Important changes in GST returns, GSTR 3b and 1

Table of Contents

Introduction-

Due to lockdown, CBIC has amended the due date of GST returns. Also, the Input tax credit for 36(4) can also be adjusted cumulatively till June 2021. These changes are introduced via various notifications issued on 1st June 2021. It was recommended by the GST council in its 43rd meeting held after a long gap of seven months. You can see the due dates of GST returns from January to June 2021 here.

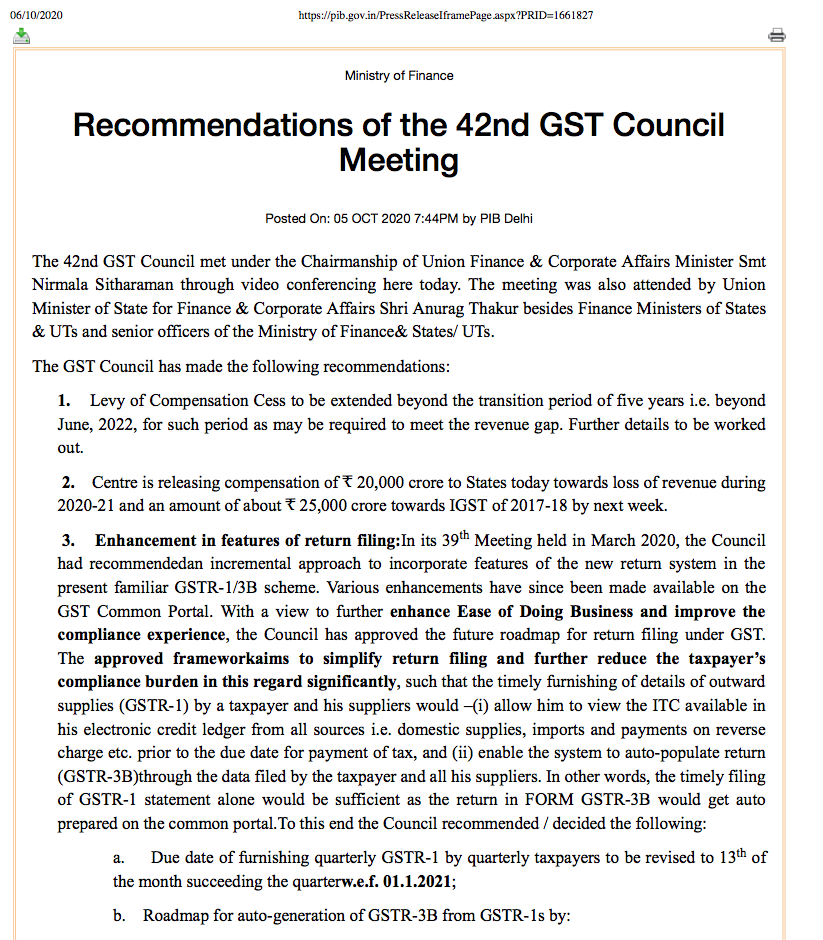

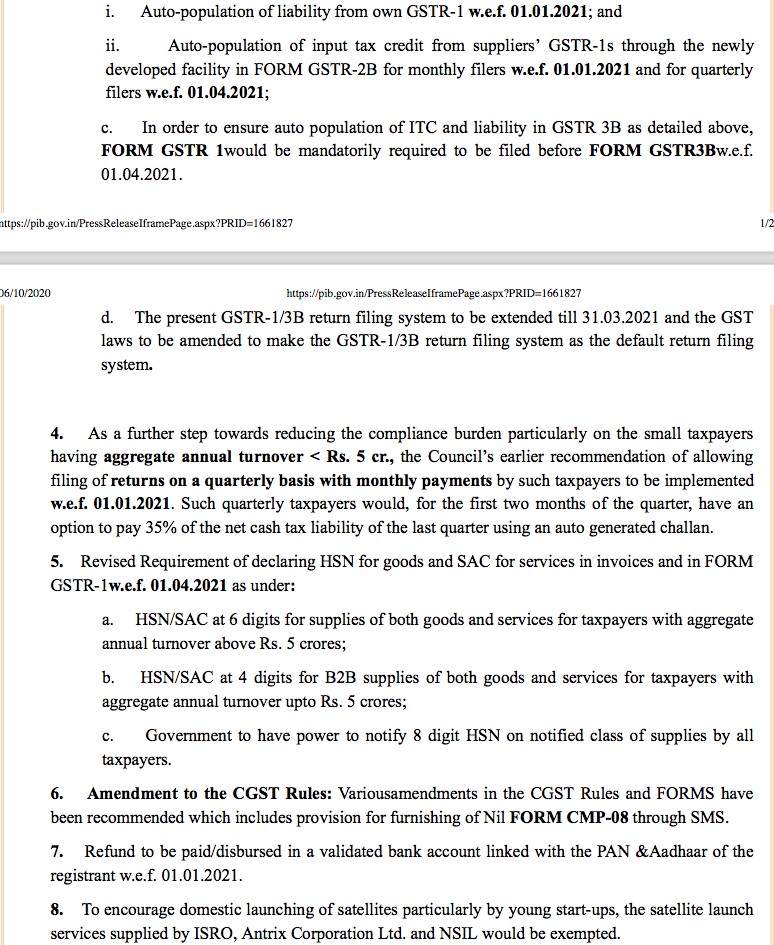

GSTR council in its 42nd meeting recommended changes in GST returns. These are very important changes as they are going to impact the taxpayers. CBIC is doing well in simplifying the returns.

Related Topic:

Check GST return status of any taxpayer without logging in

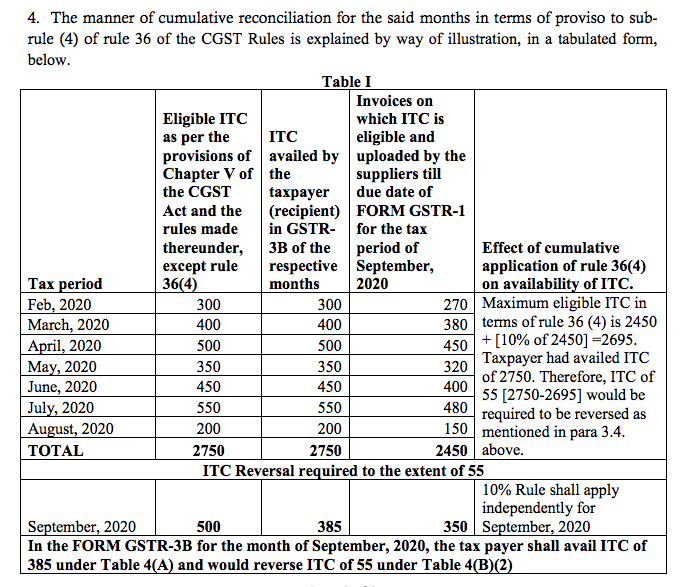

Latest updates- ITC adjustment of Feb to August 2020

CBIC clarified for the ITC to be taken in September Month. Due to the pandemic, the ITC requirement under Rule 36(4) was relaxed. Cumulative ITC was allowed from Feb to August. But now in the month of September 2020, adjustment is required.

Related Topic:

Whether Online Coaching Outside India is Liable for GST?

The manner of adjustment is also explained with examples in the circular.

Related Topic:

Sale of Rice under an Unregistered Brand name liable to GST if actionable claim or enforceable right has not been foregone not proved

Changes in GST returns, GSTR 3b and 1

- The return filing is quarterly

Earlier GSTR 1 was allowed quarterly. but now GSTR 3b is also allowed quarterly for small taxpayers. But is it actually effective? There is hardly any relief for the taxpayer. Because the tax payment is still monthly. The calculation for the payment of tax will need monthly exercise. The compilation of sales and ITC is required to calculate the tax payable.

- Payment to 35% tax- Then an option to pay 35% of the tax paid in the last quarter is also available. Let us try to understand its effect.

Related Topic:

Late Fee Calculator For filing GSTR-3B free download

e.g. The tax payment for the quarter of Say June 2021 was Rs. 140,000. Now while paying the tax for the month of July 2021, The taxpayer has an option to pay 35% of tax paid in the last quarter. In this case, it is – 35% of 140,000= 49000.

July – 35% of 140,000 = 49000

August- 35% of 140,000= 49000

September- Actual tax – (pain in July and August i.e. 70% of Last quarter’s tax)

But some questions are still open.

Related Topic:

Compliances and Returns Under Prevention of Sexual Harassment (POSH) Act

- Whether the balance is payable with interest or without interest.

- Can we pay 35% for the first month and actual for the second or vice versa.

- Whether this option is for a year or we can change it anytime.

Auto draft of GSTR 3b

Now the GSTR 3b will auto-draft from GSTR 1 and data filled by suppliers. It has two important parts.

- Sale /turnover liable for tax – Auto-populate from GSTR 1 of the same taxpayer.

- Input tax credit- Auto-populate from the invoices uploaded by the suppliers.

Related Topic:

Check GST return status of any taxpayer without logging in

In this way, the chances of errors will reduce. But only in the ideal scenario. Return is simple and easy to file for a compliant environment. But if your vendors are not compliant it, maybe too cumbersome for you.

Related Topic:

GST Returns Due Dates for GTSR 1 and GSTR 3b

- ITC

- of invoices uploaded- What about quarterly filers?

ITC of the uploaded invoice is available in GST. But when we are allowing the small taxpayers to file quarterly returns. The ITC of their invoices should flow even if they don’t file the returns. Otherwise, no company will buy from a small business. It will make their position even more vulnerable. Generally, their customers will start holding their payments up to the end of the quarter. When the businesses are already suppressed due to the Pandemic, relief should be there. Otherwise, it is better to make all the returns monthly.

Related Topic:

4 BIG COMMON Mistakes in GSTR- 3B

Read and download a copy of the Press release-

Watch the live discussion on changes in GST returns.

[embedyt] https://www.youtube.com/watch?v=aoutdpmbYYg[/embedyt]

Related Topic:

Live Demo for Filing of GSTR-3B