Exporters receiving payment via Paypal are eligible for GST refund- HC

Table of Contents

Comment-

Every exporter using Paypal should be aware of this judgment. VEry important as in many cases the refund of tax on export was denied if the payment is received in rupees. In the case of an amount received via Paypal, it is received into the account of the receiver in rupees. PAypal converts the amount into rupees before transferring it.

It is a common practice to deny export benefits in these cases.

In this case also the TP was engaged in export of services via his website. The amount was received via paypal. The AO rejected their refund of Rs. 11,64,898.

Regulation 3(3) of the Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2016 makes it clear that the authorized dealers have been permitted to allow receipts for export of goods / software to be received from a Third Party (a party other than the buyer) as per the guidelines issued by the Reserve Bank.

Merely because the receipts are rooted through the intermediary and received in Indian currency ipso facto would not mean that the petitioner has not exported services within the meaning of Section 2(6) of the IGST Act, 2017. Receipt of payment by an intermediary for and on behalf of its client like the petitioner will qualify as payment received by the client. As the only requirement is with the payments received is freely convertible foreign exchange has to be directly remitted into the authorized dealers account as otherwise an intermediary will be violate the requirements of the foreign exchange.

| CE Category- Amount received via paypal is receipt in foreign currency, Exports, refund, Export refund

Shaifaly.ca@gmail.com |

|

| CE Citation- CE Citation- GST/2024/69 | |

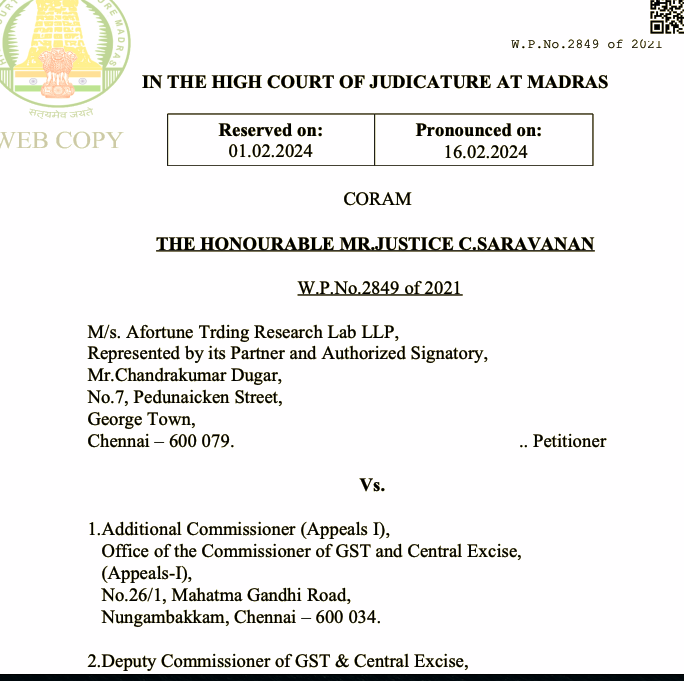

| Petitioner | M/s. Afortune Trding Research Lab LLP, |

| Respondent | Additional Commissioner (Appeals I) |

| Order no. | W.P.No.2849 of 2021 |

| Court | IN THE HIGH COURT OF JUDICATURE AT MADRAS |

| Date of judgement | 16.02.2024 |

| Decision in Favour of | Tax payer |

Pleading-

- Prayer to quash the Order dated 27.08.2020 bearing reference No.A.No.03-10/2020(GSTA-I)(CN)(ADC), issued by the 1 st respondent

- Prayer to allow the refund of the Rs.11,64,898/- denied by the respondent

Facts-

The petitioner is engaged in the business of providing online services through its website www.tradingwiser.com. Users visiting its website subscribe to plans as given and make payments. Services are provided in the form of information and knowledge on various investment options.

Payments are routed through the paypal, an intermediary, appointed by the petitioner.

The applied for refund as IGST law provides for the refund of ITC in case the export is made.

The refund claims of the petitioner were rejected by the second respondent.

The export proceeds in these cases were received by the petitioner in Indian rupees which was not in accordance with the RBI directions wherein it is stated that export proceeds against specific exports may be realized in rupees provided it is through a freely convertible Vostro account of a non resident bank situated in any country other than a member country of Asian Clearing Union, Nepal or Bhutan.

Thus the amount is not received in foreign currency.

If payments are routed through an intermediary to person like petitioner, the intermediary should be an authorised person to receive such payment in convertible foreign exchange. As an intermediary, the petitioner is required to only credit the amounts in convertible foreign exchange into Reserve Bank of India

Observation

Regulation 3(3) of the Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2016 makes it clear that the authorized dealers have been permitted to allow receipts for export of goods / software to be received from a Third Party (a party other than the buyer) as per the guidelines issued by the Reserve Bank.

Thus, without doubt, the petitioner is entitled for refund. Reference to Circular No.88/07/2019-GST dated 01.02.2019 to concluded that the petitioner has not realized the amount in freely convertible foreign exchange therefore cannot be countenanced.

Download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.