in accordance with Notification dated 01.03.2016 is arbitrary and not sustainable in the eyes of law.

Related Topic:

Punjab & Haryana HC in the case of Independent Schools’ Association Chandigarh Versus State of Punjab and others

In view of the aforesaid discussion, we modify the impugned order to the extent of charging interest @ 15%.

Read & Download the full Decision of the Court:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.