Circular No. 65/39/2018-DOR

Circular No. 65/39/2018-DOR

Circular No. 65/39/2018-DOR

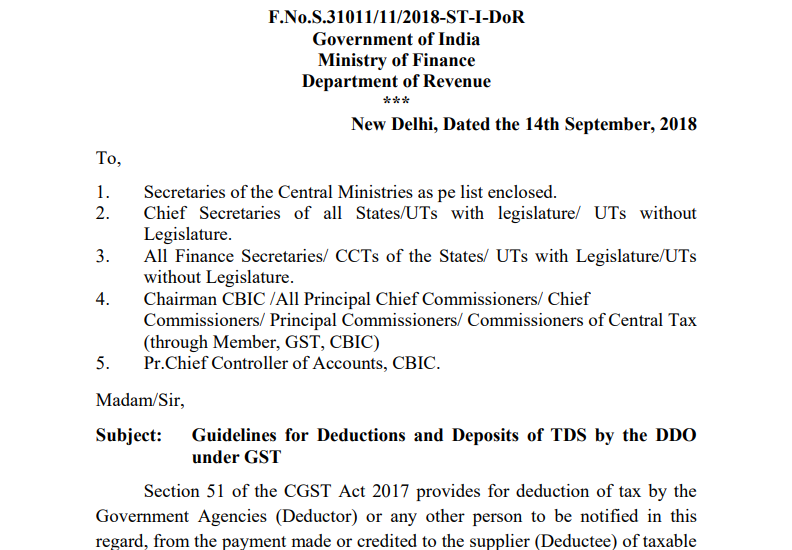

F.No.S.31011/11/2018-ST-I-DoR

Government of India

Ministry of Finance

Department of Revenue

New Delhi, Dated the 14th September 2018

To,

1. Secretaries of the Central Ministries as per list enclosed.

2. Chief Secretaries of all States/UTs with legislature/ UTs without Legislature.

3. All Finance Secretaries/ CCTs of the States/ UTs with Legislature/UTs without Legislature.

4. Chairman CBIC /All Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/ Commissioners of Central Tax (through Member, GST, CBIC)

5. Pr.Chief Controller of Accounts, CBIC.

Madam/Sir,

Subject: Guidelines for Deductions and Deposits of TDS by the DDO under GST

Section 51 of the CGST Act 2017 provides for deduction of tax by the Government Agencies (Deductor) or any other person to be notified in this regard, from the payment made or credited to the supplier (Deductee) of taxable goods or services or both, where the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees. The amount deducted as tax under this section shall be paid to the Government by deductor within ten days after the end of the month in which such deduction is made along with a return in FORM GSTR-7 giving the details of deductions and deductees. Further, the deductor has to issue a certificate to the deductee mentioning therein the contract value, the rate of deduction, amount deducted etc.

2. As per the Act, every deductor shall deduct the tax amount from the payment made to the supplier of goods or services or both and deposit the tax amount so deducted with the Government account through NEFT to RBI or a cheque to be deposited in one of the authorized banks, using challan on the common portal. In addition, the deductors have entrusted the responsibility of filing return in FORM GSTR-7 on the common portal for every month in which deduction has been made based on which the benefit of deduction shall be made available to the deductee. All the DDOs in the Government, who are performing the role as deductor have to register with the common portal and get the GST Identification Number (GSTIN).

Download the full Circular No. 65/39/2018-DOR by clucking the below Image:

3. The subject section which provides for tax deduction at source was not notified to come into force with effect from 1st July 2017, the date from which GST was introduced. The government has recently notified that these provisions shall come into force with effect from 1st October 2018, vide Notification No. 50/2018 – Central Tax dated 13th September 2018.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.