Yet another case to drop the E -way bill penalty

Comment

The specific case of the petitioner is that there is no allegation against the petitioner but the entire allegation has been made against the supplier from whom the petitioner procured the goods.

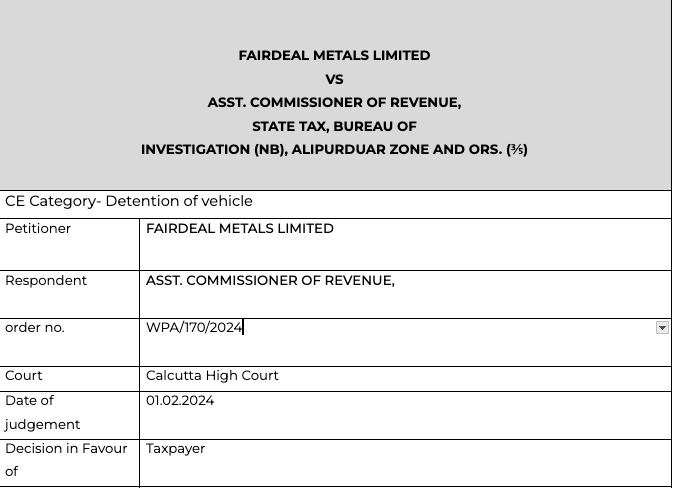

Details of the case

Citation

M/S. Shiv Enterprises Vs. State of Punjab & Ors. Standard Operating Procedure which has been published by the Commissioner, Central Board of Indirect Taxes and Customs, GST Investigation Wing on 12.05.2019.

Pleading

In the instant writ petition the petitioner prays for cancellation of the impugned detention order, the impugned show cause notice dated 31.12.2023 and the subsequent impugned order dated 05.01.2024.

Facts

Show cause notice mentions that M/S. Navaraj Trading Company i.e., the supplier of the petitioner was registered recently under the GST Act with effect from 09.10.2023 in the State of Assam. M/S. Navaraj Trading Company has shown the nature of occupancy over the place of business as ‘rented’ and in support of its claim rent agreement and the trade license was supplied. It was noticed that the goods that were being transported did not have the coverage as per their GST registration. The proper officer after perusal of the documents opined that M/S. Navaraj Trading Company was involved in receiving and passing on fictitious/bogus ITC to other parties. The said Company has been set up solely for the purpose of circulating bogus ITC. The goods were observed to be of suspicious origin and the purchase was merely a ‘paper sale’ to hide the original supplier with the intention of evading payment of tax.

Observation

The supplier Company appears to have been registered by the registered authority in Assam. Had there been any deficiency on the part of the supplier Company in production of relevant documents, registration ought not to have been issued. After registration has been issued and tax paid by the supplier Company, the allegation made against the supplier Company does not stand. The petitioner being no way connected with any of the allegations that has been levelled against the supplier Company, cannot be made liable to pay penalty as has been assessed. In view of the above, the order of detention and the subsequent order imposing penalty are liable to be set aside and quashed. The same are, accordingly, set aside and quashed. The respondent no.1 is directed to forthwith take steps to release the vehicle and the goods in favour of the petitioner at the earliest, but positively within a period of 48 hours from the date of production of the server copy of this order duly downloaded from the official website of the High Court.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.