FAQ’s on Reverse charge on security services

Reverse charge on security services

The Reverse charge on security services is introduced via Notification No. 29/2018- Central Tax (Rate). RCM on security services is made applicable to cover the entities providing security personnel. Now the recipient needs to deduct the tax and pay to the government. In the list of services liable for a reverse charge in GST, one more is added. The supply of security personnel is covered in this entry. This will increase the list of services covered in RCM. These services will be covered in RCM of section 9(3) of the CGST Act. This notification has changed the original notification no. 13/2017 of the CGST Notifications. Some entities are exempted from RCM. Like government entities etc. are not liable for RCM. Detailed analysis of this provision is below:

| 1. |

Who is required to pay tax in Reverse charge on security services? |

|

2. |

Who is exempted from a reverse charge on security services? |

|

3. |

From which date RCM on security services will be applicable? |

|

4. |

What is the meaning of a security agency?

The term is not defined in the relevant notification or CGST Act. But it was defined in erstwhile service tax provisions. Section 65(94) of Finance Act 1994 defined it as:

“security agency” means any [person] engaged in the business of rendering services relating to the security of any property, whether movable or immovable, or of any person, in any manner and includes the services of investigation, detection or verification, of any fact or activity, whether of a personal nature or otherwise, including the services of providing security personnel”

But in current notification, only the services provided by way of supply of security personnel are covered.

Who is required to pay tax in Reverse charge on security services?

Every registered person is required to pay tax in RCM for security services.

Who is exempted from a reverse charge on security services?

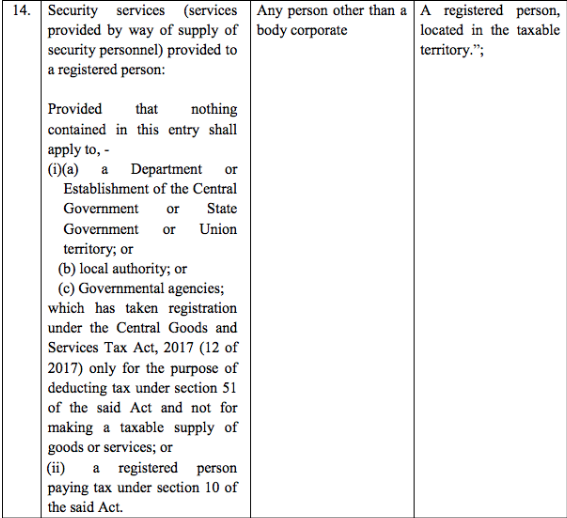

As per entry number 14 of Notification No. 29/2018- Central Tax (Rate) are not liable for RCM on Security services:

(i)(a) a Department or Establishment of the Central Government or State Government or Union territory; or

(b) local authority; or

(c) Governmental agencies;

which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 of the said Act and not for making a taxable supply of goods or services; or

(ii) a registered person paying tax under section 10 of the said Act. i.e. a composition dealer.

(iii) When the supplier is a body corporate

From which date RCM on security services will be applicable?

The reverse charge tax liability will be applicable from 1st January 2019.

What will be the impact of RCM on security services?

The recipient of services will be liable to pay the tax in RCM. The supplier will not be liable to take registration (to the extent of security service) or to pay tax.If the supplier is already registered he will raise an invoice and will tick RCM. If the supplier is not registered then recipient will be liable to raise invoice also as per the provisions of section 31(3)(f) of CGTS Act.

Whether the RCM will be applicable for the bills raised before 1st Jan but payment is made lateron?

No, The provisions are applicable from 1st January meaning thereby the transactions which will have time of supply from that date will be liable for RCM?

Whether the supplier can pay the tax in forward charge?

No, unlike GTA the security personnel supply service provider cant charge the tax in forward charge. In case the recipient is not liable for RCM, only in that case supplier can charge tax in FCM.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.