How an error in return will fetch you an instant notice in GST?

Table of Contents

Two new instant notices in GST

Well this for the good of taxpayers. Although it is taxing at the immediate level it will be helpful in future.

Two new rules are inserted in GST provisions. The dynamics between the GSTR 3b and statements fetching its two important components, GSTR 1 and GSTR 2B will be matched with the output tax and ITC disclosed in GSTR 3b. In case of mismatching a notice will be released.

The taxpayer can mention the reason for the difference or make the payment if the difference was for any erroneous reason. It is a great step towards protecting the buyers. Any difference will be traced at the very initial level.

Let us have a look at the notifications introduced these provisions

Notification no. 26/2022 -dated 26 December 2022 for difference in the GSTR 3b tax and GSTR 1

Notification no. 38/2023 -dated 26 December 2022 for difference in the GSTR 3b ITC and 2B

Notification no. 38/2023 dated 4 August 2023 for difference in the GSTR 3b ITC and 2B

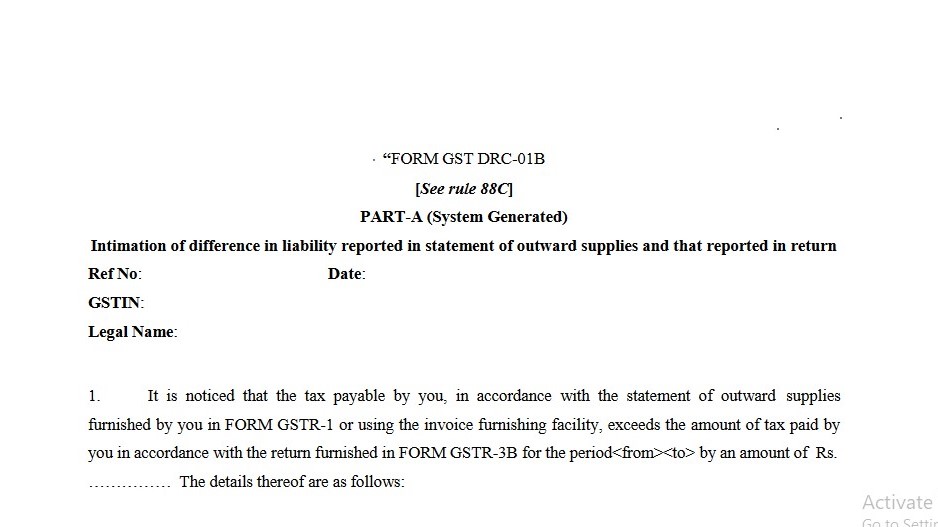

What information is required in DRC 01B and its format

DRC 01B

In case of any difference in GSTR 1/IFF and the liability declared in GSTR 3b it will be communicated to the filer. The taxpayer can pay the difference or can explain the difference within 7 days.

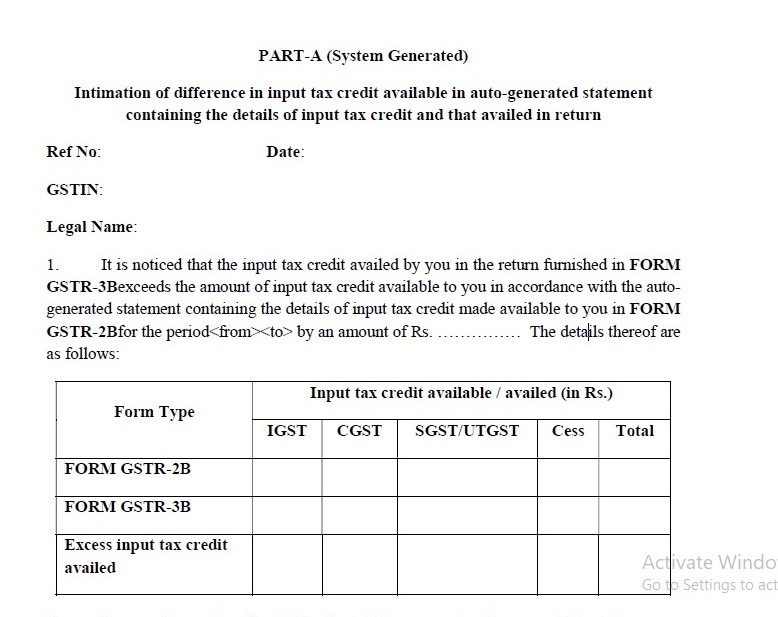

What information is required in DRC 01C and its format

DRC 01C

IN case of any difference in ITC claimed in GSTR 3b and ITC reflecting in 2b this intimation will be given. The taxpayer can reply the reasons or pay the tax to the government if it is due to some mistake.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.