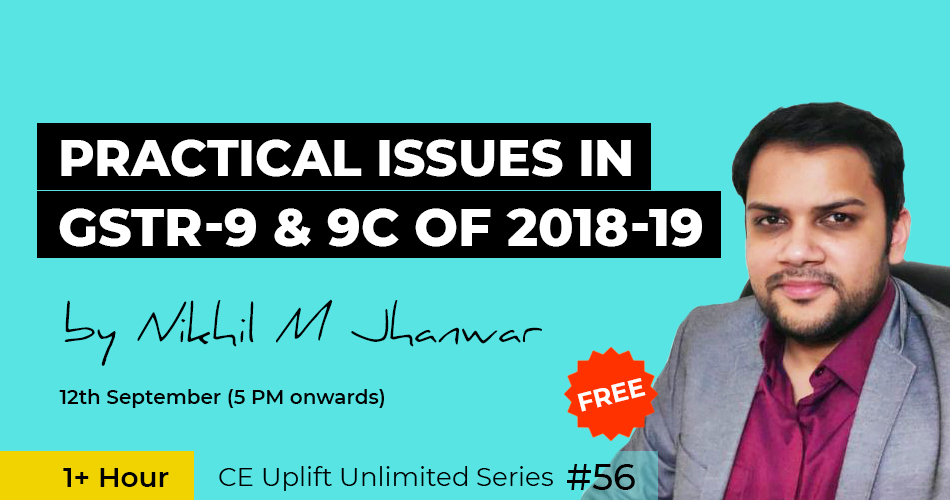

The webinar will cover the important steps while creating GSTR-9 and GSTR-9C. The speaker of the webinar is CA Nikhil M Jhanwar, who will explain the below points to help you file the annual returns:

Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.

Excellent explanation and solving of the case studies helped in understanding the laws

I like the course and i know many things in gstr 9 while we filling the return before the course many difficulty face and now i can easily filed the gstr 9 for small scale business .