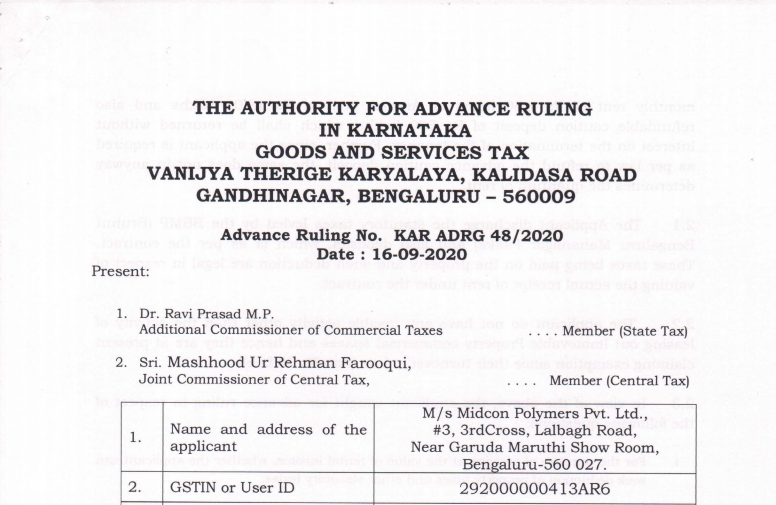

Karnataka AAR in the case of M/s Midcon Polymers Pvt. Ltd.

Case Covered:

M/s Midcon Polymers Pvt. Ltd.

Facts of the Case:

The applicant has proposed/ planned for engaging in the business of renting of commercial property on monthly rents and allied businesses. They intend to enter into a contractual agreement of renting of immovable property with an Educational Institution in Banglore. The Contract is on the basis of the reserved monthly rent of Rs. 1.50 lakhs or Annual Rent of Rs. 18.00 lakhs and also refundable caution deposit of Rs. 500 Lakhs, which shall be returned without interest on the termination of the tenancy. Further, since the applicant is required as per law to refund the advance caution deposit, the same does not in any way determines the quantum of rent.

The applicant discharge the statutory taxes levied by the BBMP (Bruhut, Bengaluru, Mahanagar palike) and also deposits, which is as per the contract. These taxes being paid on the property and such deduction are legal in respect of valuing the actual receipt of rent under the contract.

The applicant does not have any taxable activity other than the activity of leasing out Immovable Property commercial spaces and hence they are at present claiming exemption since their turnover is less than Rs. 20 Lakhs.

Observations:

We have considered the submissions made by the Applicant in their application for advance ruling as well as the issues involved & relevant facts having a bearing on the questions in respect of which advance ruling is sought by the applicant.

The applicant sought the advance ruling in respect of the questions at para 2.3 supra, which all are in relation to the proposed renting of immovable property service. We take up one question at a time for discussion.

Ruling:

- The applicant can’t deduct the property taxes and other statutory levies for the purpose of arriving at the value of rental income.

- The notional interest on the security deposit shall be taken into consideration, for the purposes of arriving at total income from rental, only if it influences the value supply of RIS service i.e. monthly rent.

- The applicant is entitled to the exemption of tax under the general exemption of Rs. 20 Lakhs, subject to the condition that their annual turnover, which includes monthly rent and notional interest, if it influences the value of supply, does not exceed the threshold limit.

Read & Download the full Ruling in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.