Judgment of Pankaj Bansal for ground of arrest in PMLA is applicable retrospectively

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

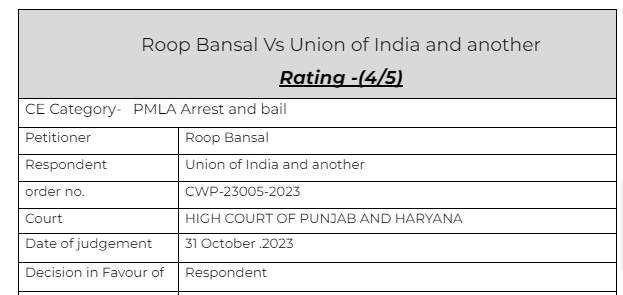

Roop Bansal Vs Union of India and another

Citations:

Vijay Madanlal Choudhary Versus Union of India & Ors

Pankaj Bansal Versus Union of India and others

Arnab Manoranjan Goswami versus State of Maharashtra and others

Union of India Vs. Ashok Kumar Sharma and others

Manoj Parihar and Ors. Vs. State of Jammu & Kashmir and Ors.

Mohammed Zubair Vs. State of NCT of Delhi and Ors

Chanda Deepak Kochhar Vs. Central Bureau of Investigation

Ashish Kakkar Vs. Union of India and Anr

Bhawana Gupta and others Vs. State of Punjab

Ranjan Kumar Chadha Vs. State of Himachal Pradesh

Facts of the cases:

The facts essential for the purpose of decision of the present petition and as emanating from the paper book are that certain FIRs were registered from 2018 to 2020 with different law enforcement agencies namely Haryana Police, Delhi Police, and Delhi EOW, under Sections 120- B, 420, 467, 471 IPC against M/s IREO Private Limited and others. These FIRs were registered at the instance of allottees of residential projects developed by the IREO Group. Since the offences under IPC are scheduled offences (as defined under Section 2(1)(y) of the Prevention of Money Laundering Act, 2002) (for short ‘the PMLA’), the Enforcement Directorate recorded an Enforcement Case Information Report No.ECIR/GNZO/10/2021 dated 15.06.2021 (hereinafter referred to as ‘the First ECIR’) against one Lalit Goyal, Vice Chairman and Managing Director of M/s IREO Private Limited and others with a view to investigate the offence of Money Laundering as defined under Section 3 and punishable under Section 4 of PMLA.

During the course of the investigation, searches as envisaged under Section 17 of PMLA were conducted and based upon the material evidence collected, a prosecution complaint under Sections 44 and 45 of PMLA bearing No.COMA/01/2022 was filed against Lalit Goyal and six IREO Group of Corporate entities

Observation & Judgement of the Court:

We have perused the judgment of the Hon’ble Apex Court in the case of Ranjan Kumar Chadha Vs. State of Himachal Pradesh (supra) which has been relied upon by learned counsel for the respondents. The said judgment was given in a set of appeals filed against judgment and order of conviction dated 20.08.2010 and order of sentence dated 16.09.2010, passed by the High Court of Himachal Pradesh in an NDPS matter. The High Court of Himachal Pradesh had set aside the judgment of acquittal passed by the Special Court and convicted the accused under Section 20 of the NDPS Act. He was sentenced to undergo rigorous imprisonment for a period of 02 years and a fine of Rs.50,000/- was also imposed.

The question which fell for consideration before the Hon’ble Apex Court was whether the High Court had erred in convicting the accused. In its findings, the scope of Section 50 of the NDPS Act was examined and it was also examined as to whether it would apply in all cases. This judgment, in the considered opinion of this Court, is not relevant for the purposes of the present case and does not, in any manner, come to the aid of the respondents.

In view of the aforementioned facts and circumstances, the arrest of the petitioner and the subsequent orders remanding the petitioner to the custody of the ED cannot be sustained. The present petition is, therefore, allowed. The arrest order dated 08.06.2023 (Annexure P-15), the remand orders dated 09.06.2023, 16.06.2023 and 20.06.2023 (Annexures P-19, P-21 and P-23 respectively) are accordingly set aside. It is directed that the petitioner be released forthwith unless his custody is required in connection with any other case

Read & Download the Full Roop Bansal Vs Union of India and another

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.