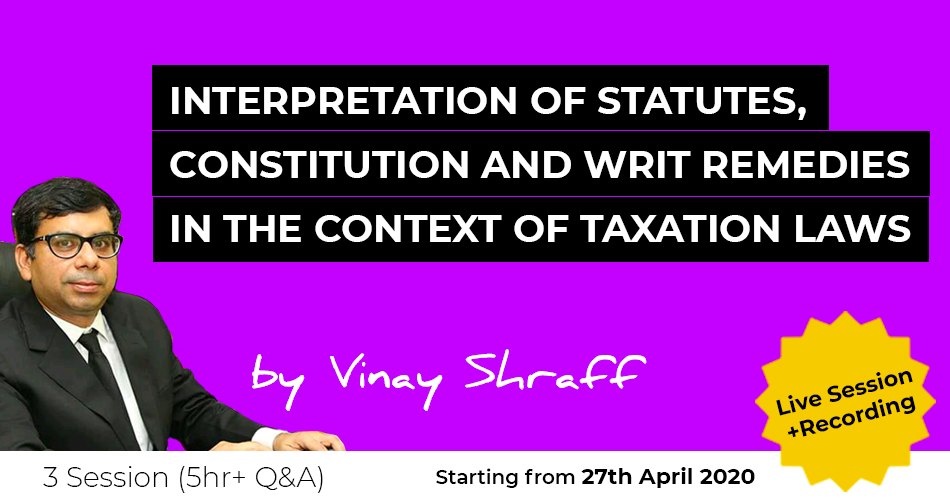

This course is intended for the Advocates, CAs, CMAs, CSs to understand the principles of interpretation of taxation statutes, articles of the Constitution of India relevant to the taxation laws and writ remedies to approach High Court and Supreme Court against Government's action or inaction.

27th April - 11:30 AM to 01:30 PM

30th April - 11:30 AM to 01:30 PM

2nd May - 11:30 AM to 01:30 PM

Questions asked during the session. 1. Sir, before going to General Clauses Act, should it not be more logicl to go to Analogous A

1. Sir, before going to General Clauses Act, should it not be more logicl to go to Analogous Acts. If yes, then in case of a word not defined in GST, can we not refer to Service Tax, and Central Excise Acts rather than General Clauses Act?

2. While discussing on penalties, you mentioned two sections, 129 and 74. Later on you also mentioned about Rule of specific which says that specific will prevail over genral like in classification issues. Isn't

129 more specific as compared to 74?

3. The recent amanemdment to Rule 89(4) amedneing the definition of 'Zero rated turnover' which restrcits the export turnover to 1.5 times of domestic turnover of same or similar supplier. Isn't it impossible for me to know the turnover of 'similar supplier thus falling under the vires of maxim Lex Non Cogit Ad Impossibilia....' Not to mention it is also exceeding the GST Act as there is no such capping under GST Act.

4. Sir, section 43A of CGST Act can be seen as unconstitutional because it infringes the substanted right of availing ITC by the registered person.Please clarify.

5. What difference can be interpreted from section 17(5)(c) and 17(5)(d) in which in sub clause c plant and machinery and in sub clause (d) plant or machinery is written? how to interpret?

6. Decision of High Court is applicable to Adjudicating Authority in other state. Whether it's Binding in nature?

7. Sir, can you throw some light on transitional provisions contained in any act/rules?

8. What is the solution if court doesn't decide on writ filed by a common man or assesssee, if the matter is urgent?

9. Whether legal maxims is enforcable on the deparment.say in one of the case, a legal maxim defends the argument of the assesse, can assesse use the tool of legal maxim to defend himself and moreimportantly whether said legal maxim is enforcable on the department or revenue authority.

10. Sir....Dont you think that if a Law is wholly guided by the realease of Circulars or Order or any Corrigendum as it is happening in GST Era includes a sharp and clear activeness of "Rule of Mischief" as against directed by Statute?

11. How to compute time for filing any appeal before any authority during lockdown period whether force mejeure is applicable where any express provision not there?

Questions asked during the session. 1. Can Memorandum to the Finance Act be treated to be a part of law? 2. Sir, what

1. Can Memorandum to the Finance Act be treated to be a part of law?

2. Sir, what about retrospective amendment whereby invereted duty structure refund was denied for Input services isn't it violation of Art 14?

3. Sir, via circular/notification it has been stated that any payment by DRC-03 ahs to be done in cash only...dont you think that it is little harsh and also exceeds the GST Act as there is no such restriction in the GST Act. Further, in your opinion can it not be challenged under Article 19(1)(g)?

4. Kindly give examples of Art 14 being challenged successful in taxation matters especially Indirect taxes.

5. Need practical implications of Art 14 e g. Whether can we challenge unequal taxing scenario e.g. blocked ITC under Section 17(5) only for cars having capacity below 13 seater. So can that be challenged as to why only for less than 13 seater etc?

6. Sir can I get reference of the cases filed before Hon Hcs in case of S16(2) under Art14?

7. Form 3b was given an effect as a return u/s 39 with retrospective amendment afer AAP Co Guj HC decision. Can this be considered to be equalization ? Can such acts of govt be challenged under Art14?

8. 279A everywhere talks about recommendations. So is it binding on State legislatures ? Also can states tomorrow decide not to follow recommendations of council can they do so ?

9. Can SLP be filed in HC ? under which article?

10. Bombay High Court in case of Nelco Ltd held imput tax is concessions. Please through light if feasible.

11. Commissioner (appeals) can never be the party before High court. He simply Carrys out his appellate function.

12. Whether amending Rule 61(5) by treating 3B as return is a sort of curing a defect of law?

13. Post 246A, the erstwhile concurrent powers stay?

14. Whether newly introduced Section 168A is as per Article 279A?

15. Interest in mentioned in cgst., why igst interest should be paid?

16. Decisison of GST Council can be a ground to challenge any provision of the Act even if such decison has not yet been adopted in the Act?

17. We often use legal maxim to take any ground in favour of the Assessee, whether legal maxim has any relationship with Constitution? Whether legal maxim is enforceable on the department?

18. Whether denial of Credit in TRAN-1 through Revised VAT return by way notification ca be challenged?

19. Can the assessee go for writ against the order u/s 263 of It Act 1961 by Commissioner of Income Tax though there is alternative remedy before the ITAT?

20. Is principle laid down by the Supreme Court regarding retrospective amendment has got applicability with regard to rule 61(5) of CGST Rule 2017?

21. Whether attachment of bank account as per provision of S281B of the IT Act 1961 is leads to violation of rights under Art 19(1)(g)?

22. GST is mostly guided by notifications and circular so whether these actions on the basis of such notifications and circulars is by authority of law?

23. Is there any remedy available for revenue loss due to Bank Acoount attached by The Income Tax Department only due to cryptocurrency transation?

24. Section 271AAd of income tax - what is valid document - F.M Speech as she said or her printed speech supplied with annexures to that speech... this is to interpret the said section as there is an ambiguity whether this section will cover only bogus billing or even loan entries. The F.M speech which she delievered only covered bogus bills whereas the printed sppech (with annexures) contain bogus bills and other such incidents. Please explain.

Questions asked during the session. 1. Sir please give example of constitutional rights other than fundamental rights? 2.&n

1. Sir please give example of constitutional rights other than fundamental rights?

2. There is no judgement of jurisdictional high court and there are favourable as well against judgement of other high court. Whether assessee can follow only that judgement which is favourable to him?

3. On which party is the burden to proof that rights were violated?

4. Will previous judegements of parellel high courts be binding on a high court if there are no apex court judgements on the matter being agitated?

5. If interstate movement of goods say from west bengal to u.p via bihar and goods have been confiscated at bihar, in which courts can we file a writ jurisdiction?

6. Time for filing appeal u/s 107 is 90 days and Time given for for payment in only 15 days in DRC07- can bank account be attached in between this period?

7. If SCN is provided without service of DRC 01- A...is it violation of natural justice or violation of statutory right? Can it be approached in the high court?

8. Freezing of individual bank account any such remedy hitherto a remedy available?

9. What is the jurisdiction for issuance of summon under section 70 of cgst act? can it be issued to assessee of other state for recording statement?

10. What is the jurisdiction for issuance of summon under section 70 of cgst act? can it be issued to assessee of other state for recording statement?

11. How should be decide whether to file writ with SC or SLP?

12. Sir, what is the remedy available if the bank account is atatched unlawfully, but to aovid any hassles, Company paid the demand to unfreeze the bank account. Is remedy available after that since the amount was literally paid under protest?

13. As mentioned by you that various HC have allowed to claim transitional ITC even if the appellant missed to file TRAN-1. So in this line can an assessee now claim transitional ITC by showing in GSTR-3B? If yes than what can be the consequences?

14. Sir what is the difference between SLP and writ?

15. If some oral observations are made by supreme court while dismissing a SLP, than such oral observations will be binding upon subordinate courts or tribunal?

16. We experience frequent disruptions in presentation.kindly look into the issue of connection at your end.same was the case for international taxation.

17. Right from subordinate legislation- you mean rules of any Act?

18. Sir, If we could not file the appeal in time for justified reason but Appelette authority refuses to condon the delay.Can one approach HC with a writ?

19. Sir, there are instances where SCNs are issued for huge amounts (high pitched assessment proposal). Instead of going through the statutory remedy of adjudication, can we approach HC through Writ? What should be the basis to go for Writ?

20. If an authority has not following a binding precedent, can we approach HC through Writ? If the assessment goes through, then there would be lot of pre-deposit to be made to carryon with appellate prceedings.

21. In case of an international Transaction, where one is facing contractual rights breach, can we file any writ ? if no whats the remedy?

22. What is vires of Act or Rule? Kindly explain

23. Income tax matter Stay petition filed on 27.01.2020 and within one month respondent did not issue hearing notice, the assessee is in fear that anytime his bank account may attach. that stay petition should be disposed of in a time bound manner, but respondent did not so. My question is that is the assessee can Approach HC after 15 days filling of Stay petition for wit remedies?

24. Will the jurisdiction be decided on the basis of address in PAN records or the place of residence of assessee in case of Income Tax matters?

25. In case of Garnishee order, during lockdown and no communication is received before or after that order than what is the remedy?

26. Will the HC jurisdiction be decided on the basis of address in PAN records or the place of residence of assessee in case of Income Tax matters?

27. A. Show cause notice cum demand in the context of indirect tax laws .. usually such show cause notices are more in the nature of assessment and demand...

28. In continuation to the above, Allowability of writ at that stage , whether admissible?

29. What is the limitations to file petition in GST tribunal ?

30. Will government company be covered in the meaning of State?

31. Will all schools & hospitals be covered under the ambit of Writ as all the schools & hospitals are performing public duty?

32. Right to be not driven out of state should be included in the right to settle anywhere in India?

33. Are all hospitals and schools and collegues be held to be state under A.21?

34. Sir there is one judgment of another state but GST officer does not our state then what to do ?

35. Without issue show cause notice addition under income tax is valid?

36. Sir if tax is paid for non issue of eway bill at the the goods are stopped on the way , it is to be paid by DRC 03, then again at the time of declaring the turnover in the returns, the tax is to be paid again, is it as per the law?

37. Sir there are some guidelines for writ under 226, are these guidelines high court wise?

38. sir on which ground the interest for 7th day to 60th day was allowed to the Assessee?

39. Sir if a stay is granted on a High Court's order by the Supreme Court, whether High Court Judgement remains valid until reversed by the Supreme Court?

40. Sir whether officers are mandated to follow a judgement which is stayed by SC?

41. In our appeal pending before ITAT there is favorable judgement of Non jurisdictional HC on the issue under consideration and no contradictory judgement of any other HC even though ITAT not allowed relief and remand the case then what course of action available to us.

42. Can a writ petition be filed even before exhausting legal remedies provided in the law?

43. Remedy Available if Courts order not followed?

44. Order of court is binding on officer. but often officer ignores. remedy available?

45. If say Section 16(4) of CGST has been challgened by way of Writ then asessee should take into consideration the place where is place of business is situated as in the instrant case it is difficult to determine the part of course action where arises?

46. Many officers say that other regional HC is not binding on them. What should be our reply?

47. Is writ remedy available in case of an NRI not having residential status as per I.T. Act, but still gets red tapped by coercion by revenue authority to comply provisions of I.T. Act, 1961?

48. What are constitutional rights, any examples and where are they enshrined in law?

49. Is the concept of State under RTI same as State in Art 12?

50. Sir what are constitutional rights, any examples and where are they enshrined in law?

51. Sir, SLP gets dimissed, any other remedy?

52. If Statutory Rights are involved and HC not allow the petition, can we go through SC under article 32?

53. Double jeopardy....does it apply to two punishments for same crime etc in same law or even in para materia laws?

54. Can double jeopardy be imposed by having a clause of 'without prejudice to any section / act'?

55. In case of forgery of some sale bill, is prosecution in civil laws as well as income tax act and GST act. You mean to say sir that the person will be prosecuted by only one act? If yes, then in which act?

56. In case of conflicting provisions or overlapping provisions, which act / law will prevail. Because now a days we find that all acts mention themselves as overriding upon all other acts in force.

57. Does the admission of SLP tantamounts to admission of Appeal?

Practicing as an arguing counsel at the Supreme Court of India, HighCourts, and Tribunals. Vinay Shraff practice as a counsel & advisor in the field of Indirect Taxation, International Taxation, FEMA, Foreign Trade Policy, Corporate insolvency Laws.

Great Learning !! Good Initiative by the team !! Keeping doing the good work !!

Great topic, more on such lines should be planned. Adv Vinay ji was wonderful.

great course, full of knowledge and all nitty-gritty has been discussed clearly. I would like to thanks the speaker for all these knowledge sharing

All the concepts are explained thoroughly. Consultease are doing the great job.. Best thing is that you can learn from the best experts from the comfort of your own place.

Very nice topics & excellent lectures delivery. Thanks Consultease.