Exception for opportunity of being heard – Keshav Mills (Pdf Attach)

Table of Contents

Cases Covered:

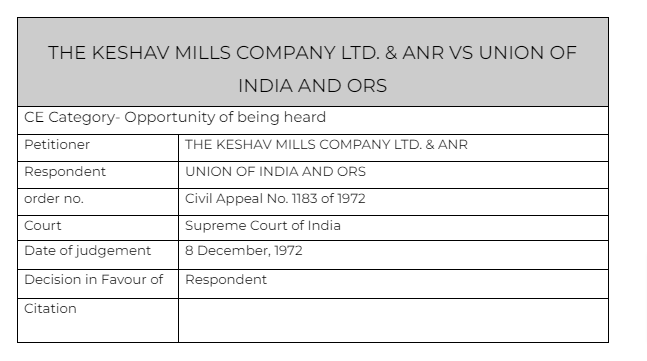

THE KESHAV MILLS COMPANY LTD. & ANR VS UNION OF INDIA AND ORS

Facts of the Cases:

This is one of the historical cases related to the principle of natural justice. Every person should be given an opportunity of being heard.

In this case an investigation was made against the appellant. But without providing them the copy of the report, the decision of undertaking the factory by the government was taken.

The appellant went to the court citing the principles of natural justice

Observations & Judgement of the court

The court decided against the appellant. The court said that the rule related to the opportunity of being heard is not a universal rule.

It should be applied where there is a detrimental effect on the party against whom the decision is taken. If there is no such effect then the opportunity of being heard may not be provided.

In the words of the honorable Supreme Court of India.

“The answer to this question also must always depend on the facts and circumstances of the case. It is not at all unlikely that there may be certain cases where unless the report is given the party concerned cannot make any effective representation about the action that Government takes or proposes to take on the basis of that report. Whether the report should be furnished or not must therefore depend in every individual case on the merits of that case. We have no doubt that in the instant case non-disclosure of the report of the Investigating Committee has not caused any prejudice whatsoever to the appellants.”

Read & Download the Full THE KESHAV MILLS COMPANY LTD. & ANR VS UNION OF INDIA AND ORS

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.