Live Demo for Filing of GSTR-3B

Live Demo for Filing of GSTR-3B

Filing of GSTR-3B is the important return and should also be filed very carefully. Because in this return we utilize the input tax credit and pay the tax liability for the period or month. The government has provided the table in GSTR-1 for amending the details, but in GSTR-3B there is no option for amendment or correction.

Step 1:

First, visit the GST portal at https://services.gst.gov.in/services/login and fill the ID and Password of the GST portal provided to you by the Department.

Step 2:

After logging into the GST portal. A page will open in which there will be an option to go directly to the GST Return dashboard.

If the option does not appear like this. Then you can also visit through the following route:

Services —– Returns —- Returns Dashboard.

Step 3:

After clicking on the ” RETURN DASHBOARD” button you will reach at the next page in which the there will be two scroll down options. One option is for selection of the financial year and other of the month or period for which you wanted to file the return.

Select the period and month for which you wanted to file the return and click the button “SEARCH”.

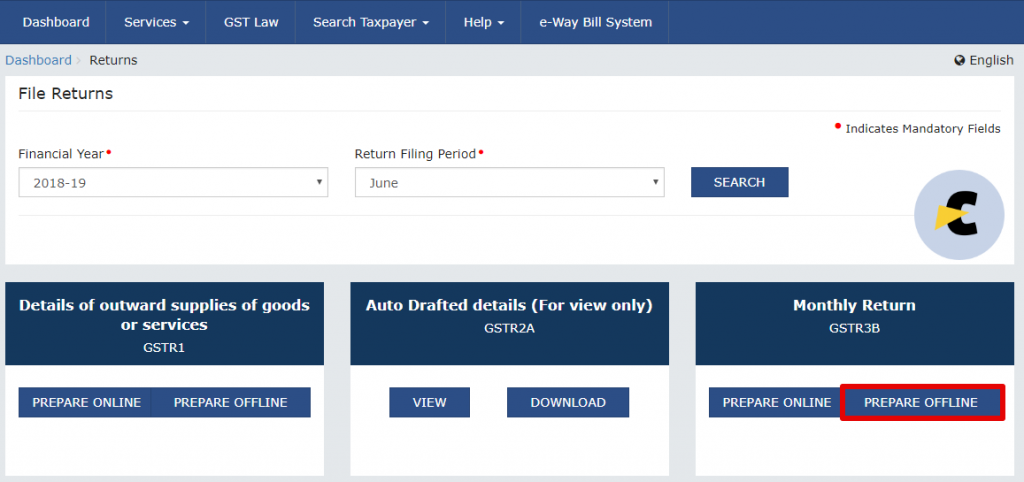

Step 4: Offline Method

The GST portal will search for the returns to be filed for the period you have entered and view the returns for the period. If you have searched for the months which is the end of the quarter, then it will show a fourth table GSTR-4A. The rest three table are GSTR-1, GSTR-2A, and GSTR-3B. GSTR-3b can also be filed online and offline mode.

The entries in GSTR-3B will be according to the period or month for which the return is to be filed. For filing of GSTR-3B offline click on the button “PREPARE OFFLINE”. This mode should have opted when you have already made the JSON file for the entries for GSTR-3B and ready to file.

After clicking on the button a new page will appear in which the there will be a button “Choose File”. Click on the button and select the JSON file you have prepared for the filing of GSTR-3B. When you have selected the file and uploaded the file. The entries will reflect automatically in the appropriate table for the month. Before filing just go through all the entries made and appeared in the tables to make sure that all the entries are right. When you are satisfied that all the entries are correct, file the return.

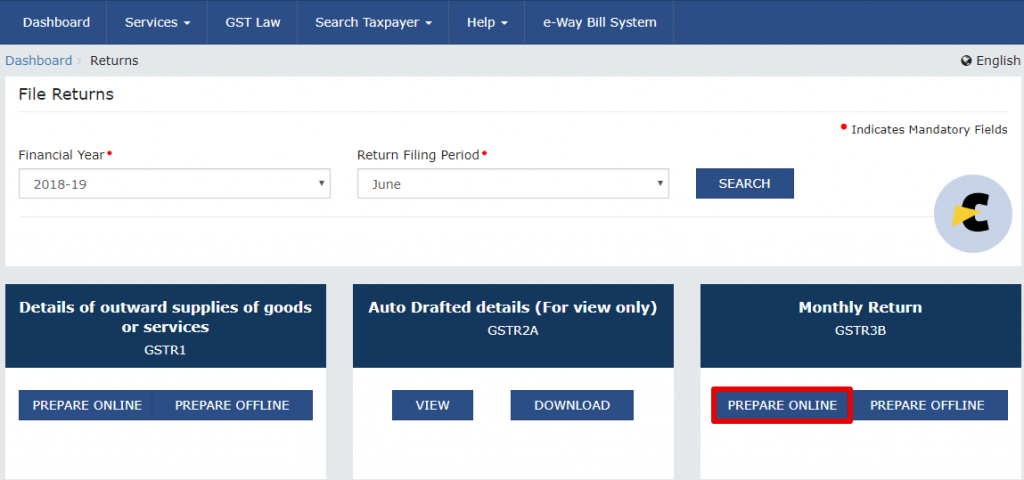

Step 5: Online method

If you have not prepared the JSON file or don’t have more entries to enter then you can opt for the online preparation. Click on the button “PREPARE ONLINE”.

Step 6:

When you select the option to prepare the GSTR-3B online the system will ask you few questions regarding the supplies for the period. The first question is about filing the Nil return, if you wanted to file nil return, mark the option “Yes” and proceed.

The Second question is about the confirmation of your supply whether you make other supplies or not. If you made the supplies in the period, then you should mark the option “Yes” and it will be yes even if there is no supply but there are some inputs which fall under the RCM mechanism.

The Third question is about the inter-state supply made to the unregistered person, composition taxable person or UIN holders. If you have not supplied then mark “No” and if you have made such supplies then mark “Yes”.

The Fourth question is about the input tax credit or ITC on the purchase of goods or receipt of services. Every firm has some ITC during the period, so it should be “Yes” in most of the cases. This question is according to the ITC you wanted to claim so read the question and mark them carefully.

The fifth question is regarding the input received under nil rated, exempt or non-GST supplies. The credit of these supplies will not be utilized for setting off the tax liability but, if there is any input supply of this nature those should be mentioned. If you have any supply regarding the above-mentioned supplies you should mark “Yes” and if not then “No”.

The Sixth question is about the interest or late fee to be paid, if you have some interest or late fee to be paid then it should be marked as “Yes” and if no then mark “No”.

Step 7:

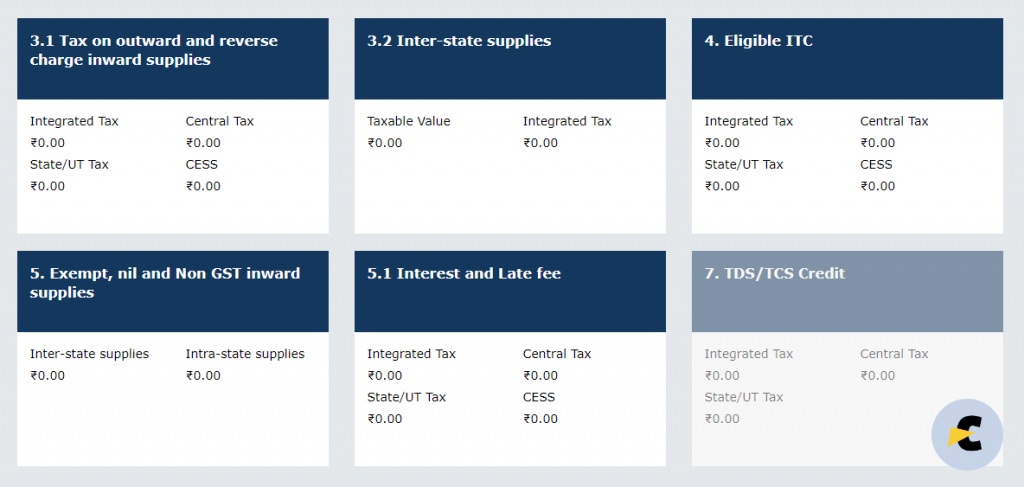

After answering all the question, a new page will appear in front of you which has the tables are provided for you to file the return. The number of the tables are decided by the questions you have asked. If the table does not appear as you have thought, then please click on the button “Back” and re-answer the questions carefully.

Step 7:

The first table and most important table for the filing of GSTR-3B is table no. 3.1 in which the details of the output supplies are to be filed. In this table all the taxable, Zero rated, Nil rated, exempted, Non-GST Supplies, and Inward supplies(Liable to RCM) is to be filed. After filling the table click on the button “CONFIRM”. Make sure that all the details are filled in the Table is correct and accurate.

Step 8:

The Table 3.2 is also for the output supplies, but this is a little different from the Table3.1 because it is only for interstate supplies. But not any ordinary supply, supplies related to the Unregistered person, Composition Dealer and UIN Holder is to be filled. This table is divided into three parts for every different kind of person so that the different entries can be made for every other category. In this table, there are only three things to be filled: Place of supply, Total taxable value, and amount of Integrated tax(Because of the interstate supply). When you have filled all the necessary details click the button “CONFIRM”.

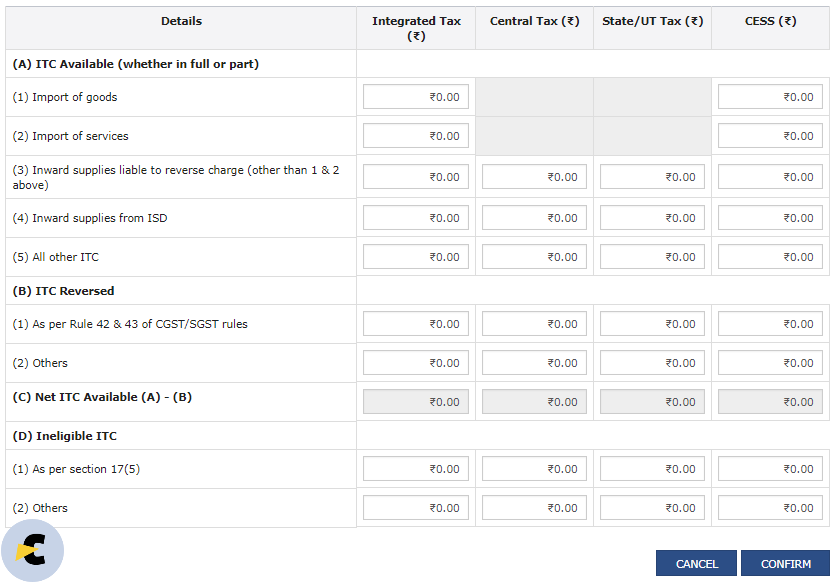

Step 9:

The next table is Table No. 4 which is for the eligible ITC(Input Tax Credit). It is divided into four parts in which the details of ITC should be filled. The First part is for the available ITC. Which consists of import of goods, import of services, inward supplies liable to reverse charge, Inward supplies from ISD, and all other ITC.

The second part is regarding the ITC reversed and it consists of reversal as per rule 42 & 43 of CGST/SGST rules and others. The conditions are written in these rules, in that case, the ITC should be reversed. The other is regarding all other ITC reversals which may be caused by mistakes or errors.

The third part is consists of the Net ITC available for the period and consists of ITC Available – ITC Reversed. Which provides us the eligible ITC for the period.

The fourth part is about the ineligible ITC, consists of the blocked credit u/s 17(5) and others.

There are many scenarios where the ITC should be reversed so please be careful and reverse the ITC as soon as you got the knowledge for its reversal. Because it may cause you the to pay the interest on such ITC.

Step 10:

The next table is Table No. 5 in which the input values of exempted, nil rated, composition scheme and non-GST supplies should be mentioned. THere will be no ITC available for such inputs, but still, it is important data for the government. It has four cells which are the combination of the place of supplies and nature of supplies. Fill the invoice value of the inputs under these categories.

Step 10:

The last table is Table No. 5.1 which is for the interest and the late fee for filing the return. The interest should be calculated according to the provisions of the Act and Rule applicable for such interest. There are two rates of interest, one is @18%p.a. and another one is @24%p.a.

Step 11:

After filling all the details and verifying those entries with the original entries you have wanted to file. Click on the button “SAVE GSTR3B” and Click on the button ” PROCEED TO PAY” when the return has been saved.

Step 12:

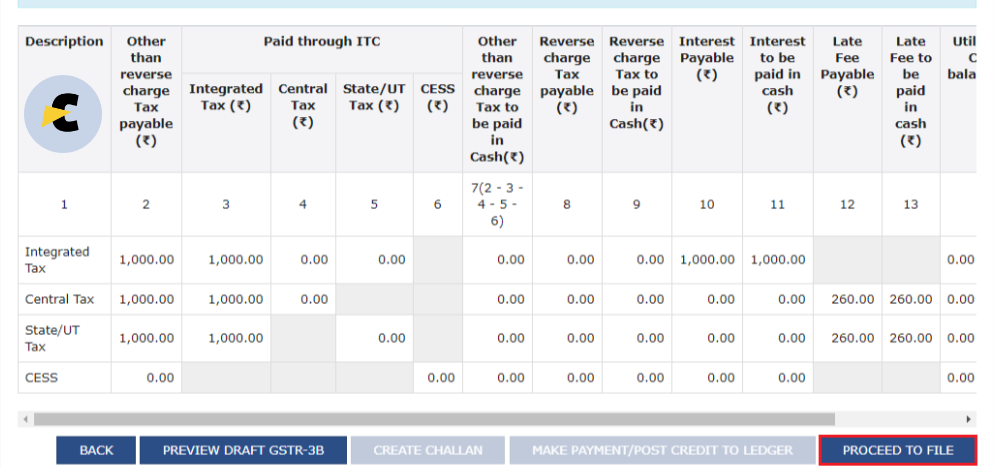

When you click on the button”PROCEED TO PAYMENT”, a new page will appear and the in which the balance of cash ledger & credit ledger will appear. You have to scroll down to check the tax liability and to set off the liability with credit.

The credit must be utilized in the prescribed manner. The system will auto-generate the suggestion for setting off the tax liability, but you can change it according to you. The charges of RCM will always be shown separately because the tax to be paid under RCM will always be paid or set off by cash or cash ledger. The last column must be zero to set off the tax liability. So make sure that there is enough credit cash balance for the tax liability. Because you can’t be able to file the return unless you have paid all the tax liability against the supplies made by you. When the last column is all zeroes, the Click the button “MAKE PAYMENT/POST CREDIT TO LEDGER”.

Before making the payment or setting off the tax liability to make sure that the information is true and correct to your knowledge. Because there is no option to amend or revise the GSTR-3B.

Step 13:

When all the tax liability was set off/paid, the option to file the return will appear and you can be able to file the GSTR-3B. Click the button “PROCEED TO FILE”.

Step 14:

When you proceed to file, a new page will appear just like the page when you file the GSTR-1. In this page the name of the authorized person is available in the drop-down menu, select the authorized person. After selection opts for the option to file with EVC/DSC. The DSC should be of the authorized person you have selected. If you select the option of EVC then the mobile no. should be of the authorized person. On which OTP will be received.

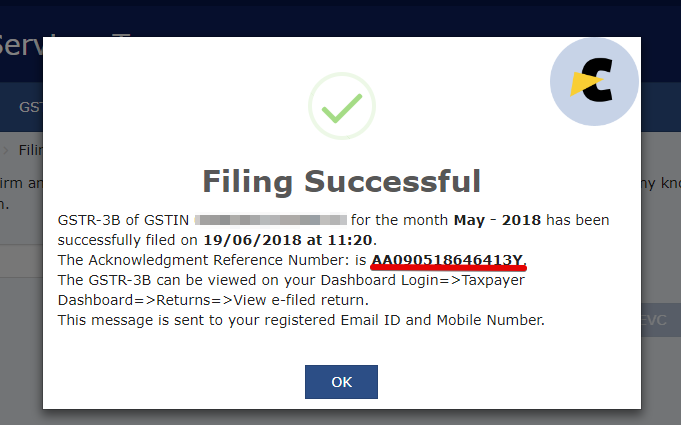

Acknowledgment

When all the process will be finished. A popup will appear on your screen with the ARN for the filing of GSTR-3B.

Neeraj Kumar Rohila

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

New Delhi, India

A Learner, who wants to learn from the experience.