A cost of Rs. 50,000 levied on conducting the search during moratorium period by the GST department

Brief summary of the case-

CE Category- NCLAT interplay with GST

Author can be reached at shaifaly.ca@gmail.com

A cost of Rs. 50,000 was levied on the department for conducting search during the moratorium period.

In this case the company was admitted to CIRP. After that the respondent GST deptt conducted a search in the premises and seized the documents available there. Cases of Embassy Property development Vs state of karnataka, Sundaresh Bhatt and Associate decor were discussed.

Circular No.134/ 04/ 2020-GST under section 168(1) CGST Act was also taken into account and it was held that the department had no right to conduct a search. The court held that the Search and seizure of records of the corporate debtor and issuance summons to applicant/resolution profession are violative of mortarium order passed under section 14 of IBC, 2016. A compensatory cost of Rs. 50,000 was also levied on the deptt.

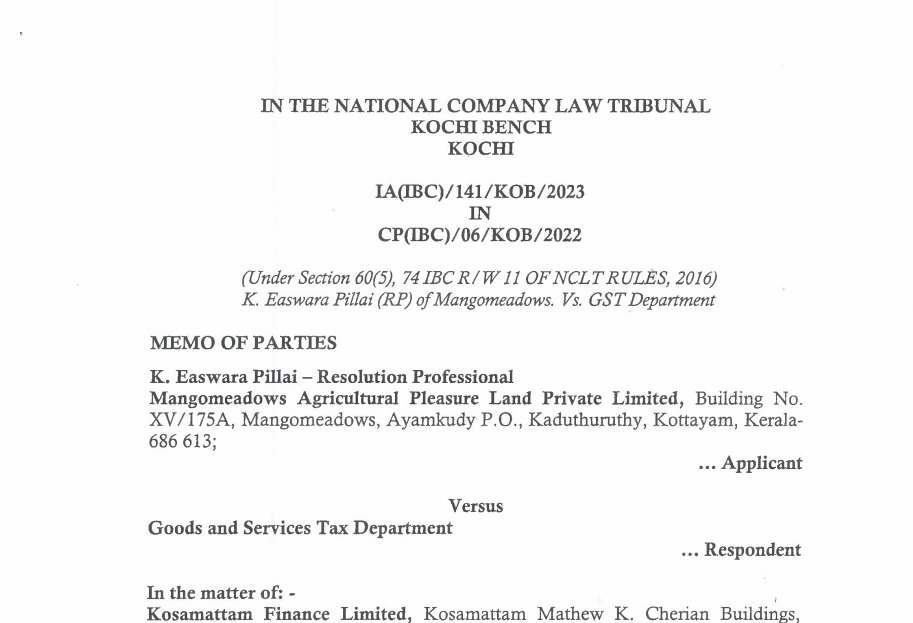

| Petitioner | Eshwara Pillai |

| Respondent | Goods and services tax department |

| Order no. | IA(IBC)141/KOB/2023 and CP(IBC)/06/KOB/2022 |

| Court | NCLAT Kochi |

| Date of judgement | 26.07.2023 |

| Decision in Favour of | Appellant |

Facts-

The corporate debtor M/s Mango meadows Agricultural land private limited was admitted to CIRP in C.P.No. 06/KOB/2022 on 25.01.2023 on petition filed by a financial creditor.

The respondent raided the premises of the corporate debtor. The respondent also seized the documents of the Corporate debtor.

The respondent on the other hand said that the corporate debtor is engaged in the business of amusement parks and is registered in GST.

The search was conducted on the basis of information from GST evasion wong and made a search u/s 67 of CGST Act.

The applicant side argued that the search was conducted in the moratorium period.

Observation-

The case of Embassy Property and Sundaresh Bhatt were discussed. The court observed in this case-

“The Kamataka High Court in Associate Decor Limited Rep. by Resolution professional vs Deputy Commissioner of Commercial Taxes in W.P.No. 17303/202 l(T-RES) dated 16.12.2021, after referring Apex court citations held that the notice issued under section 65 the State Goods and Services Tax Act 2017, R/w Rule 101(4) of KGST Rule, informing the discrepancies found in audit and asked the registered person to submit reply, is hit by mortarium order passed under section 14 of IBC 2016 and stayed/kept in abeyance, the proceedings pursuant to the said impugned notice till the lifting of moratorium.

The Government of India, Ministry of Finance, finance Department also issued Circular No.134/ 04/ 2020-GST under section 168(1) CGST Act, Annexure Al of the petition explaining that no coercive action to be talcen in respect of dues ·of GST pertaining to corporate debtor, under the CIRP. The respondent despite the supra guidance taken the coercive action.

The acts of the respondent undern1ined the authority of Resolution professional and because of seizure of Boolcs of accounts of the corporate debtor causes much inconvenience and paralyzed the Resolution process, the same shall be completed in time bound manner.

In the circumstances it is concluded that the search and seizure of records of the corporate debtor and issuance summons to applicant/resolution profession are violative of mortarium order passed under section 14 of IBC, 2016. ‘

16.0n the applicant side prayed in the application to initiate proceeding against the respondent for violation of moratorium order under section 74(2) of IBC, 2016. This section is criminal in nature fall under Chapter VII under the heading Offences and Penalties, hence under section 236 (1) of IBC, 2016 special court alone have jurisdiction. Further under section 236 (2) of IBC, 2016 cognizance of the offence can be taken only on the compliant of IBBI or Central Government. Hence the applicant is granted liberty to approach the IBBI to proceed against the Respondent’s erred officials in this regard.

In view of the above discussion we inclined to concede the prayer of the applicant and order the respondent to return all the records seized from the premises of the corporate debtor mentioned in seizure mahazar Annexure P4 and set aside the summon dated 13.03.2023 Annexure PS issued by the respondent and also impose a compensatory cost of Rs.50,000/- payable by the respondent to applicant towards CIRP cost, and respondent is granted liberty after paid the compensatory cost, to recover the said amount from the erred official(s).”

Read /download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.