Stay on demand if 20% deposited and commit to reach tribunal when it is formed(Pdf Attach)

Cases Covered:

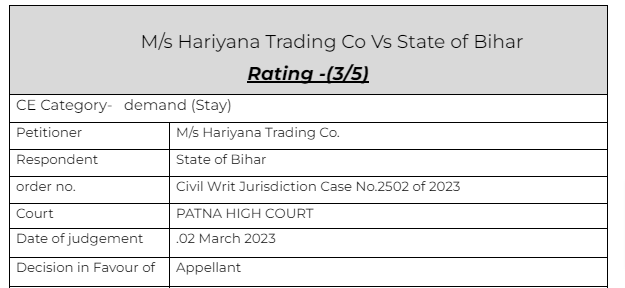

M/s Hariyana Trading Co Vs State of Bihar

Citations:

1. Angel Engicon Private Limited vs. the State of Bihar & Anr

Facts of the cases :

In this case the appellant lost the appeal. He wanted to got to the tribunal but couldn’t do it for the reason that the tribunals are not yet formed by the government. Meanwhile, the department raised the demand of balance amount. Thus the appellant approached the court to get a stay on demand

Observations & Judgement of the court:

The court said that –

The statutory relief of stay on deposit of the statutory amount, in the opinion of this Court, cannot be open ended. For balancing the equities, therefore, the Court is of the opinion that since order is being passed due to non-constitution of the Tribunal by the respondent- Authorities, the petitioner would be required to present/file his appeal under Section 112 of the B.G.S.T. Act, once the Tribunal is constituted and made functional and the President or the State President may enter office.

The appeal would be required to be filed observing the statutory requirements after coming into existence of the Tribunal, for facilitating consideration of the appeal. In case the petitioner chooses not to avail the remedy of appeal by filing any appeal under Section 112 of the B.G.S.T. Act before the Tribunal within the period which may be specified upon constitution of the Tribunal, the respondent- Authorities would be at liberty to proceed further in the matter, in accordance with law. With the above liberty, observation and directions, the writ application stands disposed of.”

Read & Download the Full M/s Hariyana Trading Co Vs State of Bihar

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.