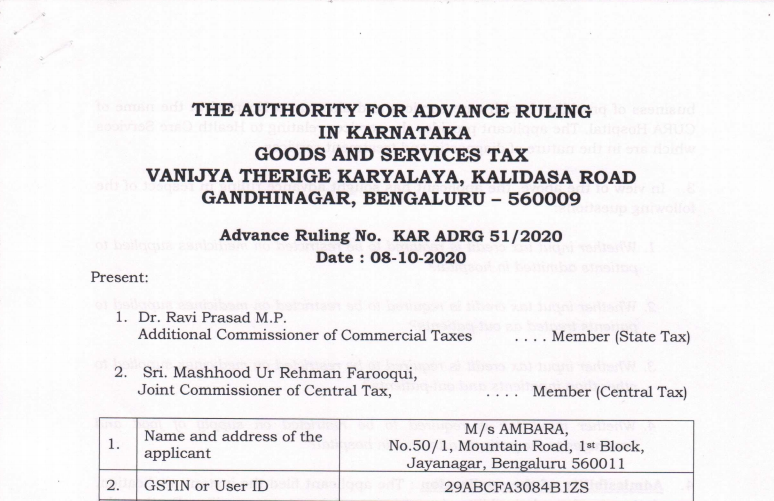

Karnataka AAR in the case of M/s. Ambara

Case Covered:

M/s. Ambara

Facts of the Case:

The applicant is a partnership firm registered under the provisions of the Goods and Services Act, 2017. The applicant states that they are engaged in the business of providing health care services and also run a Hospital in the name of CURA Hospital. The applicant provides the services relating to Health Care Services which are in the nature of diagnostic and treatment services.

In view of the above, the applicant has sought the advance ruling in respect of the following questions:

- Whether input tax credit is required to be restricted on medicines supplied to patients admitted in hospital?

- Whether input tax credit is required to be restricted on medicines supplied to patients treated as out-patients?

- Whether input tax credit is required to be restricted on medicines supplied to other than inpatients and out-patients?

- Whether input tax credit is required to be restricted on supply of food and beverages to the patients admitted in hospitals?

Observations:

The applicant is running a hospital providing health care services, to both in-patients as well as out-patients. The applicant, in addition to health care services also provides food & beverages, medicines to the in-patients. The applicant has been making item-wise billing to the in-patients & out-patients. Thus the applicant supplies medicines to three types of persons, (a) impatients, (b) out-patients and (c) customers.

Ruling:

- The input tax credit is required to be restricted on medicines used in the supply of health care services provided to inpatients.

- The input tax credit is required to be restricted on medicines used in the supply of health care services provided to outpatients. Further, in case of medicines are supplied independent of health care services, them the applicant is eligible to claim input tax credit subject to payment of taxes on such independent supply of medicines.

- The input tax credit is not required to be restricted on medicines supplied to others i.e. customers, who are neither inpatients, as there is no health care services provided and is liable to pay tax on such outward supply of medicines.

- The input tax credit is required to be restricted on supply of food & veverages supplied to inpatients and is part of the health care services.

Related Topic:

Karnataka AAR in the case of M/s. Page Industries Limited.

Read & Download the full Ruling in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.