Recommendations on New Simplified GST Returns by Tally Solutions Pvt Ltd.

Recommendations on New Simplified GST Returns by Tally Solutions Pvt Ltd.

Following is the Recommendations on New Simplified GST Returns by Tally Solutions Pvt Ltd.:

|

Serial No. |

Page No. /Table No. |

Para |

Recommendation |

|

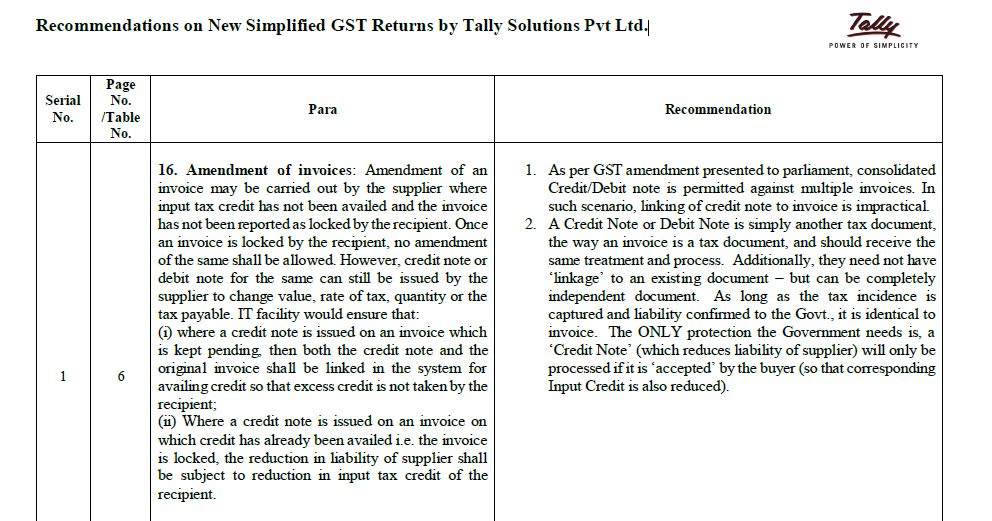

1 |

6 |

16. Amendment of invoices: Amendment of an invoice may be carried out by the supplier where input tax credit has not been availed and the invoice has not been reported as locked by the recipient. Once an invoice is locked by the recipient, no amendment of the same shall be allowed. However, credit note or debit note for the same can still be issued by the supplier to change value, the rate of tax, quantity or the tax payable. IT facility would ensure that: (i) where a credit note is issued on an invoice which is kept pending. Then both the credit note and the original invoice shall be linked in the system for availing credit. So that excess credit is not taken by the recipient; (ii) Where a credit note is issued on an invoice on which credit has already been availed i.e. the invoice is locked. The reduction in liability of supplier shall be subject to reduction in input tax credit of the recipient. |

1. As per GST amendment presented to parliament, consolidated Credit/Debit note is permitted against multiple invoices. In such scenario, linking of credit note to invoice is impractical. 2. A Credit Note or Debit Note is simply another tax document, the way an invoice is a tax document and should receive the same treatment and process. Additionally, they need not have ‘linkage’ to an existing document – but can be the completely independent document. As long as the tax incidence is captured and liability confirmed to the Govt., it is identical to invoice. The ONLY protection the Government needs is, a ‘Credit Note’ (which reduces the liability of supplier) will only be processed if it is ‘accepted’ by the buyer (so that corresponding Input Credit is also reduced).

|

Download the full pdf on Recommendations on New Simplified GST Returns by Tally Solutions Pvt Ltd. by clicking the below image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.